Tariff Tantrum all over again, and my strategy (NOTW#63)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Markets were significantly down this week as geopolitical/tariff fears were reignited once again. I will discuss what has happened in the market overview and will also lay out my strategy for paid subscribers.

Without further ado, let’s get on with it.

Articles of the week

I did not publish any articles this week. Earnings season kicks off next week (ASML on the 15th), so I anticipate there will be quite a few articles published over the coming weeks.

Without further ado, let’s see what the markets did this week.

Market Overview

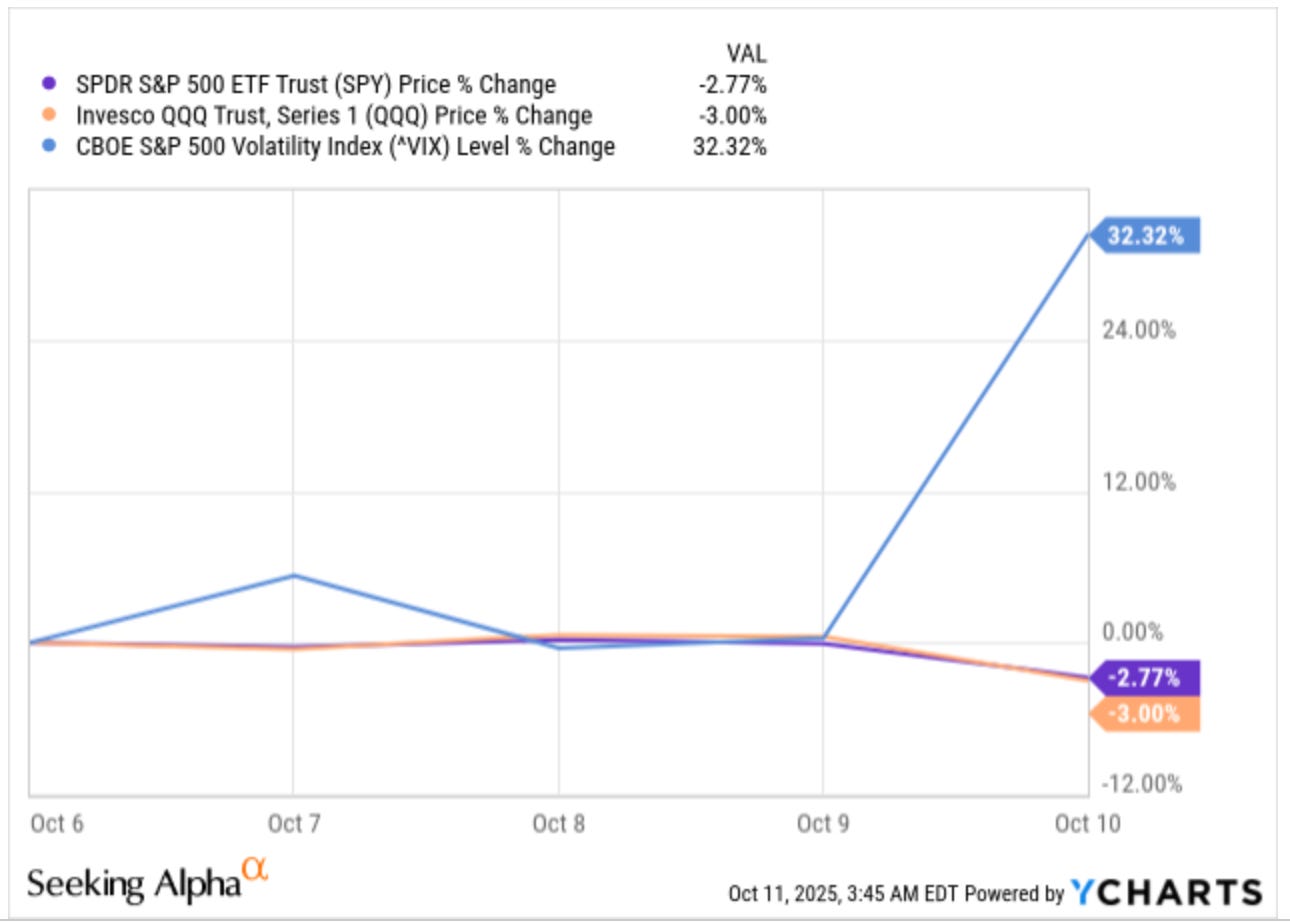

Volatility is back! Both indices were significantly down this week, and the VIX (volatility index) spiked:

If you are wondering what the reason behind the volatility might have been and whether it’s the same source that has created volatility over the past year, let me tell you that you might be on the right track: Trump strikes again! The President of the United States posted the following across his social media accounts. It came in two waves. First, Trump posted that the US Government was considering additional tariffs on China:

Some very strange things are happening in China! They are becoming very hostile, and sending letters to Countries throughout the World, that they want to impose Export Controls on each and every element of production having to do with Rare Earths, and virtually anything else they can think of, even if it’s not manufactured in China. Nobody has ever seen anything like this but, essentially, it would “clog” the Markets, and make life difficult for virtually every Country in the World, especially for China. We have been contacted by other Countries who are extremely angry at this great Trade hostility, which came out of nowhere. Our relationship with China over the past six months has been a very good one, thereby making this move on Trade an even more surprising one. I have always felt that they’ve been lying in wait, and now, as usual, I have been proven right! There is no way that China should be allowed to hold the World “captive,” but that seems to have been their plan for quite some time, starting with the “Magnets” and, other Elements that they have quietly amassed into somewhat of a Monopoly position, a rather sinister and hostile move, to say the least. But the U.S. has Monopoly positions also, much stronger and more far reaching than China’s. I have just not chosen to use them, there was never a reason for me to do so — UNTIL NOW! The letter they sent is many pages long, and details, with great specificity, each and every Element that they want to withhold from other Nations. Things that were routine are no longer routine at all. I have not spoken to President Xi because there was no reason to do so. This was a real surprise, not only to me, but to all the Leaders of the Free World. I was to meet President Xi in two weeks, at APEC, in South Korea, but now there seems to be no reason to do so. The Chinese letters were especially inappropriate in that this was the Day that, after three thousand years of bedlam and fighting, there is PEACE IN THE MIDDLE EAST. I wonder if that timing was coincidental? Dependent on what China says about the hostile “order” that they have just put out, I will be forced, as President of the United States of America, to financially counter their move. For every Element that they have been able to monopolize, we have two. I never thought it would come to this but perhaps, as with all things, the time has come. Ultimately, though potentially painful, it will be a very good thing, in the end, for the U.S.A. One of the Policies that we are calculating at this moment is a massive increase of Tariffs on Chinese products coming into the United States of America. There are many other countermeasures that are, likewise, under serious consideration. Thank you for your attention to this matter!

This message was somewhat cryptic because it didn’t include any deadlines or real details, but then Trump posted the following:

It has just been learned that China has taken an extraordinarily aggressive position on Trade in sending an extremely hostile letter to the World, stating that they were going to, effective November 1st, 2025, impose large-scale Export Controls on virtually every product they make, and some not even made by them. This affects ALL Countries, without exception, and was obviously a plan devised by them years ago. It is absolutely unheard of in International Trade, and a moral disgrace in dealing with other Nations.

Based on the fact that China has taken this unprecedented position, and speaking only for the U.S.A., and not other Nations who were similarly threatened, starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying. Also, on November 1st, we will impose Export Controls on any and all critical software.

It is impossible to believe that China would have taken such an action, but they have, and the rest is History. Thank you for your attention to this matter!

Let me share some brief thoughts here. Some things have changed compared to the situation we experienced several months ago, while others have not. Let’s start with what might have changed. The main “difference” is that many companies are much better prepared for a tariff war today than they were in April. We’ve evidently not seen a full “decoupling” from China in such a short period, but there’s no denying that the pandemic and the first Tariff tantrum in April have made supply chains across the board much more flexible.

The things I believe have not changed are several, but they can be summarized in one: the outcome of the tariff threats is likely to be negotiations. The reason I claim this is that Trump has set a 20-day deadline from today, which likely indicates he is open to negotiation (or else this would’ve been with immediate effect). The fact that China also set its deadline on November 1st likely signals a similar predisposition to talk. We’ve seen this before, just a few months ago, and I believe it’s likely that both countries will end up reaching a deal (who knows, maybe this is the first time the T.A.C.O trade doesn’t work!). I plan to be pretty aggressive taking advantage of the opportunities, which I will discuss in more detail later for paid subscribers.

The industry map was something we’ve not seen in a while: a sea of red with few exceptions:

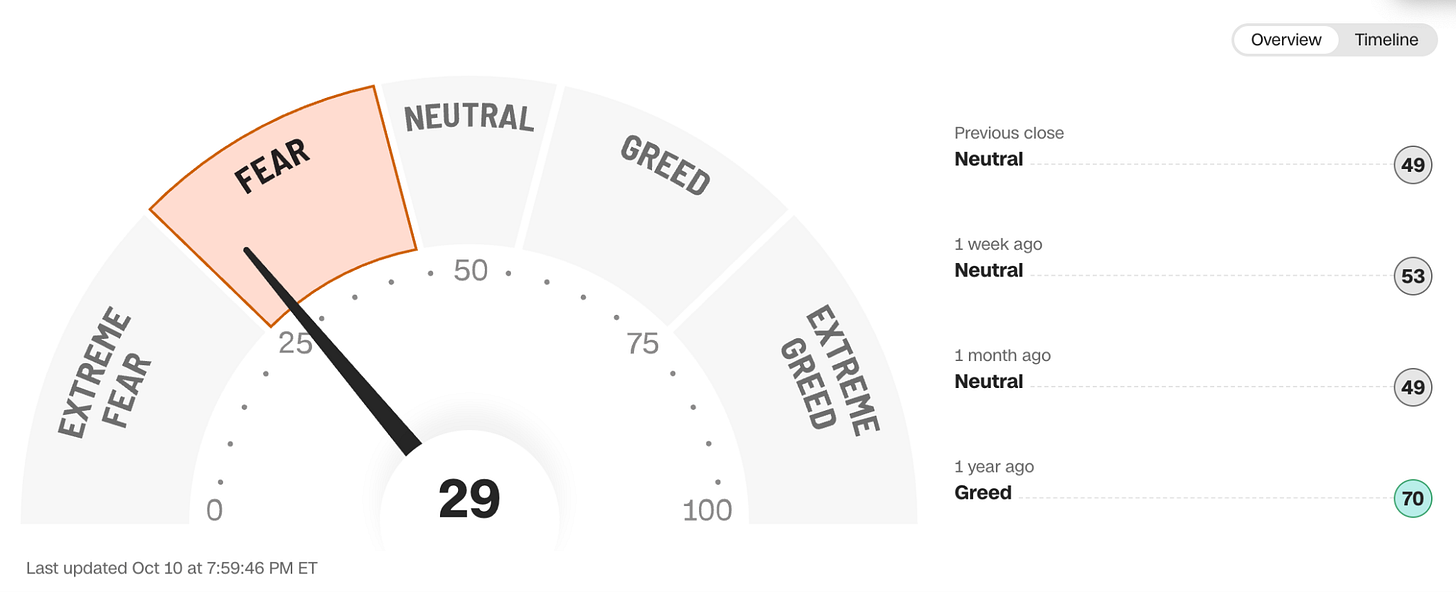

The fear and greed index dropped considerably from almost greed territory to being close to extreme fear:

This, in my opinion, portrays why there tend to be opportunities in the stock market: sentiment changes fast like lightning, but the intrinsic value of the underlying companies does not.