The Eye of the Storm (NOTW #40)

Before we start…there’s currently a 30% forever discount running for the annual subscription. For less than 80 cents/day you can have access to…

Detailed research reports on high-quality companies

Ongoing coverage and updates on my holdings

Access to my portfolio and transactions

The complete archive of past in-depth reports (already covering +10 companies)

A clear framework for long-term, quality-focused investing

Access to a community of like-minded investors

Transcripts to all the Best Anchor Stocks podcasts

…

If you want to get a grasp of the research I share, there are two in-depth reports open to the public:

The discount expires on April 21st and you can join using the link below:

Both indices were down during this short week, although it might have been one of the most relaxed weeks since the start of the year. I discuss the positive and negative aspects I see based on what happened this week.

Without further ado, let’s get on with it.

Articles of the week

I published two articles this week. The first one was the transcript of my podcast episode with Ryan O’Connor about Nintendo. I highly recommend listening to (or reading) it because it portrays quite well why I believe Nintendo will do very well from here despite all the turbulent macroeconomic conditions. I would go so far as to say that the turbulent market conditions are another reason to consider Nintendo, despite this not being immediately apparent.

The week’s second article was my ASML earnings digest (this is free to read for everyone). The company reported a strong quarter if one can look past the noise stemming from quarterly numbers. The qualitative commentary was the most important aspect of the release, so I discuss it in more detail.

The Same Story Every Quarter

ASML reported earnings earlier this week in a not-so-benevolent market environment (neither broadly speaking nor specifically speaking about semis). Just like it has happened to the company since god…

Market Overview

Both indices were down this week by more than 1%:

I don’t know if it was me who looked less at macroeconomic news or spent less time on X, but I felt like this was the first week in which we had some relative calmness regarding tariff news. There were some positive developments on this front:

Both China and the US claimed that they are open to negotiations, albeit it seems like a deal that benefits both parties will be tough to reach (due to the ego of their respective leaders)

Talks of the US with other countries seem to be evolving in the right direction, and deals might be announced soon

From these two (and as I have discussed several times), #1 is the most important, as it is where most of the pain resides. Sure, reaching deals with other countries is essential, but all this mess will be resolved when the US and China reach an agreement. Now, like with all things macro, WHAT happens is not the only important variable; WHEN and HOW it happens also matters. There’s no denying that the longer this situation stays unresolved, the more significant the second-order effects will be. It is fairly evident that the US may be heading into a recession if things do not change quickly; however, it is very challenging to forecast the depth, duration, and other aspects accurately. There are numerous reasons to be bearish here, but that’s always the case, and often the bearishness is merely noise. The likelihood of bearishness being a signal is relatively high this time, if I may say so, but still quite impossible to forecast accurately.

One thing that was a negative this week was Trump’s comments regarding Jerome Powell. The President of the United States claimed that Jerome Powell should be fired because he is a “terrible President of the Federal Reserve”. As discussed in other articles, Trump appears to want lower interest rates to refinance the debt, and the first step to achieve this is for the Fed to lower interest rates. Some people claim that history tends to repeat itself, and this is a pretty good example: Trump tried a similar strategy during his first term (both lowering interest rates and trying to fire Jerome Powell). I don’t know if he will succeed in firing Jerome Powell and appointing a new President, but if he does, that would be terrible news. There’s a reason why the Federal Reserve is (theoretically) independent from the Government: so that politicians can’t play with interest rates at their will. Ending this separation would be disastrous news for the long-term health of the US economy and its reputation among international investors.

All that said, I continue to slowly deploy my cash into positions that I feel are attractive, and honestly, I still think that I don’t own enough Nintendo heading into this scenario. There’s definitely no need to rush in deploying cash, as there are few things with which one can feel incrementally positive. However, it’s also worth acknowledging that I don’t hold a crystal ball and have no clue what might happen over the next few weeks. I have always believed that the best mindset for a long-term investor is to remain cautiously optimistic at all times. Another effective framework is to remain short-term agnostic and long-term optimistic. In a scenario with so much uncertainty, the market can play mental games with investors (I discussed this in detail in my last news of the week).

How the market can play with you (NOTW#39)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

I wouldn’t trust the industry map too much because I believe it includes Friday last week, but here it is:

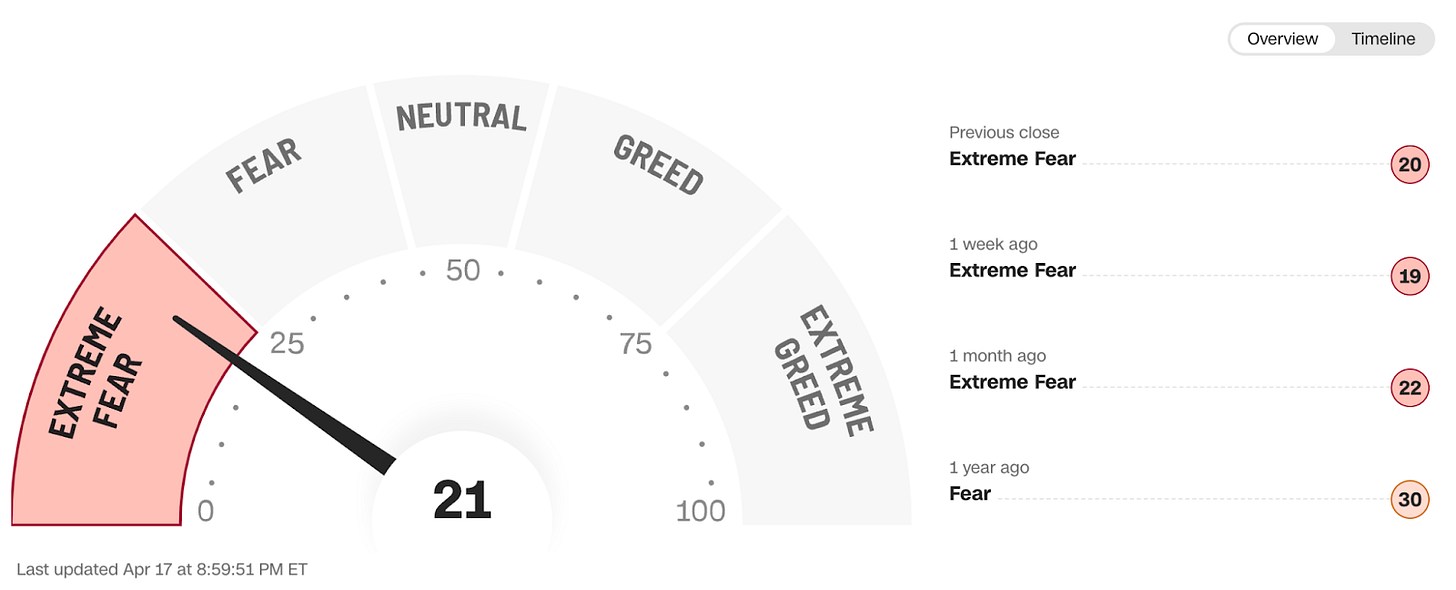

The fear and greed index improved significantly, consistent with the absence of more incrementally negative news, but I would be cautious in thinking we are out of the woods yet (although I have no clue, of course):

The rest of the content where I share my transactions and the news of the week is reserved for paid subscribers.