SaaSmageddon (NOTW#75)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

It was a pretty hectic week for software investors (I’ll discuss why in the market commentary section) although a pretty uneventful week if you don’t have exposure to software. AI is creating a pretty wide bifurcation across industries, in some instances driven purely by narrative (thus far). This means that there might be opportunities appearing on the horizon.

Without further ado, let’s get on with it.

Articles of the week

I did not publish any article this week but have started working on the next in-depth report that I will publish soon. Note that it’s a company from a new industry and a new country, so it’s going to be an interesting one!

Just to give some clues…

20%+ CAGR over 12 years

“Recent” IPO

Founder led

Early innings of the growth runway

Without further ado, let’s see what the markets did this week.

Market Overview (SaaSmageddon)

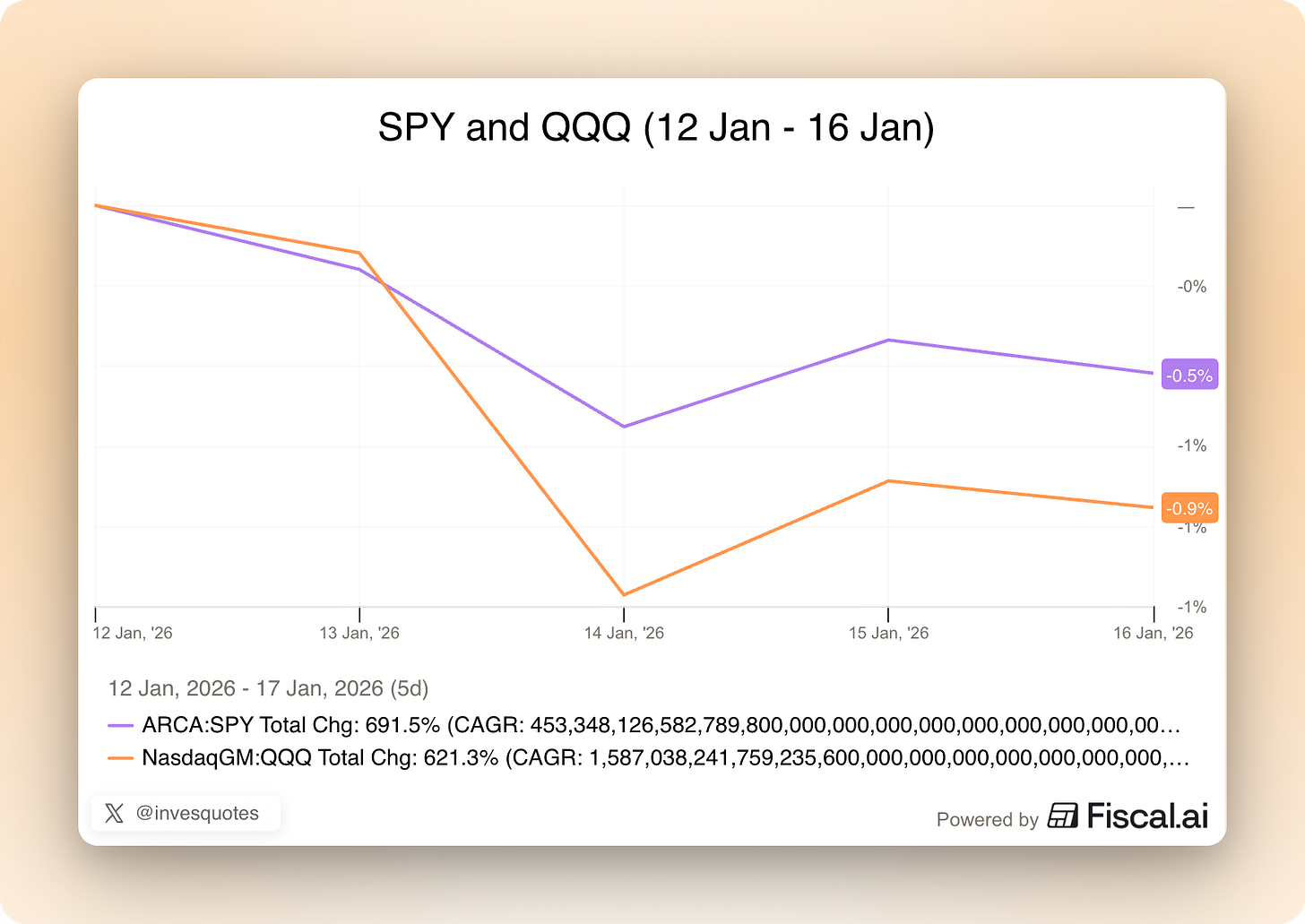

Both indices were down this week for the first time this year:

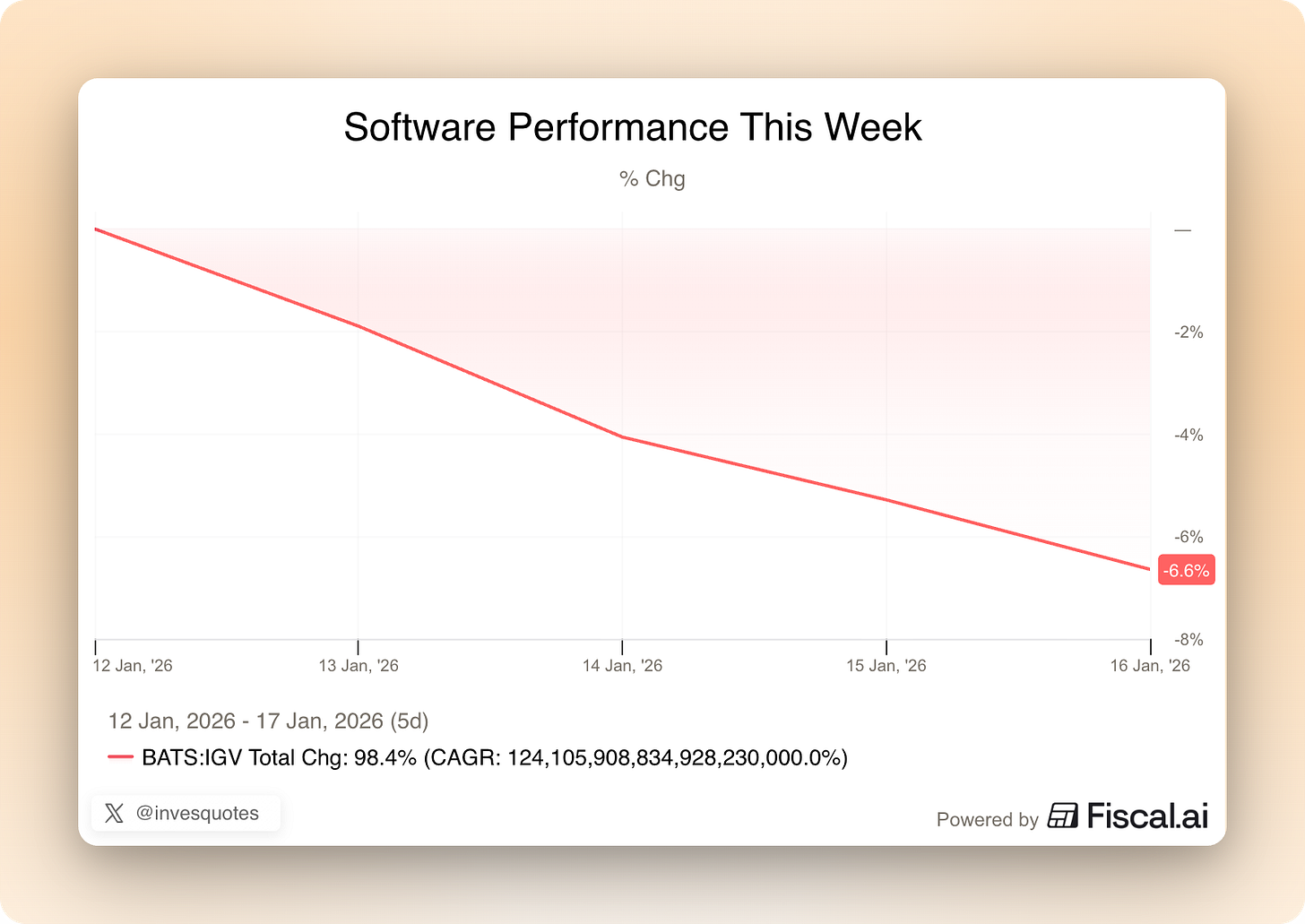

I titled today’s article “SaaSmageddon” and I don’t think I need to explain why: SaaS stocks got clobbered this week, hit again by the AI narrative as soon as Claude Cowork was launched (it’s definitely impressive). Even though the Nasdaq and the S&P were barely down, some software ETFs were down as much as 6.6% this week:

So, the question here is:

Is the drop justified?

We’ll only know the answer in hindsight, but I wanted to share some thoughts in this NOTW. I’ll share these from two POVs (points of view). First, from the POV of a fundamental-focused investor, and secondly, from the POV of an investor who is cognizant about how markets work. Both POVs are actually somewhat in conflict over the short to medium term, which is what makes having a strong opinion hard. Let’s start with the POV of a fundamental-focused investor.

So, the narrative goes as follows:

AI will lower software development costs to pretty much 0, disrupting software businesses.

Seems like a fair concern, but actually it’s not that fair when we consider how history has unfolded. When software transitioned to the cloud (from on-premise), the argument was similar: costs to develop software had come down (and, with them, entry barriers) and therefore software businesses would get disrupted. It didn’t happen, but what’s most interesting is to think about this from the POV of capitalism. Many software companies have been putting up 80%+ gross margins and software development costs have been decreasing for many years, so why haven’t these margins been competed away already? I mean, should entry barriers only be related to development costs, then it would be very enticing to disrupt those 80%+ margins, especially in a world in which capital has been abundant (ZIRP era). The fact that it didn’t happen means potentially two things:

Capitalism failed (unlikely)

There’s more to entry barriers than development costs (likely)

There definitely seems to be something more than development costs to come up with a successful software product that is sellable and scalable. These two posts capture this quite well:

I believe this is pretty obvious to the informed investor (I don’t know if it is for the market), but I also believe AI brings additional “challenges” for incumbents that can potentially be disruptive. For starters, it promises to completely disrupt the pricing model. SaaS firms used to price on a per-seat basis, but with software potentially being much more productive, this may need to change to a pricing model that’s value-based. There still has not been a significant hit to seats as companies have taken advantage of the better productivity to do more, but there’s no assurance this is not going to change in the future. Some companies are already adapting to this “paradigm shift”, but not all companies will manage to adapt.

Secondly, it requires applying AI to incumbent software, and problems can always arise from execution. AI’s disruptive force is as new to incumbent software management teams as it is for you and me, and this increases the probability of a misstep.

There’s also a flipside though. Should incumbents survive, they can potentially benefit from significantly lower development costs while adding more value to their end customers in what would theoretically be a win-win situation.

What does this all mean? While I don’t believe AI is entirely disruptive (at least in terms of development costs), there’s no denying that it brings a paradigm shift that can potentially be disruptive to the business model. Businesses will need to adapt, and some businesses will f*ck it up in that adaptation phase. The good news is that the market will throw out the baby with the bathwater, meaning that it’s unlikely to discriminate between who is more or less exposed to potential disruption. What does this result in? Potential inefficiencies.

Now, everything becomes more complex when we look at it from the POV of market narratives. Software has “lost” the AI narrative, at least for now. This means that the market is now in “show me” mode, with the only problem being that it’ll be tough for software companies to “show something” over the short to medium term. What I mean by this is that it’ll probably take a while for the market to feel comfortable with a new narrative, one in which software benefits from AI rather than one where software is disrupted by AI. I don’t have a crystal ball, but I can imagine a situation in which it takes a long time for the market to realize. Note that AI companies will continue to launch products, these products will go viral, and everyone will continue talking about how they disrupt software. Rinse and repeat.

This means that, while fundamentals might continue to do well (or at least not show signs of apparent disruption), the valuation multiples might continue compressing. So, from the POV of an investor, you might be right on how AI will impact software, but you might end up facing losses either way (this is why this game is tough). Another possibility, of course, is that one is wrong in expecting how AI will impact software, with the market already discounting this possibility to an extent with the multiple compression.

While narratives can take a while to shift, it’s also true that they can shift unexpectedly and fast. ASML and Google both experienced a pretty substantial narrative shift last year for no apparent reason, while everyone predicted at the lows how tough it would be for the narrative to shift. I do admit that software/AI is an entirely different debate and will take longer to settle, but the market is totally unpredictable. We’ll see.

The industry map was mixed this week, and the bloodbath in SaaS (and the great performance of semis) was palpable:

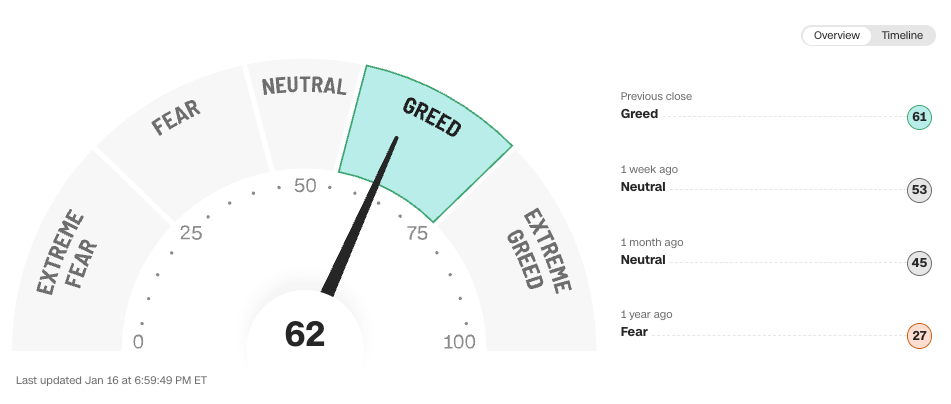

The fear and greed index jumped to greed territory, which was kind of a surprise to me: