Is the worst over for TI?

Q1 results offer encouraging signs

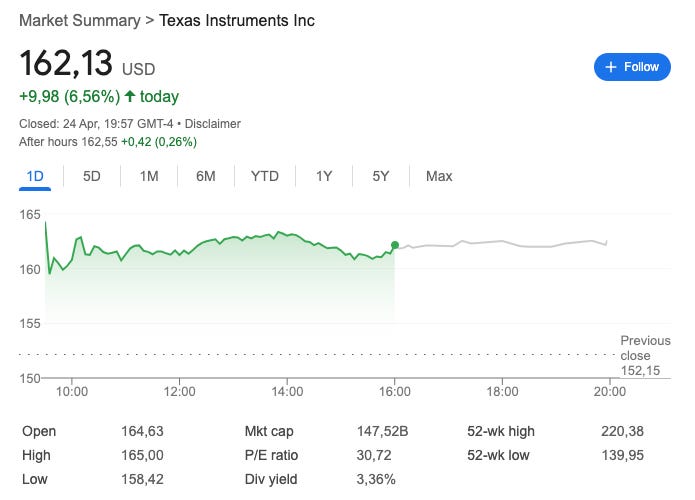

Texas Instruments reported a very solid quarter on Wednesday. The company delivered a revenue beat, an EPS beat, and a Q2 guidance beat in what many had expected to be a weak quarter given the noise surrounding tariffs. The beats on revenue and EPS could have been anticipated, even in this uncertain scenario (Liberation Day took place just at the beginning of Q2, so Q1 was mostly unaffected). However, I believe it was the Q2 guidance that took many by surprise. It appears that the current developments are not deterring the cycle from recovering, although the call was packed with discussions on tariffs (discussed in more detail later). The market took the earnings well, and Texas Instruments’ stock rose significantly on Thursday:

The quarterly numbers are not yet normalized because the company is still emerging from the downturn and the Capex expansion plan is not yet complete. However, we can clearly see how the cycle is recovering slowly but steadily. It was the first quarter since Q3 2022 that revenue grew double digits, and management is guiding for yet another acceleration next quarter (+14% YoY at the midpoint). Here’s the company’s summary table:

Several points to highlight here. The first one is the state of the different end markets. While management expressed doubts about the state of the industrial market last quarter, the recovery appears to be already well underway. The industrial market grew in the upper single digits sequentially after seven consecutive quarters of sequential decline. Management also noted something interesting regarding customer inventories: