Section 232 Tariffs, Some Self-Reflection, And Plenty Of (Relevant) News (NOTW#61)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Markets were down this week for the first time in a while. I share some self-reflections in the market commentary section and highlight some relevant news for portfolio companies in the News of the Week section.

Without further ado, let’s get on with it.

Articles of the week

I published one article this week, discussing the highlights from Constellation Software’s call on the impact of AI.

Is AI eating Vertical Market Software?

Constellation Software hosted a call today about the impact of AI on its business, and decided to write a brief article with the highlights. Note that most of the highlights are really shared through…

There were several highlights, but the main one was that Constellation refuses to forecast the future with certainty (a practice that is usual for many investors). As you might have seen, Constellation received some very relevant news this week: Mark Leonard is retiring, effective immediately. I’ll go over this in the news of the week section (reserved for paid subscribers).

Next week, I will publish an in-depth report on a company I will be adding to my portfolio:

Without further ado, let’s see what the markets did this week.

Market Overview

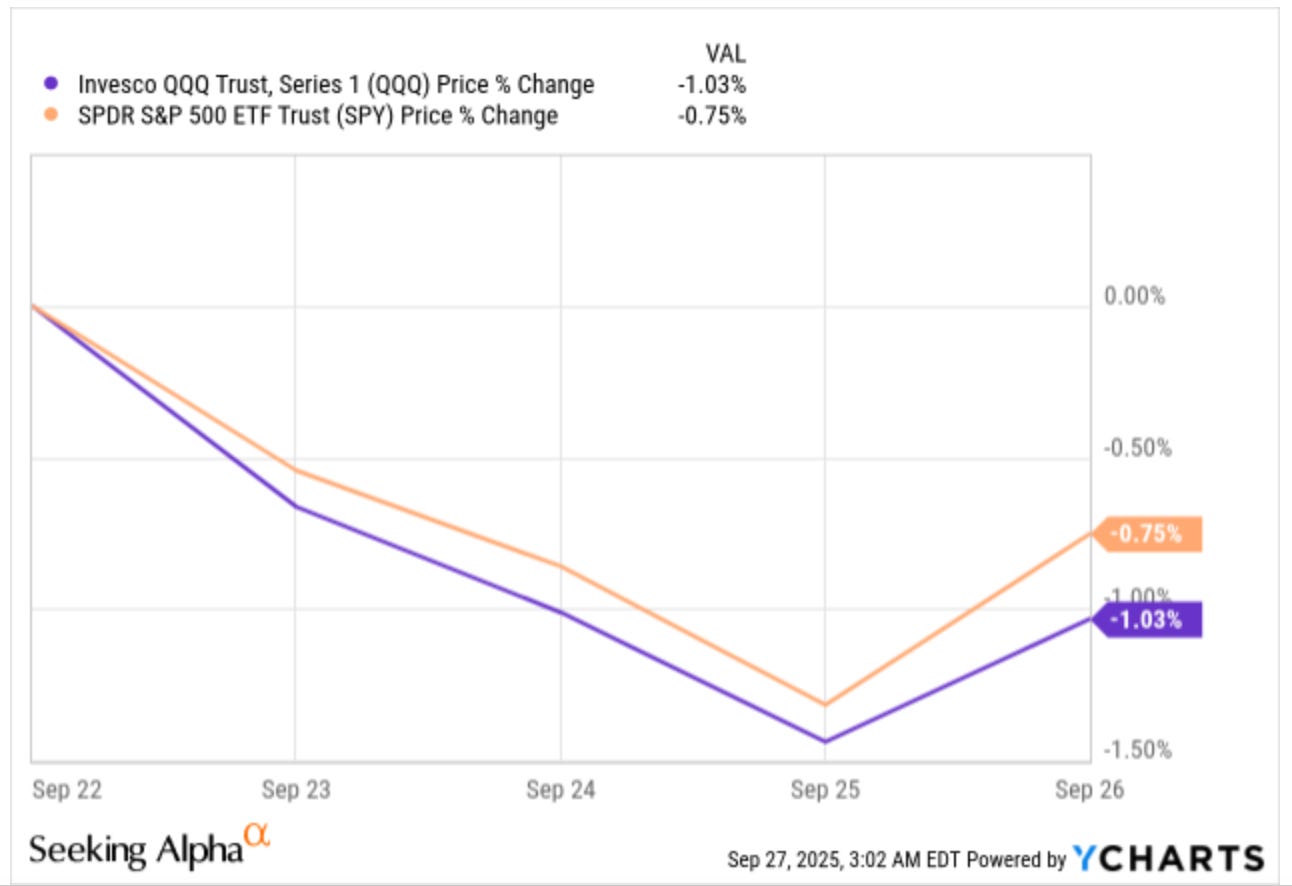

Both indices were down this week for the first time in a while:

I honestly don’t have much to discuss this week. Trump did impose additional Section 232 tariffs before heading to the Ryder Cup, but I discuss those in the News of the Week section and how they impact/benefit some of my portfolio companies (the stock reactions of some of these were puzzling, to say the least).

