New In-Depth Report in 3,2,1... (NOTW#76)

Best Anchor Stocks has a partnership with Fiscal.ai (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Indices were up again this week in a week marked by noise and volatility. It seems like markets increasingly follow momentum (has been this way for a while) and narratives, and little else matters in this context. The good news for long-term investors is that fundamentals eventually prevail (or they should!). There was plenty of company specific news this week and I’ll also share when I am releasing the new in-depth report (which is about a company I will add to my portfolio).

Without further ado, let’s get on with it.

The new in-depth report

I did not publish any articles this week, but I was able to finish the new in-depth report that I’ll publish next week. Paid subscribers will receive it in their invoice on Monday and I will start a position shortly after.

I posted some stats about the new company on X this week:

Emerging market

20%+ CAGR over a decade (and no signs of slowing down with a 37% 3-year revenue CAGR)

Replicating a proven model

High insider ownership

Sustainable (and widening) competitive advantages

A reasonable valuation that supports a 15% CAGR over many years

There were plenty of guesses in the replies but not a single person managed to get it right. The company is relatively unknown. Evidently, a company like this is not free of risks (or else it would trade at an unsustainable valuation), but I’ll also discuss those in the report.

Without further ado, let’s see what the markets did this week.

Market Overview

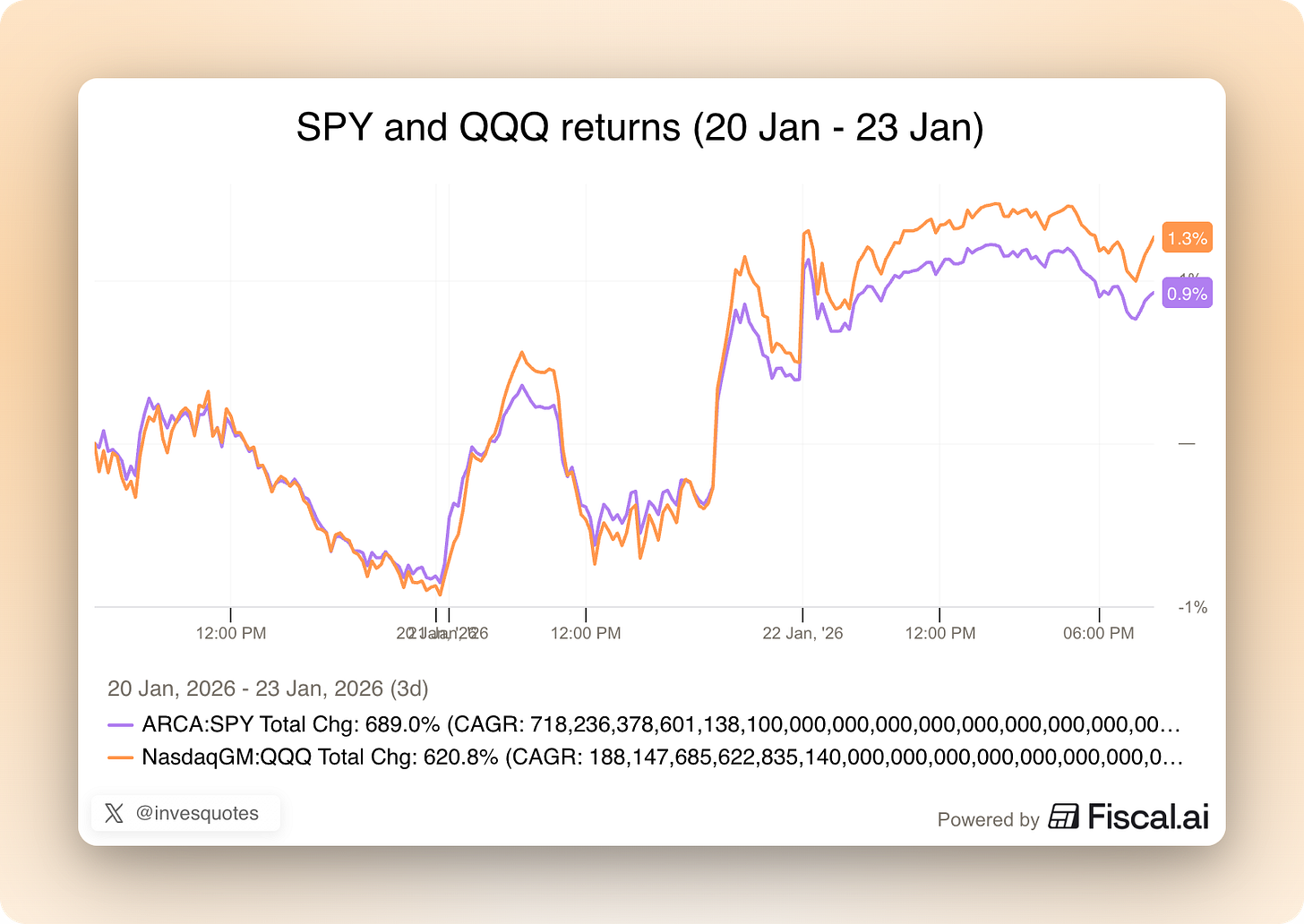

Both indices recovered somewhat this week after suffering the first down week of the year last week:

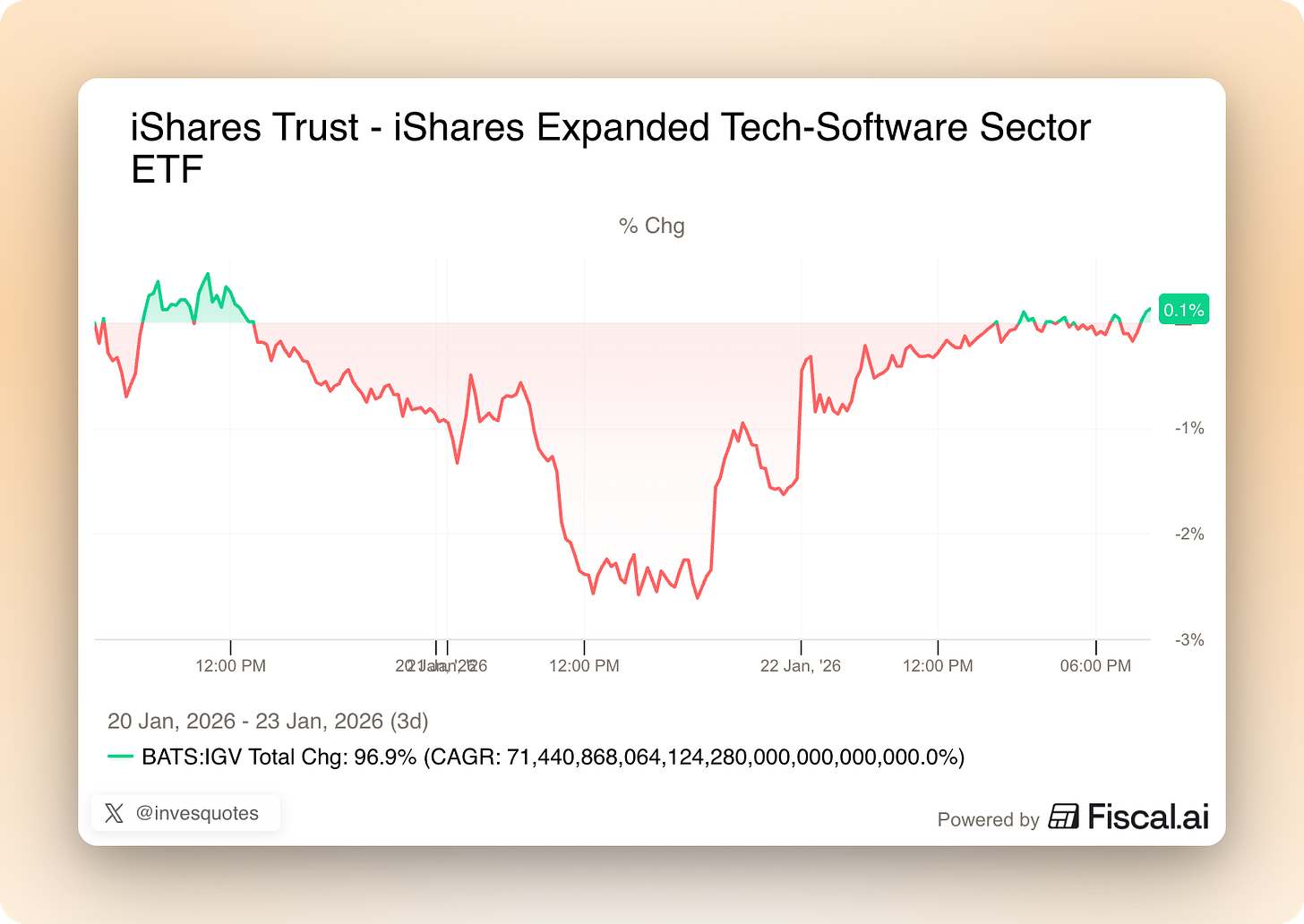

I titled last week’s article “SaaSmageddon” and I somewhat “jinxed” the software bears (at least for now). After dropping 6% last week, the IGV (a software ETF) was flat this week, albeit not without volatility:

The ETF started the week poorly again but rose almost 3% from the lows of the week. Does this mean that software is out of the woods and that the AI narrative was overdone? Not necessarily, and I believe it’ll take some time for the narrative to shift (or maybe it takes nothing, who knows). Anecdotally, I have started seeing some kind of a change of sentiment on X regarding software’s entry barriers and how coding costs are just one of many things you need to get right to build a successful software enterprise (I gave more thoughts in last week’s NOTW). This said, I must admit one has to be careful with perceptions here. The X algo can play tricks on you and only show you what you believe is true and feed your confirmation bias. I thought that this post was pretty good, but again, you must consider that this is my current view and therefore it displays somewhat of a confirmation bias:

If you want to laugh, this was also a very good post:

On another note, we had certain Trump-related news this week. First, he went “all-in” on Greenland on Friday night by threatening to impose tariffs on certain European countries. Uncoincidentally, this happened when markets were already closed and would remain closed until Tuesday. If I learned one thing in 2025, that was that pretty much any decision made by the Trump administration has the stock market in mind (it’s up to you to decide if this is good or bad!). Evidently, markets dropped on Tuesday (always remember that money hates uncertainty) but Trump capitulated soon. He attended the World Economic Forum in Davos and said two things:

That the US would not use the force to take Greenland

That he had had a very prolific call with Rutte (the Netherlands’ PM) and that tariffs were off the table

All it took for Trump to capitulate was a 2% drop on certain indices, which by the way are at ATHs (all time highs). That wasn’t enough for him, though. He also claimed that the stock market would double under his leadership. It’s an interesting “prediction” and one that I would evidently take with a grain of salt.

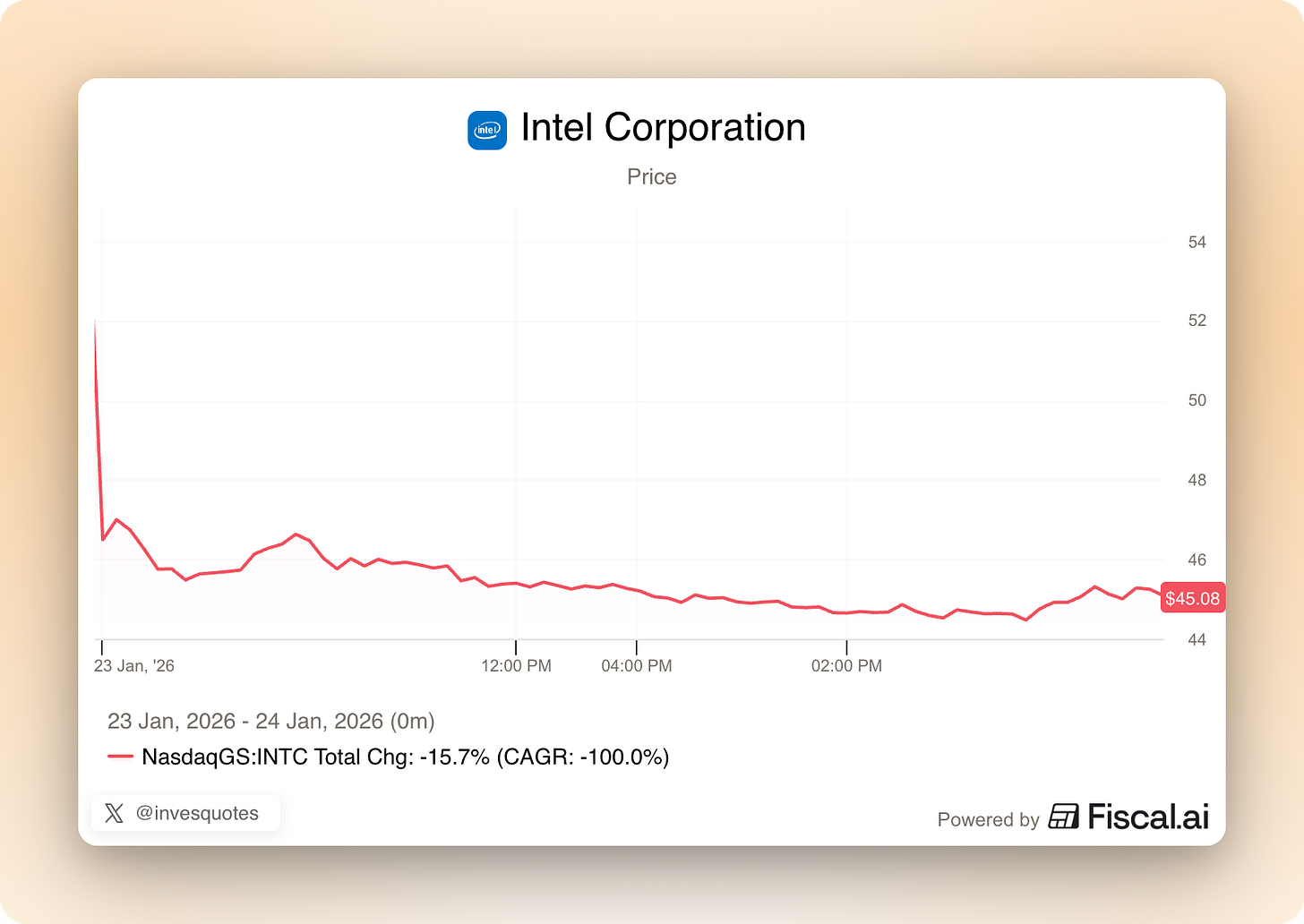

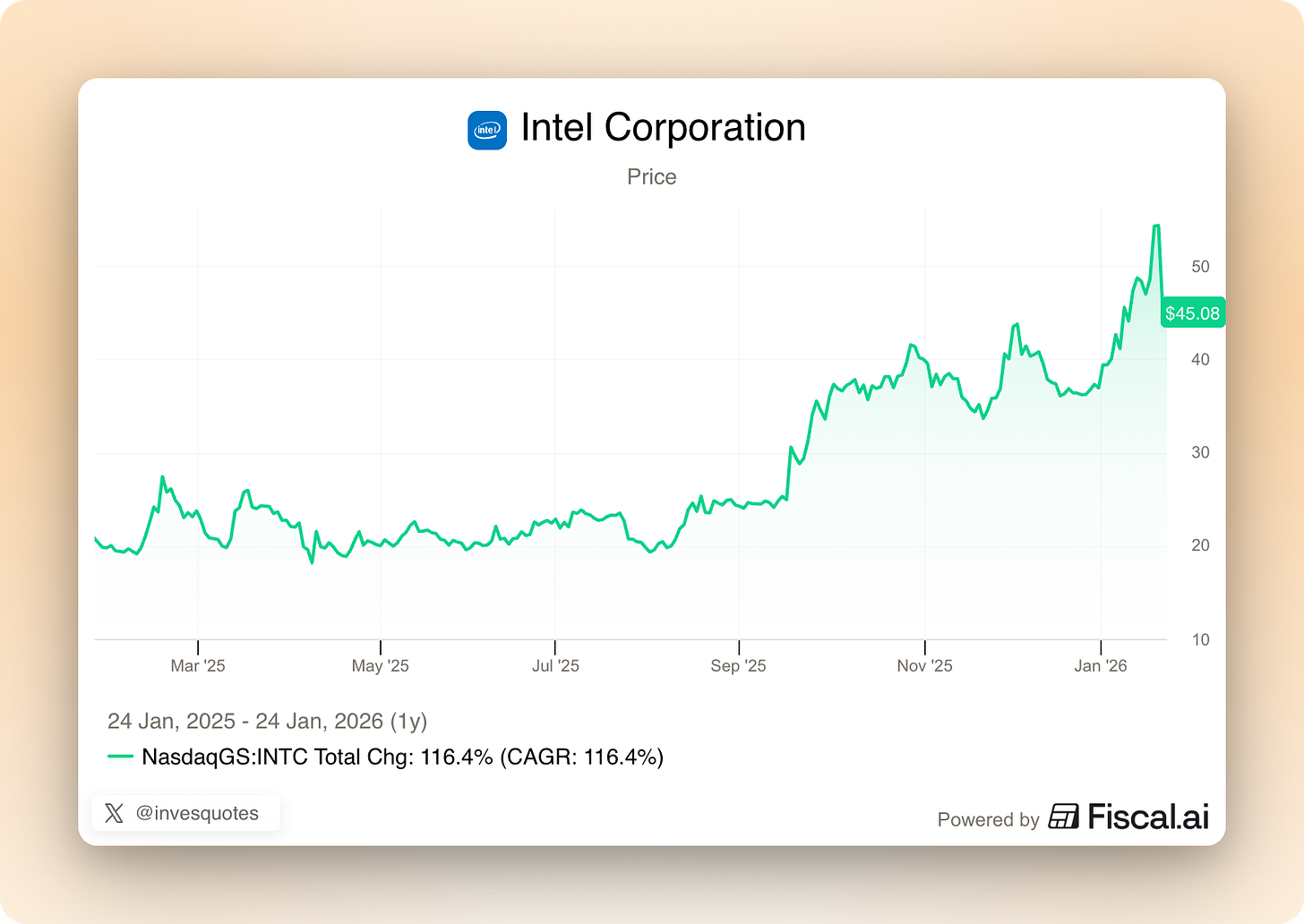

One of the stocks that “skyrocketed” as soon as the Government put their eyes on it is Intel. This good performance led by the US Government led some people on X to basically call you “stupid” if you were not leveraged long Intel going into earnings. Well, Intel’s stock did not react well to earnings (although they were pretty good for semicap, as I’ll explain later in the company specific news section):

This reaction made some people (almost) go bust on Intel. You might ask yourself…how can someone almost go bust on a stock that has done this over the past year?

The answer is leverage! Two dangers to avoid here. The first one is evidently leverage, and the second one is overconfidence. I don’t think there will ever be a more dangerous combination than leverage combined with earnings season. Note that you might correctly guess how earnings will go, but you’d also have to guess how the market will react (and these two are not always correlated).

The industry map was (as almost always) mixed this week:

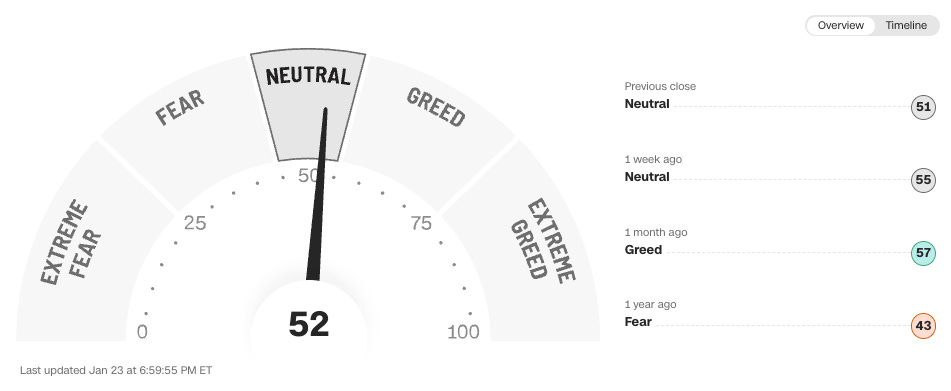

The fear and greed index retraced to neutral territory, although I must say certain things in my portfolio are closer to extreme fear:

This is what I bought this week

I added to several positions this week that I believe are getting swept by narratives that make little sense. Here you can find my transactions for the week: