Tariff talk again, a $10 million handbag, and announcing the next in-depth report (NOTW#51)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Both indices were relatively flat during a week when the tariff talk retook the center stage. There was news about two portfolio companies: Hermes and Amazon.

Without further ado, let’s get on with it.

Articles of the week

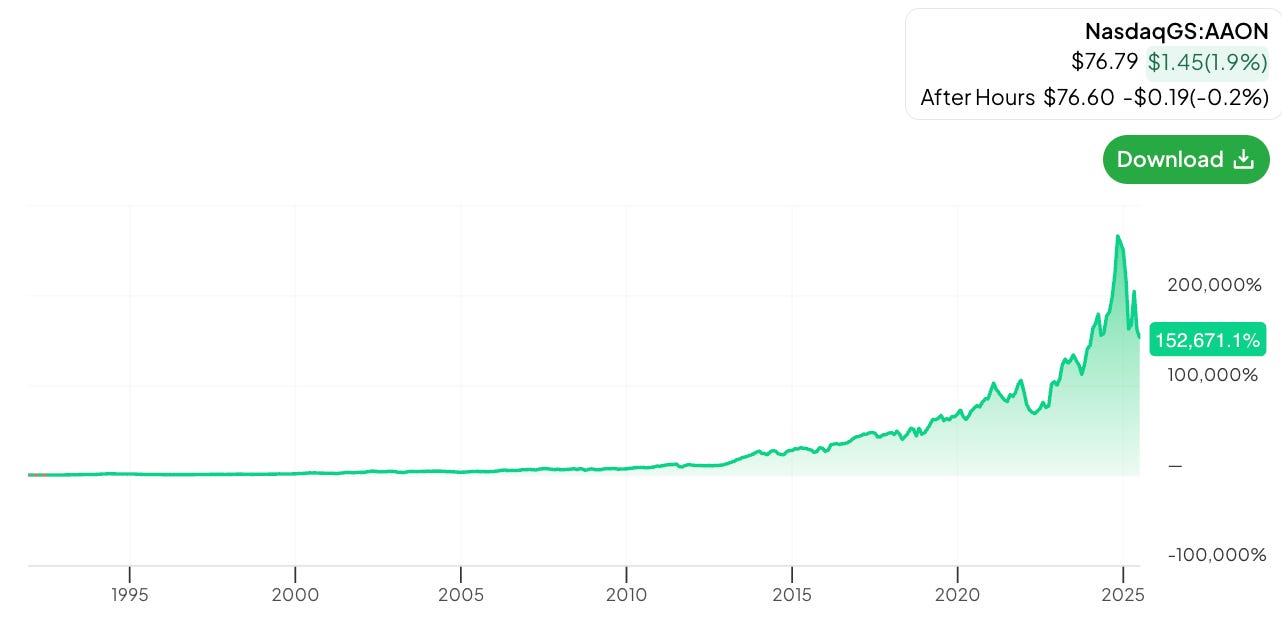

I didn’t publish any articles this week. I have already started working on the next in-depth report, which I will try to publish two weeks from now. The company that the in-depth report will be based on is AAON (AAON):

AAON is a 100 bagger that went from being a Hedge Fund and Wall Street bets favorite to being down more than 40% from peak in a matter of months:

It’s a very interesting company that has a unique approach to its markets. The report will be available exclusively to paid subscribers…

…although I released a free report on one of the industries where AAON operates just last week: ‘Cooling AI.’

🤖❄️ Cooling AI

When people talk about AI, two words tend to come out of their mouths: chips and Nvidia. Jensen Huang’s company is the largest company on earth primarily thanks to the sales of GPUs (Graphics Process…

Market Overview

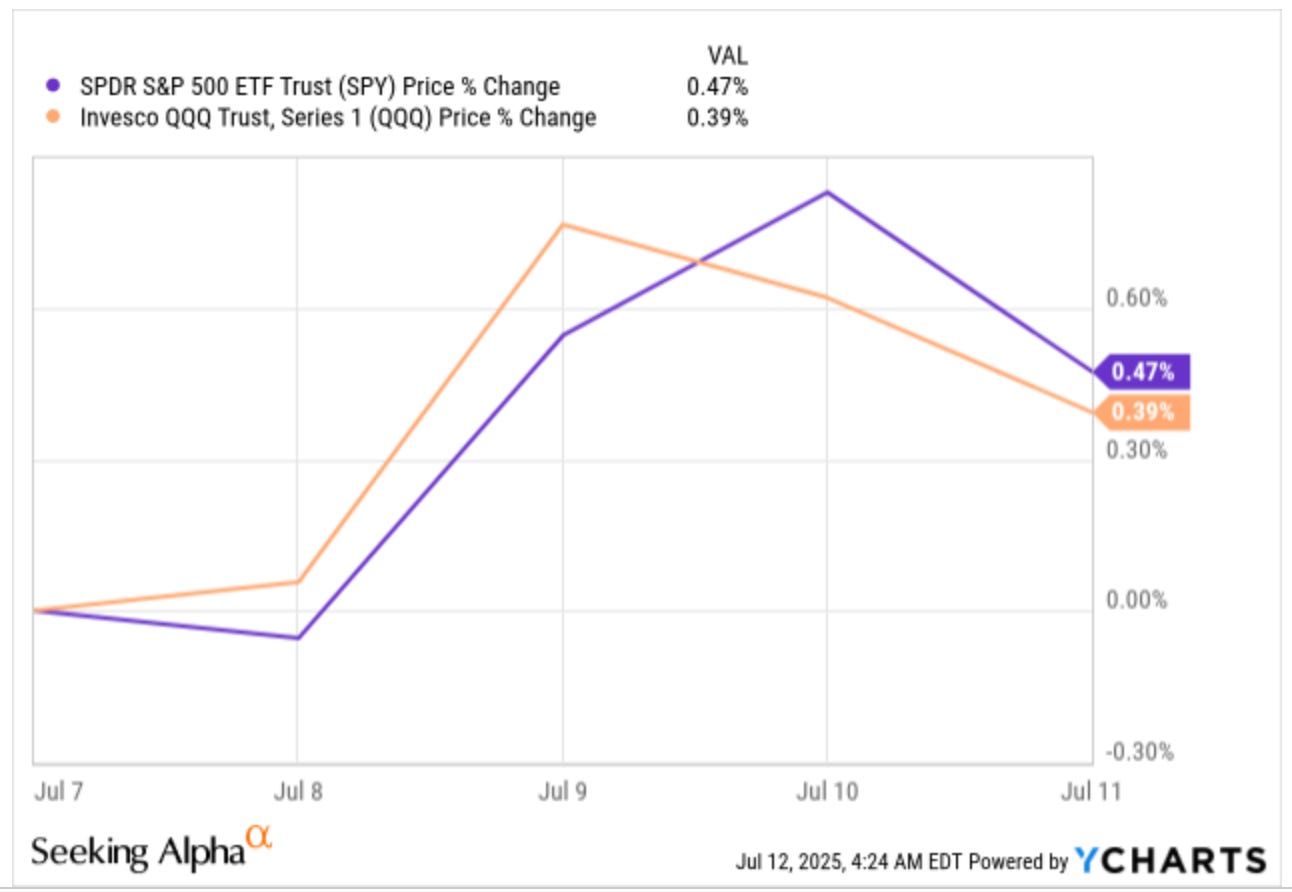

The markets were mostly flat this week amid the tariff talk:

I have been pretty disconnected from markets this week, but I have been aware of all the tariff talk. Trump has gone back to his discourse on tariffs, with the non-minor difference that markets are currently at ATHs (all-time highs) and barely budging on said news, whereas they were much lower when he first started talking about them. This can only mean one of two things…

The market doesn’t believe what Trump is saying, and T.A.C.O (Trump Always Chickens Out) is a possibility again

The market is ignoring that tariffs might get implemented (if this happens, we might go much lower)

I have no clue which one of these two will end up happening, but the reality is that nobody does. Is the market trading on the expensive side of things? Historical multiples would say so, but this conclusion would be a tad misleading for two main reasons. First, the indices’ composition is significantly different today than it was 40 years ago, so the historical comparison is not really apples to apples. One would think that, if the index is heavily weighted today towards higher quality companies than in the past, the justified multiple should be higher (all things equal). This is something that also applies to individual companies. A company might have seen multiple expansion in recent times without this necessarily meaning that it’s expensive compared to its history.

The second reason why multiples might be misleading (albeit this is TBD) is AI. AI can be a significant tailwind for the largest companies in the indices, so we might see their earnings grow significantly faster than expected. I have no clue if we will eventually see this, but nobody does, which is why being so sure that the index is expensive/cheap is probably not the best idea.

Then comes the next derivative: to what extent should an investor in individual securities be so worried about the valuation of the index? While it will be almost impossible to do well if markets are crashing (the market will go on risk-off mode), I don’t think the same applies to the markets going sideways or offering subpar returns going forward. While one should be aware of what the market can do directionally and all the options available, I don’t think overobsessing with what is out of one’s control is the best use of an investor’s time.

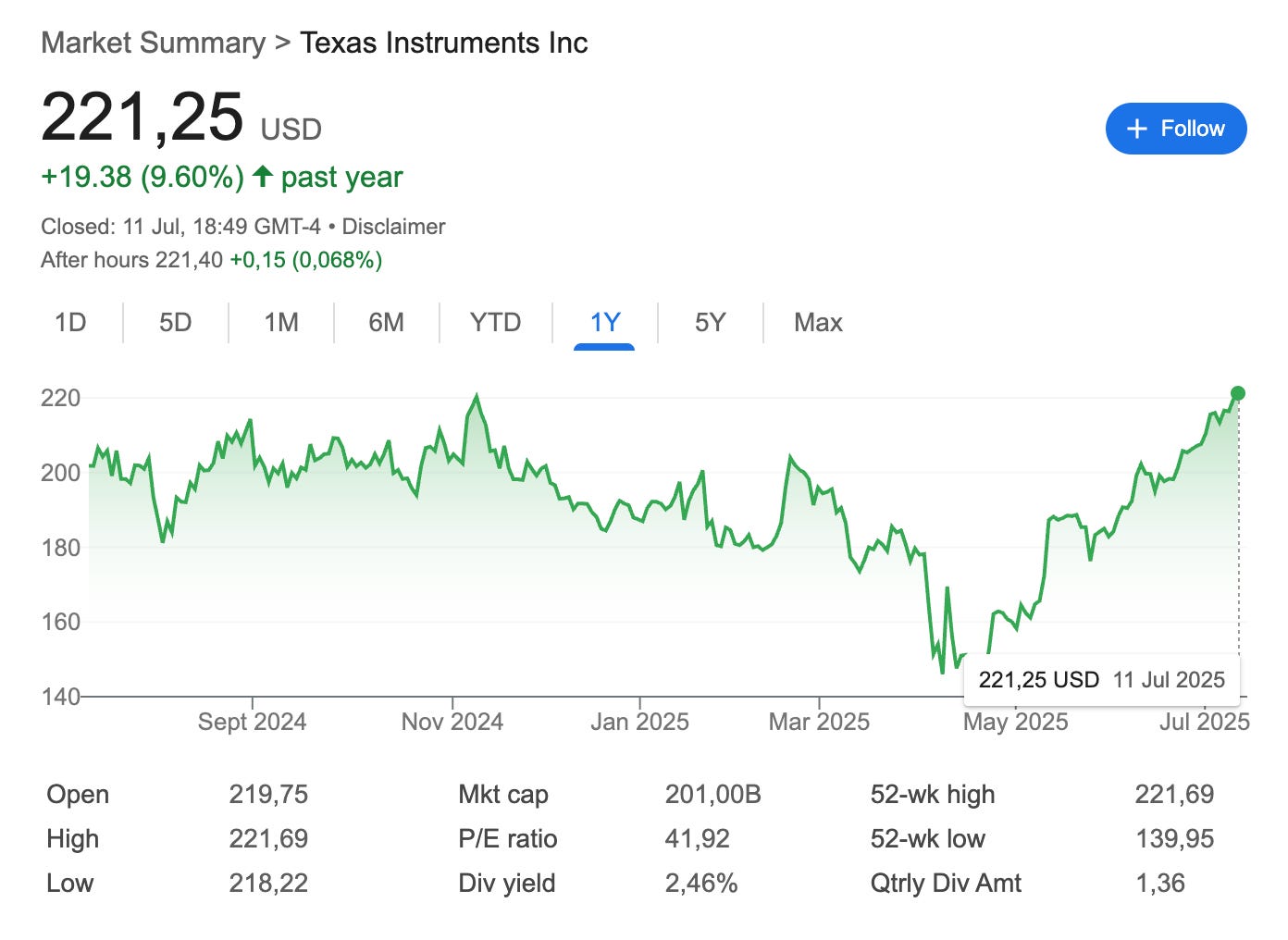

We must also be aware of how pro-cyclical the market is. We had a good example this week. Texas Instruments experienced a significant drop in April due to the tariff talks, coinciding with a poor sentiment in the analog industry. Well, the stock is now up 52% from the April lows and has breached a new ATH:

Unsurprisingly, several sell-side analysts have started to rate the stock as outperform after the run. Pro-cyclicality in its purest sense! Luckily for me, I added to my position considerably around $150-$160.

The industry map was mixed this week:

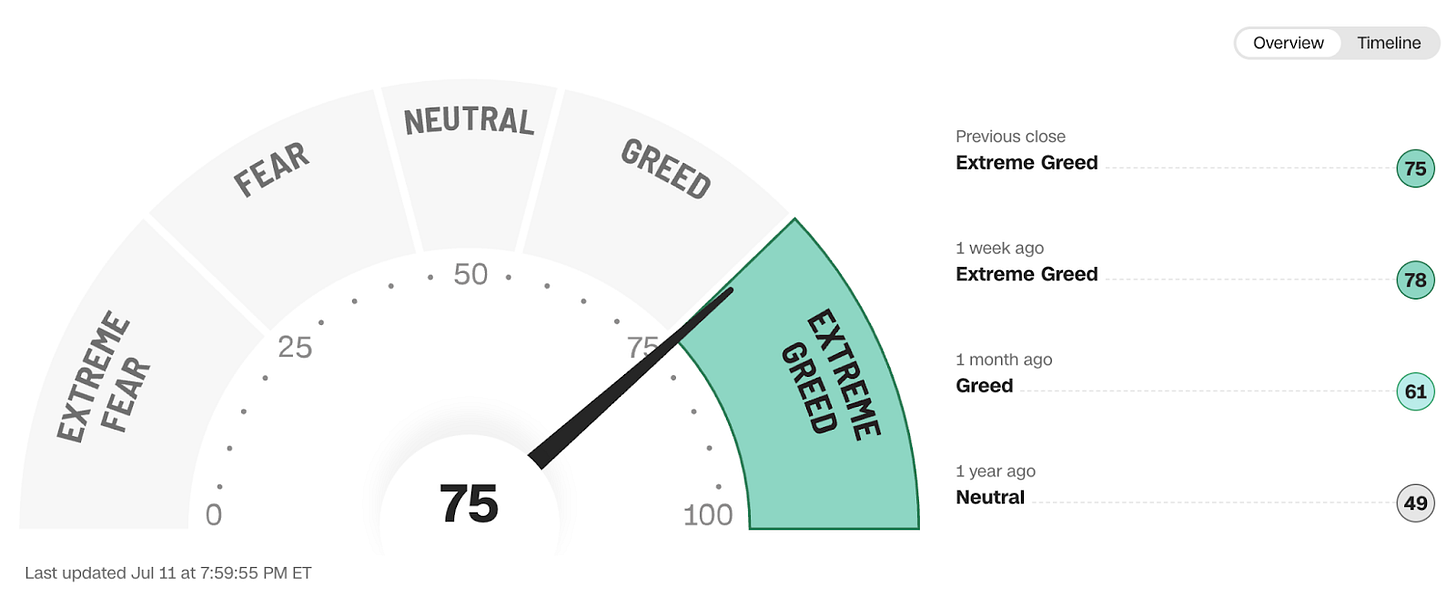

The fear and greed index dropped slightly, but remained in extreme greed: