Is that light at the end of the tunnel?

Danaher's Q1 Earnings

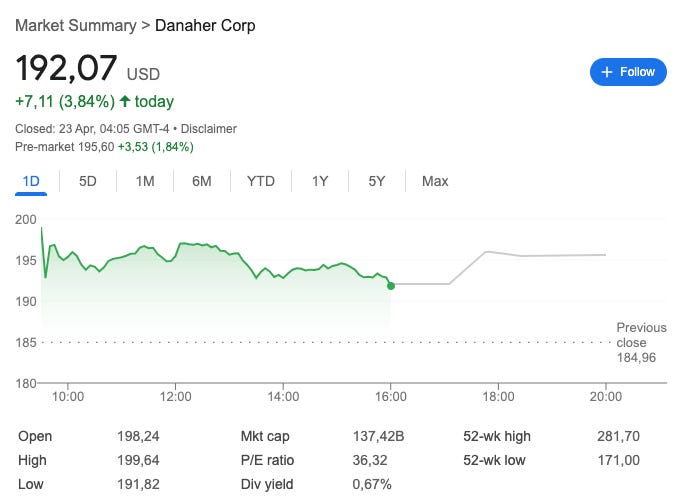

Danaher reported a better-than-feared quarter, beating both top and bottom line estimates significantly and maintaining its annual guidance. In any other market environment, this is good, but not exceptional. However, maintaining guidance is akin to raising it in the current environment because it demonstrates that Danaher has something that not many businesses possess in such an environment: visibility. The market seemed to like Danaher’s results:

It’s tough for a stock to completely decouple from the market’s performance if the latter does poorly. That said, it’s always much safer to own resilient businesses like Danaher when uncertainty is so high. For me, companies like Danaher or Stevanato are sleepwell investments in a tariff and recession-driven world, and it’s why both are currently top 5 positions for me.

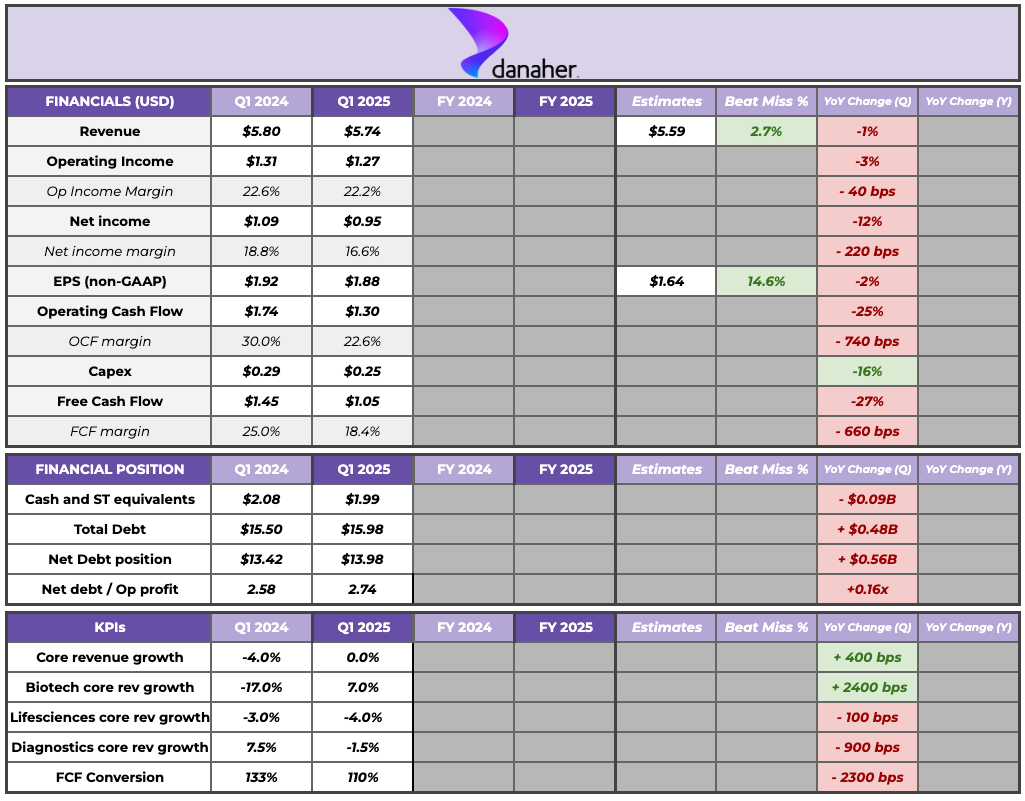

Here’s the summary table for Danaher:

Besides Danaher’s beat, the quarterly numbers were not great, but we shouldn’t read too much into them. These numbers should serve as confirmation of what we already knew: Danaher’s bioprocessing business (and the industry at large) appears to be finally emerging from the destocking cycle. Core revenue remained flat in Q1 and improved significantly with the growth rate achieved in the comparable period thanks primarily to the acceleration in the bioprocessing business.

Bioprocessing was THE highlight in the quarter. Consumables grew LDD (low double-digit), which should not come as a surprise if one had read the Sartorius earnings call. In my Q4 earnings digest (‘Three Reasons to be Optimistic’), I mentioned that guidance (especially that of the biotechnology segment) appeared to be quite conservative. Management essentially confirmed this by raising the full-year biotechnology guidance to high single digits (up from 6-7%).

The reason the upgraded biotechnology guidance did not result in a rise in the full-year guidance was due to a weaker-than-expected lifesciences segment. Management lowered the Lifesciences guide from low single-digit growth to flat. They alluded to the academic/university environment as the primary source of this new guide, but this doesn’t seem to make sense based on their comments. Management made two claims in parallel that seem to contradict each other.

First, they claimed that exposure to academia or universities is relatively low, and that exposure to direct NIH funding is even lower, at 1%. Secondly, they claimed that bioprocessing is a much larger business than this portion of lifesciences that is currently underperforming…shouldn’t this justify an upward revision of the annual guide? I think so. That said, it makes sense for management to remain conservative (I’ll discuss why later on).

While the academia/university discussion might not be very relevant for Danaher due to its low relative exposure, it’s quite relevant for a company like Judges Scientific. There are both positive and negative aspects for the UK serial acquirer. Let’s start with the latter.

The negative aspect was that Danaher alluded to the academic and university environment slowing down significantly in the US due to the uncertainty surrounding funding. In a recent news of the week, I mentioned this as a potential headwind for Judges due to its exposure to universities (universities made up around 50% of Judges’ revenue in 2024). The exposure is more limited once we put it in the context of the US (note that Danaher alluded to this being a source of weakness for the US in particular). In 2024, approximately 25% of the Judges’ revenue was generated in North America. Assuming the same customer distribution in North America as elsewhere, the real exposure would be around 12% of total sales. Still high, but manageable.

There was also a positive side, though. Danaher’s management alluded to China (excluding the impacts of Volume-Based Procurement, to which Judges is not exposed) doing well, and that stimulus is making its way through to universities. We may encounter a situation where China compensates for the weakness in the US for Judges, albeit China currently accounts for a lower portion of its revenue. Note that Danaher is a considerably larger company than Judges and therefore this read-through might not be entirely accurate, but I do feel it should be directionally correct.

The impact on Danaher’s diagnostic segment from volume-based procurement (discussed in the last quarterly earnings digest) was within expectations, and Cepheid outperformed yet again. Management has been expecting lower respiratory revenue at Cepheid for a while, consistent with an endemic level. That said, the non-respiratory business is doing exceptionally well, and there is no reason to believe that the current respiratory level is not sustainable, as we could argue that we are already past the pandemic state of COVID! Maybe Cepheid is simply performing better than expected.

All in all, the quarter per se was not excepcional, but it did confirm the trend: destocking seems to be finally over. Bioprocessing investors can finally see the light at the end of the tunnel!

Tariffs

Tariffs were (logically) a topic discussed during the earnings call. Management quantified the impact tariffs (in their current state) can have on the business, and it’s around $350 million. The impact is not incredibly large because Danaher has been localizing its production facilities for years. So, for example, a substantial portion of the China business is serviced within China, meaning that imports/exports are not an important consideration. That said, $350 million is still an impact, and management believes they can offset it in three main ways:

DBS (Danaher Business System) in what relates to cost containment

Slightly moving around the manufacturing

Pricing (i.e., passing the costs to customers)

Management will likely lean more towards #1 and #2 than #3, but #3 is definitely an option if things get worse. I honestly don’t think that an investor in Danaher should worry too much about tariffs considering the mission-criticality of most of its products and how ingrained they are in its customers' workflows. I also don’t think management is worried judging by the fact they decided to initiate FY 2025 EPS guidance. Seems like a stupid thing to do when you lack visibility in such a volatile environment.

The non-GAAP EPS guide was $7.68 (midpoint), although management was quick to point out that it’s beatable so long as things don’t get worse tariff-wise. Judging by the latest news, it seems that tariff-related news are about to get better from here (although one can’t never know). This means that Danaher is set to grow non-GAAP EPS by at least 4% this year. Not only is this number conservative but it also doesn’t consider the impact of future repurchases. If Danaher were to exhaust its current buyback program at current prices it would retire around 2% of its shares outstanding, which would be yet another tailwind for non-GAAP EPS. Current market estimates are somewhere around $7.69, and this estimate seems very beatable.

Buybacks and M&A

I have a theory that Danaher’s management team has been sandbagging guidance to execute the ongoing buyback at better prices (I discussed it in more detail in past articles). Cash had built on the balance sheet and, absent M&A opportunities, management and the board decided it was a good time to repurchase shares. The company quickly exhausted what was left of its former 20 million buyback program and decided to approve a new one for the same quantity. With this backdrop, it made little sense for management to be optimistic as buybacks would be less accretive at higher prices.

Buybacks continued this quarter. Danaher repurchased around $1 billion worth of stock in Q1, and shares outstanding are down around 4% after peaking in March 2024:

The best news of all is that there are still approximately 12 million shares outstanding in the buyback program. This is great because Danaher is expected to remain cash generative through all the tariff mess, so it’s likely it’ll get the opportunity to repurchase more shares at attractive prices. The remaining 12 million shares are also potentially the reason why the full year guide was not raised on the face of a better bioprocessing performance: they still might be repurchasing shares this quarter!

It’s worth noting that management began repurchasing shares at significantly higher prices, so without a significant impact on the business from the latest macroeconomic news, it would make sense for the company to be repurchasing more shares here. The only thing that could put a pause on repurchases would be M&A. While Danaher is not expected to be impacted much by the current environment, some companies might struggle and M&A targets might finally become attractive again. In the face of such an environment, it might make sense for Danaher to stop repurchasing shares and use its cash to conduct an acquisition. I would personally prefer repurchases unless there’s some outstanding deal out there. The reason is that I don’t feel Danaher is particularly expensive here, and there are no integration risks from buying its own stock!

Have a great day,

Leandro

great stuff leandro