Nintendo's 6-months Earnings

Reasons to be optimistic

Hi reader,

Nintendo reported earnings earlier this week, and many people were spooked by the numbers. Despite having no reason to be surprised, investors are always surprised by Nintendo’s earnings. One of the things that might cause this is that the company never shows quarterly numbers but rather 6-9 month or FY numbers (except in Q1, of course). What this meant for this quarter is that the “terrible” numbers of Q1 were included in this quarter’s reported numbers, and therefore things looked quite grim.

In last quarter’s article, I mentioned that Nintendo faced two significant headwinds in Q1, which created very tough comps:

The Super Mario movie

The launch of the Legend of Zelda Tears of the Kingdom

These explained to a great extent the significant drop in sales and profits the company experienced. Not only were these two headwinds present in Q2 (albeit to a lesser extent), but as Nintendo bundles Q1 and Q2 when reporting numbers, the Q1 drop “contaminated” this quarter’s numbers.

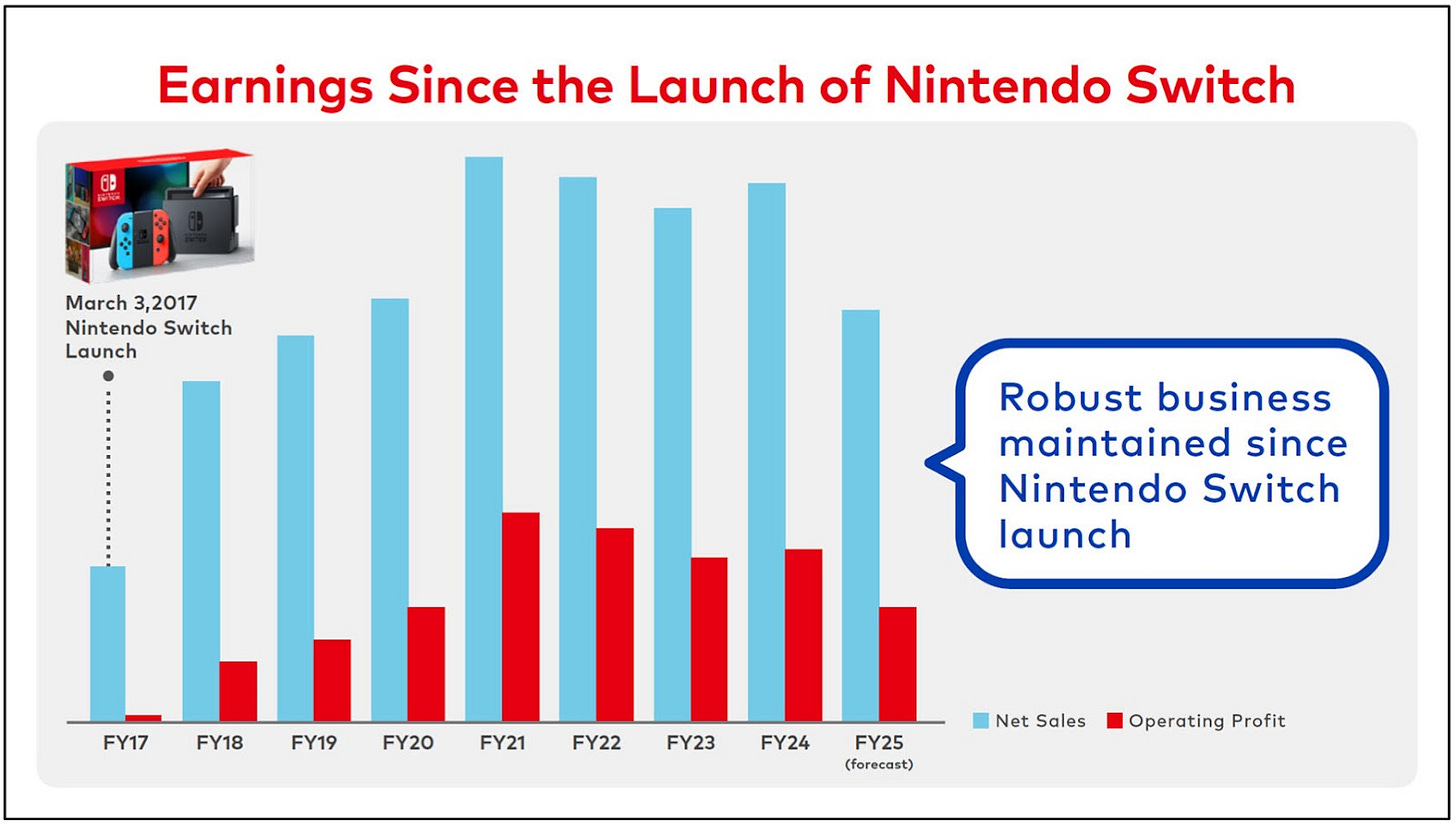

Before jumping into the details of the earnings, I think it’s worth clarifying that seeing numbers drop over the first half of this year shouldn’t have taken anyone by surprise. The Switch was launched eight years ago, so it’s evidently in decline. What should’ve surprised investors materially is seeing Nintendo grow sales and earnings north of 20% on the seventh year of a hardware lifecycle; this is what happened last year.

The following slide shows quite graphically how FY 24 was an abnormal year. Nintendo is generating similar sales as in FY 20, demonstrating resilience:

In no way do these drops have relevance for the long-term thesis (in my opinion), and I’d go as far as to say that they even demonstrate that the thesis is intact. Nintendo has demonstrated two things throughout the last several years:

It’s IP is very valuable and heavily under-monetized

Customers remained engaged with this IP despite technical specs of its hardware being vastly inferior to that of its competitors

All this said, let’s take a look at the numbers.

The numbers

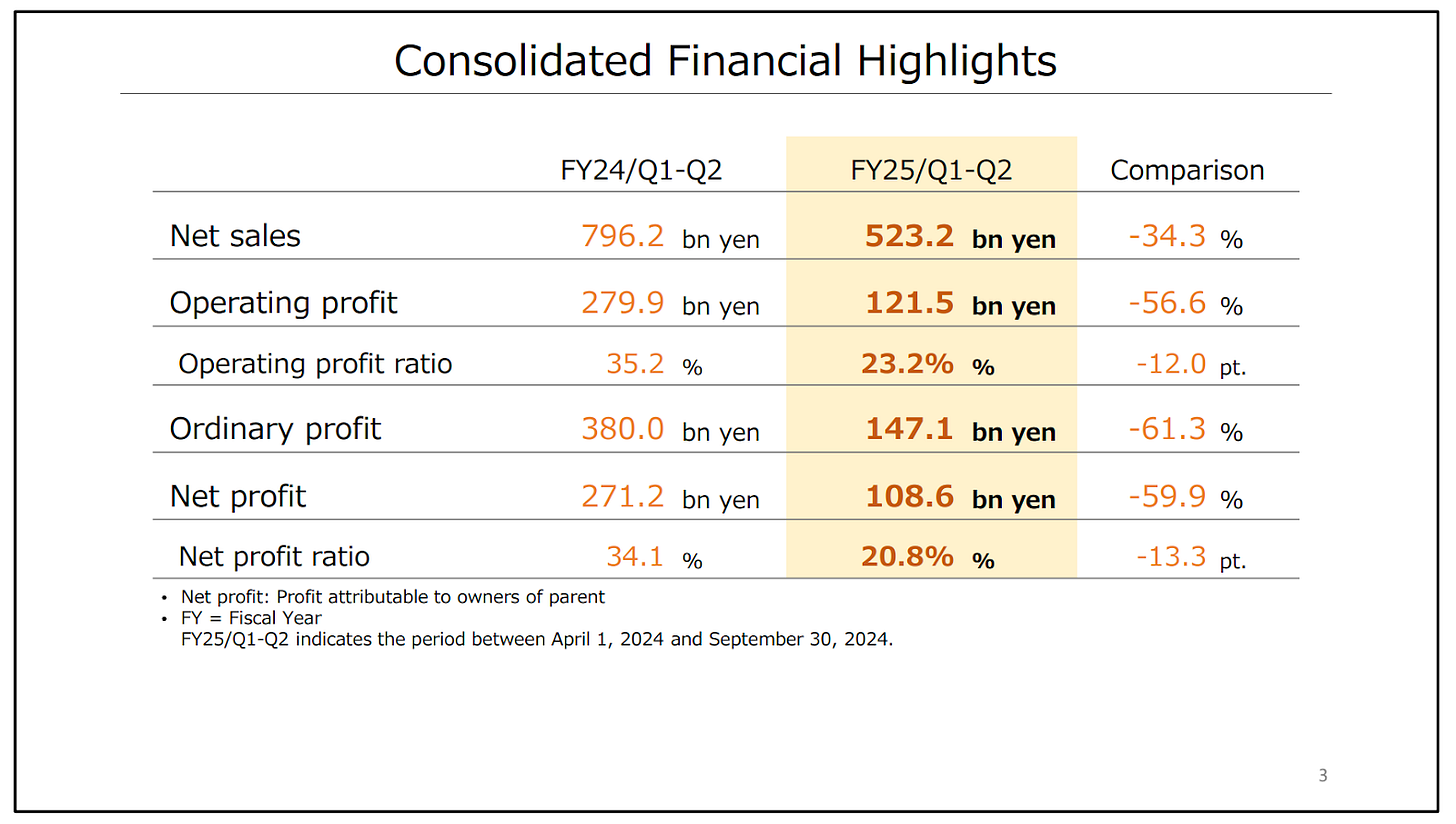

Nintendo reported a 34% and 57% drop in sales and operating profit, respectively, over the first 6 months of its fiscal year:

This drop, however, must be contextualized by focusing on the quarterly numbers. Sales were down 17% in Q2, which is not great either but much more in line with what we should expect at this stage of the Switch’s lifecycle. The sales drop moderated from Q1 to Q2 because the toughest comps occurred in Q1. This quarter’s drop can be explained by some delayed impact of those tough comps (Q2 sales last year were “only” down 4%) and due to the Switch being a hardware system in decline (let’s not forget it was launched 8 years ago).

Zooming out a bit also helps contextualize these numbers: Q2 sales are down 20% from Q2 FY 23 (two years ago). This is a more normal drop considering the Switch’s lifecycle, but the comparison is also not entirely fair because 1P game releases have been absent lately probably due to the imminent arrival of the Switch’s successor.

Operating profit decreased faster than sales because Nintendo is a fixed-cost business. This fixed-cost nature is not inherent to the business (manufacturing is outsourced) but rather introduced by management through SG&A expenses. Despite the sales drop, gross margins were up (due to a lower proportion of OLED model sales), but the operating margin was down because Nintendo keeps investing in R&D, probably focusing on the next hardware system:

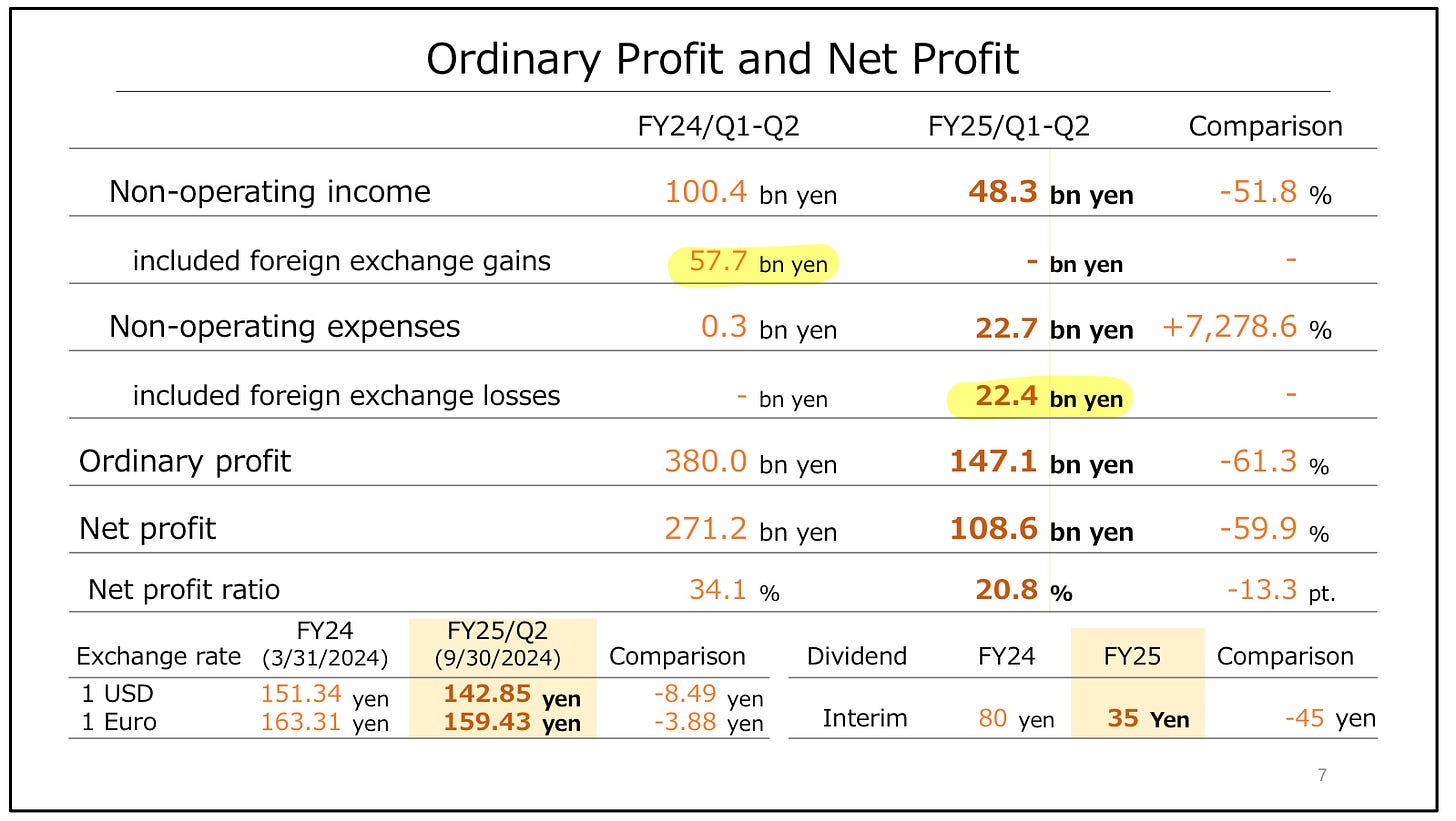

As I always say, a fixed-cost business works both ways: when sales growth returns, we should see significant operating leverage because it will not come with increased costs in R&D (maybe it does on Advertising). The drop in operating profit was further magnified to the bottom line because Nintendo went from 57.7 billion yen in foreign exchange gains to 22.4 billion yen in losses, an 80 billion yen differential. There's not much we can do about this, and I don’t think it will be that relevant long-term.

The “lowlight” of the release was evidently the guidance. Management reduced their estimates pretty much across the board:

I must say, though, that this should’ve also been expected. Nintendo expected to sell 13.5 million units of the Switch (only 14% less than last year) in the eighth year of the hardware and after announcing a successor was coming soon. To this, we must add that last year’s hardware sales benefited from the tailwinds of a Mario movie and the Zelda game. All things considered, the new 12.5 million guidance also seems pretty optimistic.

In terms of software, Nintendo expected a 17% drop compared to last year, which also seemed optimistic considering all the tailwinds experienced last year, but it’s definitely a place where management tends to be more conservative. All this said, I don’t think this guidance is of much significance for the long-term thesis, which still relies on the launch of the new hardware (which I’ll talk about later on).

There were, however, some highlights in terms of 1P software. ‘The Legend of Zelda: Echoes of Wisdom’ has sold 2.58 million copies in 5 days (it was launched September 26th). Older games such as Mario Kart 8 Deluxe continued to do outstandingly well, selling 2.3 million copies during the first 6 months. This, in my opinion, demonstrates how relevant Nintendo’s IP still is.

The thesis has been confirmed on Twitter (in a pure Nintendo fashion)

There are still ongoing rumors about the potential successor to the Switch, but rumors are increasingly dissipating to let reality sink in. President Furukawa claimed that nothing has changed about the timeline: Nintendo will make an announcement about the new system this fiscal year, so earlier than March 2025. There were, however, several confirmations regarding the shift to a more recurring hardware cycle. The first one came on Twitter in a pure Nintendo fashion:

Backward compatibility was one of the keys behind the new iterative model, and it was confirmed this quarter. This is great news for game collectors because their game library will remain relevant in the next hardware system.

There’s still the doubt if Switch 2 games will be playable in the Switch 1, but I guess we’ll have to wait a bit longer for that one. This would be great news for developers because their games would automatically be playable by a +100 million user base instead of waiting for a build-up in the Switch 2 installed base. The latter, however, seems like it will not stop these developers from working on games for the Switch 2, considering how fast that installed base is expected to build.

Two other quotes during the Corporate Management Policy confirmed that Nintendo wants to part ways with the historical boom and bust hardware cycle. Here they are:

Moving away from the traditional dedicated video game platform business cycles we saw in the past, we intend to maintain the momentum of our business by continuing to engage many people with Nintendo Switch.

We believe we are breaking away from the traditional dedicated video game platform business cycle and are building a new foundation for the future.

One of the things investors are most anxious about is the company’s massive cash position. Some argue that when Nintendo transitions to a more recurring model, it should be more open to putting this cash to work because the company would not need it in case of an unsuccessful hardware launch. Management hinted this would be the case during the Corporate Management Policy. The use of this cash will most likely be software and media:

Specifically, investment in the games category is expected to grow significantly due to increased capital expenditure on Corporate Headquarters Development Center, Building No. 2 (tentative name), which will enhance our research and development capacity.

Furthermore, in the non-game entertainment category, we plan to further utilize cash on hand to help continue delivering movies and other forms of visual content.

All in all, despite the “bad” headline numbers, it was a good quarter for long-term investors. The thesis got pretty much confirmed and Nintendo’s IP continues to be as relevant as ever.

In the meantime, keep growing!

muy buen artículo!