The market’s bipolarity and the case for Big Tech

Amazon’s Q4 2025

Just 6 months ago, Amazon reported Q2 earnings that “spooked” the market and caused the stock to drop significantly post-earnings. The market’s worries revolved around AWS and Capex:

A lower-than-expected growth rate in AWS

More measured Capex plans than its peers

The market understood this (at the time) as a sign that Amazon was losing ground in AI to peers such as Microsoft and Alphabet. Amazon’s management understood the message (and probably saw significant opportunities to accelerate spending) and did what the market demanded in Q3 and Q4. Q3 saw AWS accelerate and Capex increase (the stock rose as a result), whereas in Q4…

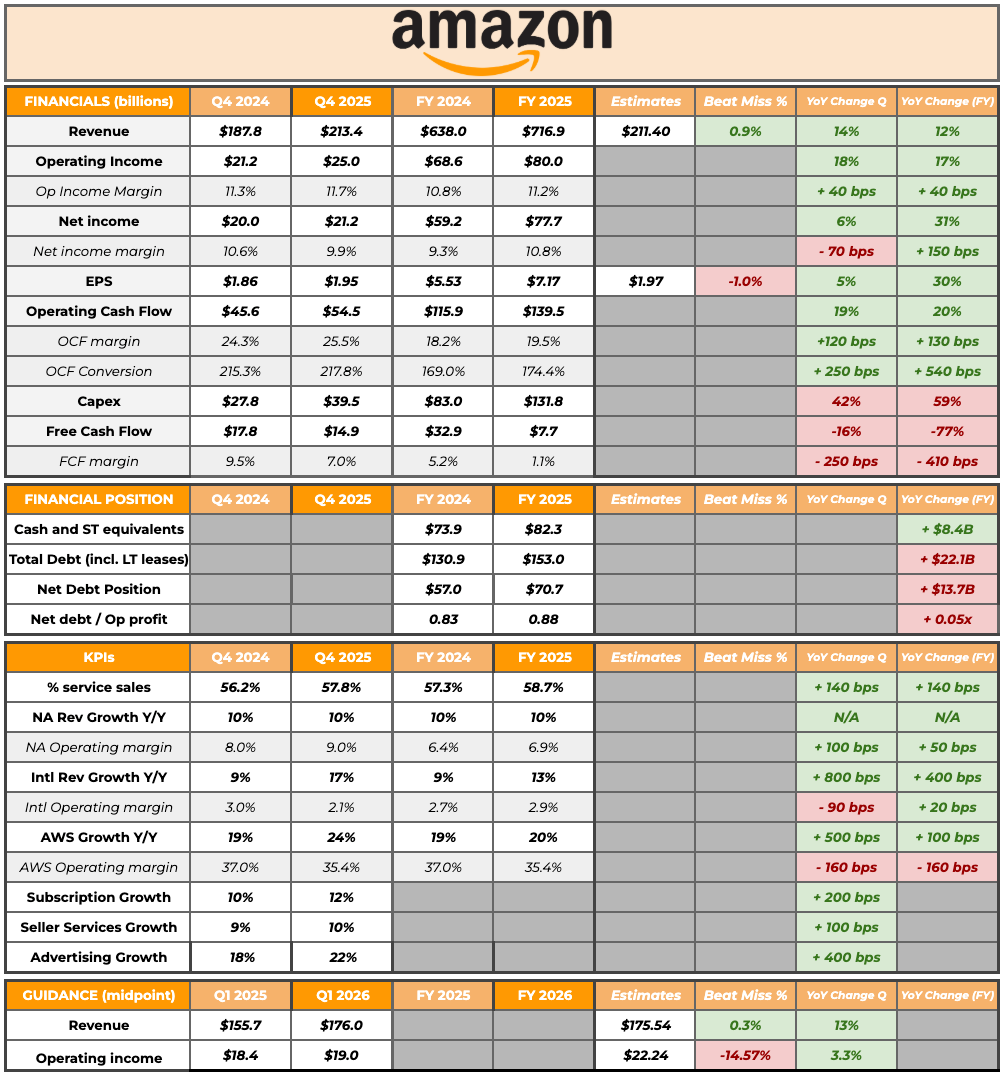

AWS accelerated to 24% growth YoY, its fastest growth over the past 13 (!) quarters

Management announced a $200 billion Capex figure for 2026, significantly above those of Alphabet and (especially) Microsoft

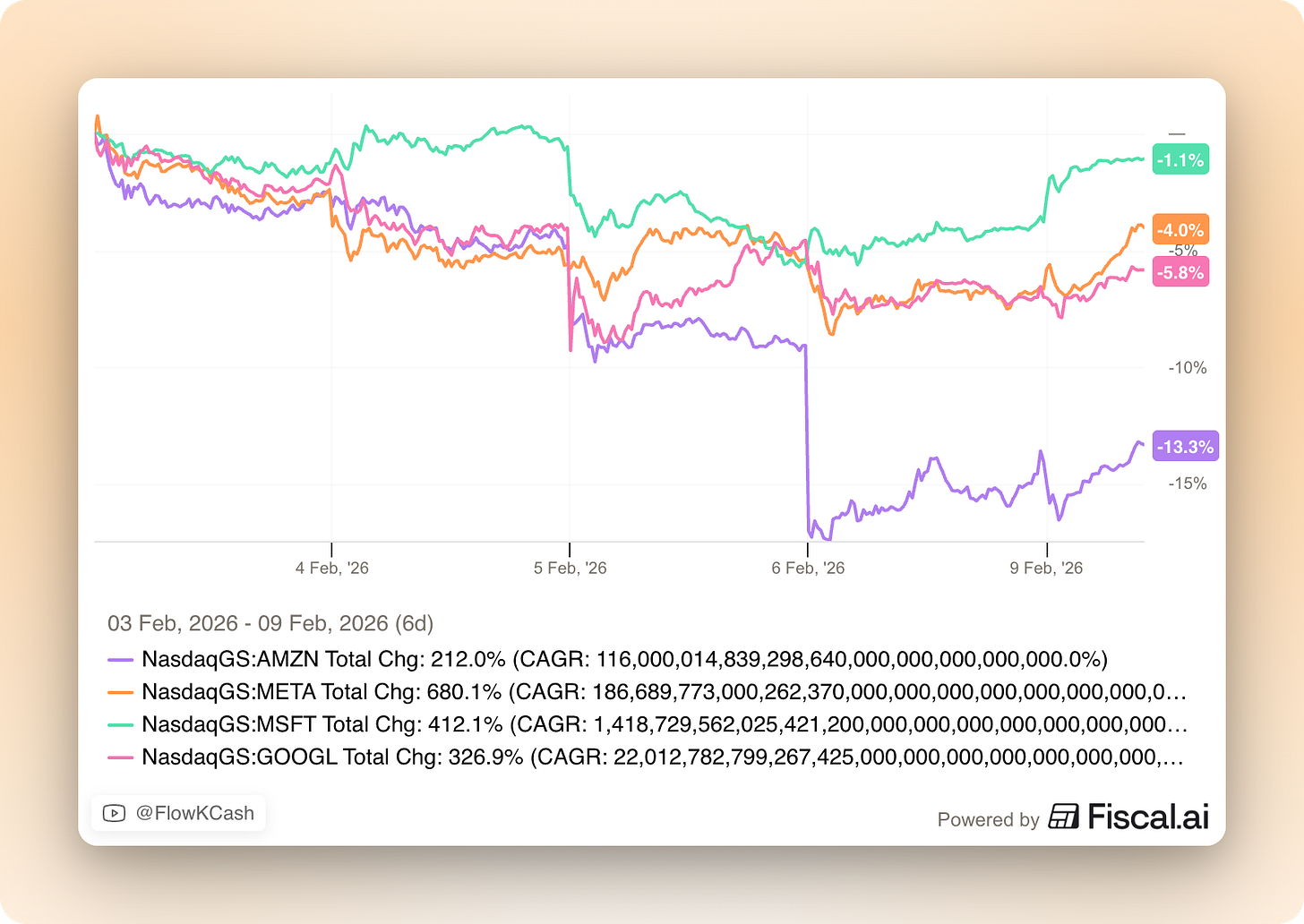

One thing that did not change with respect to Q2 was the market’s reaction. The market displayed its bipolarity and not only did it sell Amazon, but it also decided to sell all the large Capex spenders (i.e., the hyperscalers and Meta):

This article’s goal is to go over Amazon’s quarter and year, but also to make the “case for Big Tech.” Big Tech companies such as Amazon, Google, Apple, Microsoft, and Meta are very well followed across the investor community. While this to some might mean that there is no “alpha” to be found in their stocks, I believe that…(1) this is evidently not true judging by what companies like Nvidia, Google, and Meta have done over the last couple of years, and (2) probably makes a lot of people miss the forest for the trees.

We are undoubtedly seeing some whopping Capex numbers coming out of Big Tech, which are making some people nervous regarding the law of large numbers. But what if Big Tech is actually a good opportunity to get exposure to AI without significantly suffering from the downsides? I believe that the best skew to AI lies in healthcare and semis (when valuation is not a consideration), but I’ll make the case for Big Tech after reviewing Amazon’s earnings.

Amazon’s Quarter and Year

Amazon reported once again a pretty solid quarter. Here’s the summary table:

The first thing that stands out is growth. Growth is something many people continue to take for granted for Big Tech. The fact that a +$700 billion revenue company just accelerated its growth rate to 12% is impressive no matter how one wants to spin it. Of course, there’s a flipside to this feat: investments to achieve said growth have skyrocketed. Amazon could grow as fast as it wants, but if these investments don’t end up generating good returns, then it’s not the place to be. Spoiler alert: I do believe that returns will be accretive, but I have no way of knowing it for sure (or else I would go all in or all out).

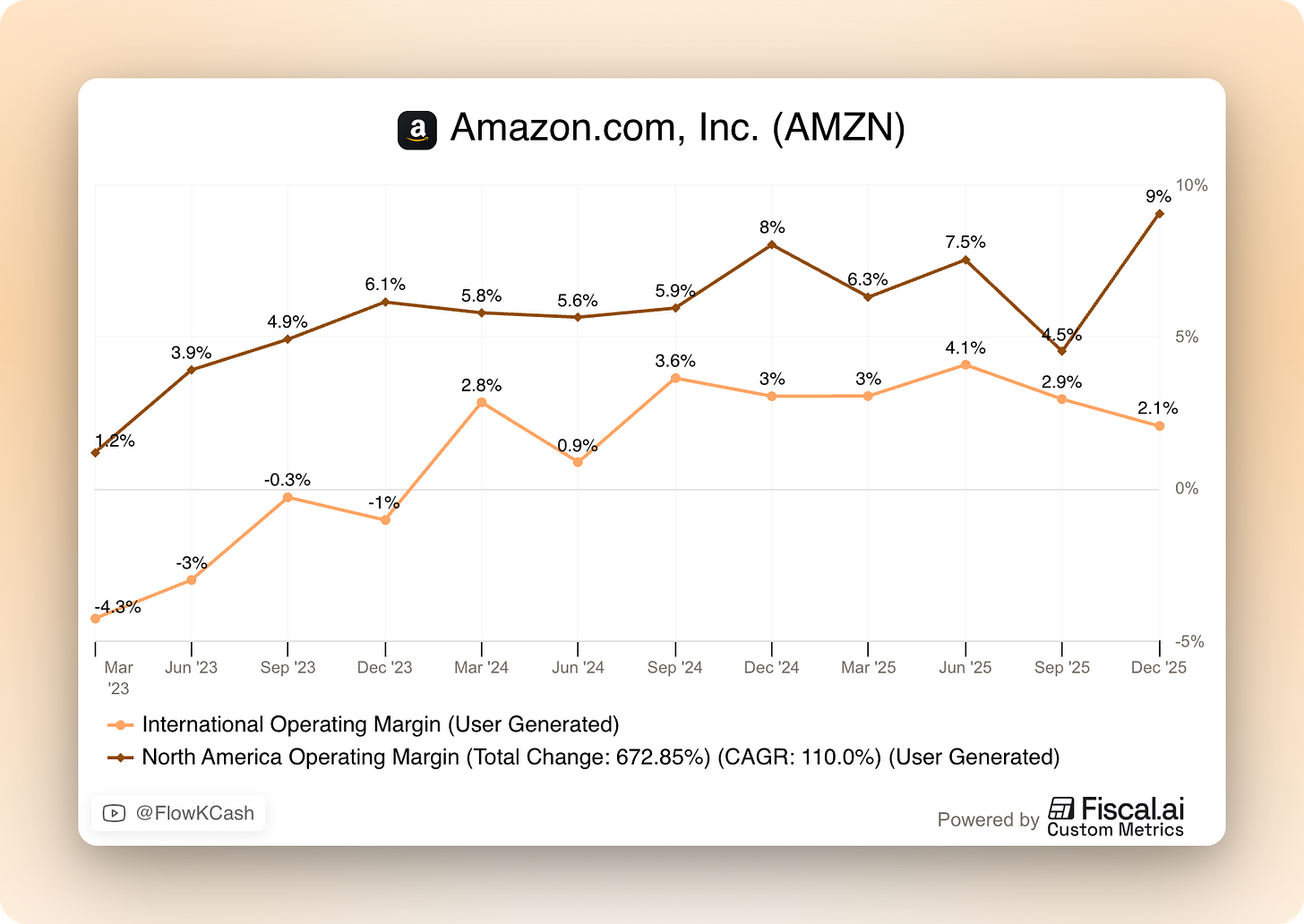

Talking about investments…I believe it is best if we conceptually divide these between labor and capital. Let’s start with the former: labor. Amazon managed to grow its revenue by 12% in 2025 despite barely growing its employee count. This means that there’s labor leverage in Amazon’s operating model, especially across its retail business. Where does this labor leverage come from? I’d say it comes from several places:

Automation/robots: we could expect this to be an increasing driver of operating leverage in the retail business

Network optimization: AI should help Amazon’s network become more efficient as well as everyday essentials, which continue to grow at a fast pace

Ads: as Amazon continues monetizing its ad inventory more efficiently, revenue should grow faster than labor (as ads do not require much labor)

Both of these things have enabled a continued margin expansion in Amazon’s retail business which has not come at the expense of growth:

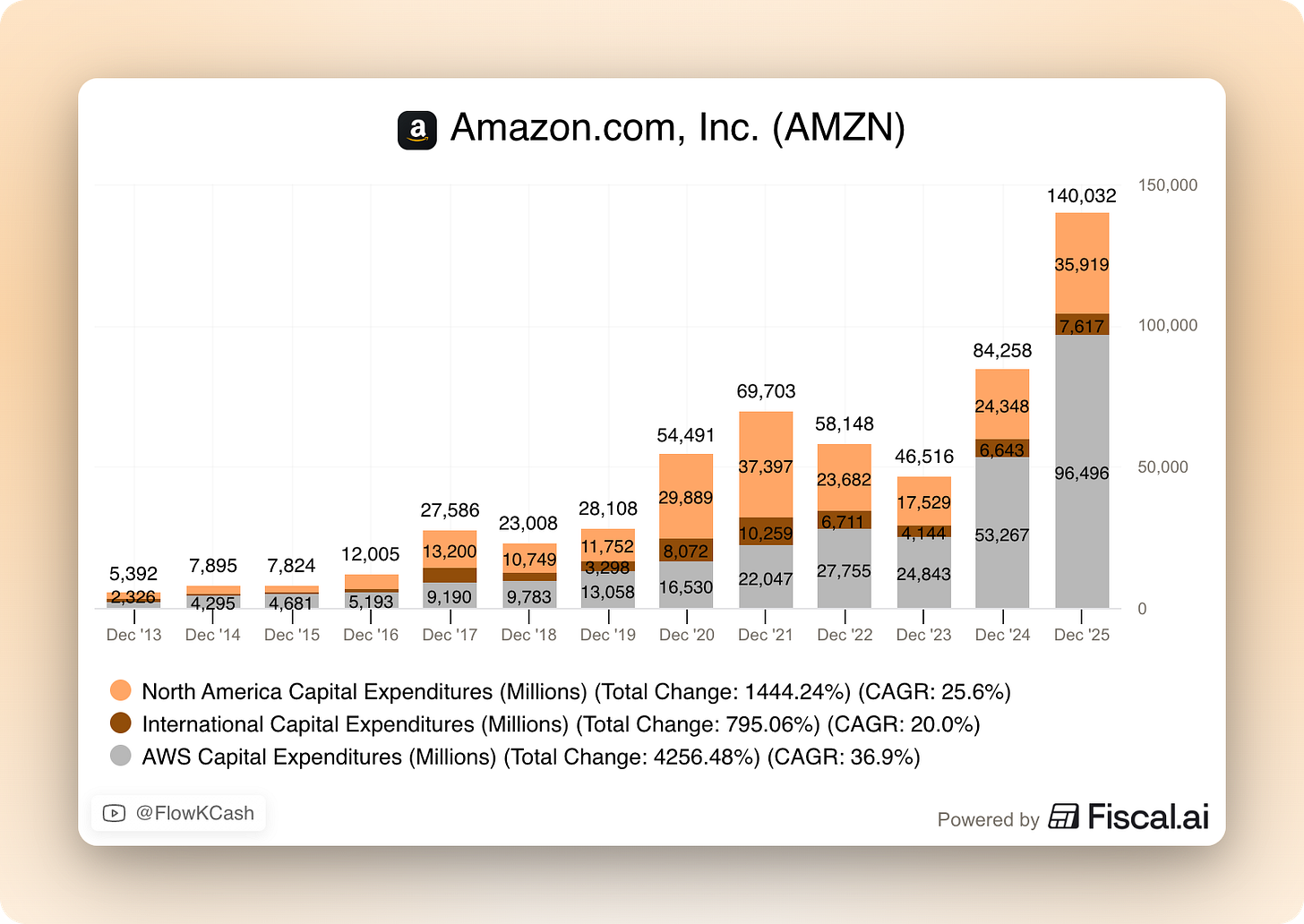

Now, Amazon not only reinvests in its business through labor, it also does through Capex. It does so in retail to continue improving its value proposition to customers (“For the third year in a row, globally, in 2025, we achieved both our fastest-ever delivery speeds for Prime members while also reducing our cost to serve.”), but increasingly so in AWS. Capex invested on AWS has ramped up pretty fast and it will probably remain this way for a while:

This takes us to the second investment area: Capex. Now, I must say that this is conceptually a harder area to grab one’s head around. For starters, Amazon began its AWS investment phase (AI-related) around 2023-2024, so it’s still too early to know whether these investments will generate adequate returns for shareholders (this is what the market is ultimately worried about). Just to contextualize the build-out, take a look at the following stat:

In the last 12 months, we added 3.99 GW of power. Just for perspective, that’s twice what we had in 2022 when we were an $80 billion annual run rate business. We expect to double it again by the end of 2027.

We’ll likely see two things during the build-out phase:

Faster growth as capacity comes online

Lower margins as expenses are front-loaded

This is happening at AWS (and Amazon in general), but there’s a caveat: #1 is right now constrained by supply availability. AWS grew 24% YoY in Q4, but management argued they could be growing faster…

If you look at the capital we’re spending and intend to spend this year, it’s predominantly in AWS, and some of it is for our core workloads, which are non-AI workloads, ‘cause they’re growing at a faster rate than we anticipated. But most of it is in AI, and we just have a lot of growth and a lot of demand. When you’re growing 24% year-over-year with an annualized revenue run rate of $142 billion, you’re growing a lot. And what we’re continuing to see is as fast as we install this capacity, this AI capacity, we are monetizing it. So it’s just a very unusual opportunity.

This is consistent with the fact that the backlog is growing considerably faster at 40% YoY. Management believes that their investments should allow AWS to grow “in the ballpark” of what it has been growing lately.

The thing is that AWS is not the only opportunity available to Amazon; the company has a lot of things going for it. For example, Amazon’s Trainium and Graviton chips are now generating over $10 billion in annual revenue and they are growing triple digits percentage year over year. Andy Jassy claimed that Trainium3 has just launched but that they expect pretty much all of its supply to be committed by mid 2026. What would a business like this be worth in public markets? There’s a couple of nuances here. While it’s indeed third-party customers that are using these chips, they are somewhat “forced” to do so while using AWS (i.e., they are, to an extent, captive customers). Nevertheless, one could argue that a business such as this should be worth around 10x sales (remember that it’s growing triple digits). This means that just the chips business would be worth around $100 billion.

Despite being an AI infrastructure“vendor”, Amazon is also using AI internally with some positive tangible results. First, we have Rufus, Amazon’s AI shopping assistant. Andy Jassy claimed during the call that more than 300 million customers have used Rufus and that customers that use Rufus are 60% more likely to make a purchase. The second place where Amazon can benefit from AI in its retail business is Ads. The company’s inventory continues to grow and AI can potentially improve ad performance (ask Meta). Lastly, AI evidently helps with physical network optimization. So, not only is Amazon seeing heightened demand as an AI infrastructure vendor, but it’s also seeing tangible results from using AI across its business.

Then you have Amazon Leo (previously known as Project Kuiper). Amazon is sending satellites to space to provide broadband connectivity in low-connectivity or remote areas (similar to what ASTS and Starlink want to offer). I evidently don’t know how this business will evolve, but I can imagine the synergies it might have with Amazon’s Prime subscription and enterprise customers using AWS. This should set Amazon apart from the competition:

Leo will offer enterprise-grade performance and advanced encryption with secure private networking that bypasses public internet, connecting directly to AWS.

Overall, Andy Jassy sees the current environment as one of the best environments to invest increasing amounts of Capex:

We’re seeing strong growth, and with the incremental opportunities available to us in areas like AI, chips, low Earth orbit satellites, quick commerce, and serving more consumers’ everyday essentials needs, we have a chance to build an even more meaningful business at Amazon in the coming years, with strong return on invested capital, and we’re investing to do so.

So, what does this all mean? Two things. First, Capital Expenditures across Big Tech are likely going to be significantly larger than anyone predicted in their models. Secondly, and somewhat related to the first, if these investments yield the appropriate returns, then growth is going to remain elevated for a significantly longer period than any model predicted. The key variable here is returns because investors need to understand whether this will be profitable growth (not just growth at all costs). The problem I see here is that many investors tend to see this as black or white, when in reality it might be grey!

Despite not knowing what the future will hold, Andy Jassy argued that Amazon is likely situated in the part of the AI supply chain that is the largest and most durable:

The way I would describe what we see right now in the AI space is it’s really kind of a barbelled market demand, where, you know, on one end, you have the AI labs who are spending gobs and gobs of compute right now, along with what I would consider a couple runaway applications. And then at the other side of the barbell, you’ve got a lot of enterprises who are getting value out of AI in doing productivity and cost avoidance types of workloads. These are things like customer service or business process automation or some of the fraud pieces. And then in that middle of the barbell are all the enterprise production workloads.

I would say that the enterprises are in various stages at this point of evaluating how to move those, working on moving those, and then putting them into production. But I think that middle part of the barbell very well may end up being the largest and the most durable. I would put in the middle of that barbell, too, by the way, I would put just the altogether brand-new businesses and applications that companies build that right from the get-go, run in production on top of AI.

Be careful with these words because Andy Jassy’s statement doesn’t rule out subpar returns. Amazon is not the only company that’s participating in this “middle part of the barbell.” Microsoft and Google also have their say, and if this part gets commoditized then no matter how large it’ll be, returns will be tough to come by.

Let’s make the case for Big Tech.