One thing I did this week was some self-reflection, coming up with the following conclusions:

Think that it’s important to remain self-critical as an investor, so here’s a shot at it (have been thinking about writing long form about it):

The good: I think I’ve been relatively good at the research in general and spotting opportunities. I am not looking for 10x (although I sure welcome them) and I think I’ve found a good balance between risk and return (I’ve obviously made mistakes as they are part of the game)

The bad: I think I have to improve quite a bit in terms of position sizing. I’ve been relatively good at sizing up positions (maybe not enough), but terrible at sizing them down when the risk/reward was not favorable. This has cost me performance and have to get better at it

One of the challenging things about investing is that mistakes seem obvious and are easy to spot in hindsight, but it’s tough to change our behaviour while making one.

I think this last quote is pretty important (even though I am biased because it’s mine). I strongly believe that investing is challenging because it’s easy to think about what you could have or could have not done in hindsight, but spotting it in real-time is extremely tough. Say that I believe a stock is overvalued and therefore that I should trim. If I don’t trim and the stock goes down, then I feel bad. If I trim and suddenly the stock pops (for whatever reason), I also feel bad. This reluctance to make decisions about trimming positions when the risk-reward ratio is not as favorable has definitely saved me taxes, but it has also cost me quite a bit of performance, and I need to improve at it. Again, I am saying this with the benefit of hindsight.

I think that trimming (or trading around positions) makes sense so long as you have a more or less clear estimate of how much a company is worth, and I also think that optionality matters when making such decisions. For example, I round-tripped ASML from a 100% gain to flat (now up 40%+) because I didn’t take optionality into account. The stock was somewhat expensive when it was at a 100% gain based on 2030 guidance, and I was close to trimming, but got anchored in the concept of optionality. I should’ve realized that, due to its capacity constraints, it did not have much optionality (as others may have). ASML definitely has optionality over the very long term, but that’s probably more “forecastable” than the “immediate” optionality that typically results in outperformance.

Another interesting thing that I think becomes evident every time a stock suddenly goes down or up is that bear/bull cases suddenly become more likely. If a stock is down 30% the bear cases will seem as probable as ever, and when a stock is up 30% it will be the opposite. The reality is that, if bear cases were present before and their magnitude has not changed significantly, they are less likely to have an impact on the stock when it’s already down 30%. Likewise, when a stock goes up 30%, the risks don’t suddenly disappear; it’s just that we believe they are less likely to play out (when indeed the risk is higher).

The industry map was somewhat mixed this week:

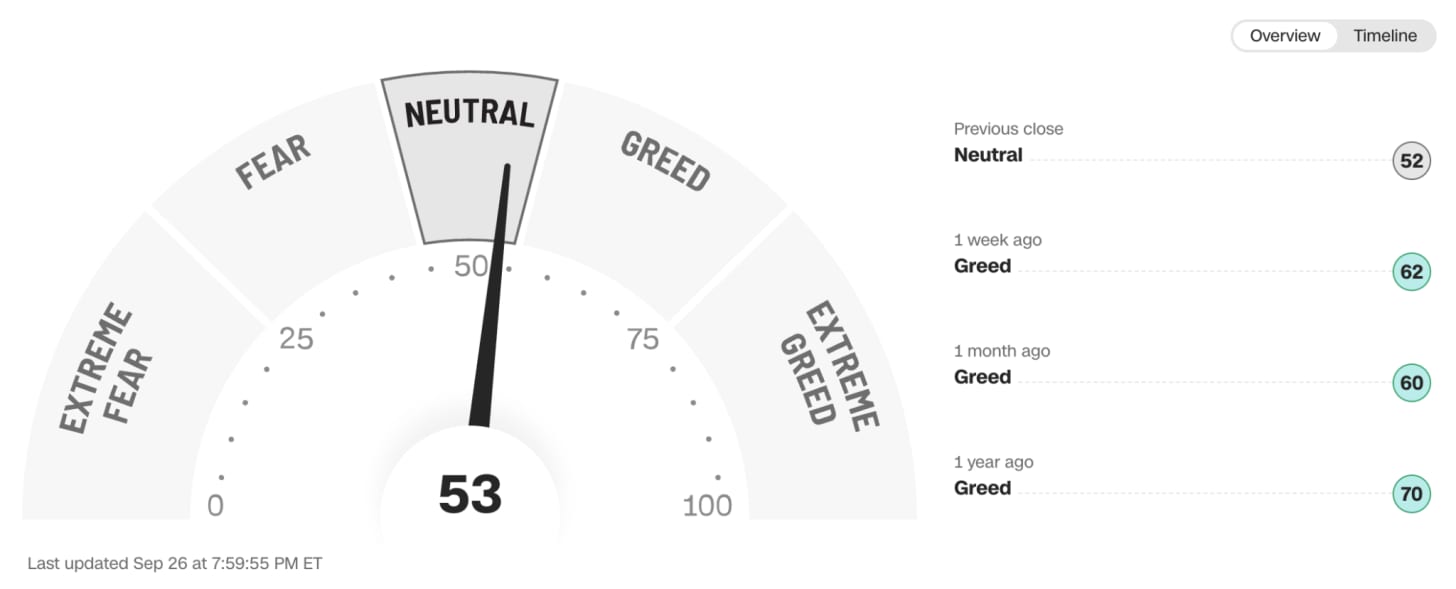

The fear and greed index retraced back to neutral territory: