Interest Rates, Royalties, and the WSJ vs. Zoetis (NOTW#26)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

Hi reader,

It was a “strange” week in the market, with the Fed’s message having a considerable negative impact for the first time in a while. I share some thoughts about this and also about royalty businesses and what makes them special and similar to software business models.

Without further ado, let’s get on with it.

Christmas Gifts

Just a heads up: I am gifting an annual subscription to Best Anchor Stocks to someone who complies with the requirements of this tweet:

You can also gift a subscription to Best Anchor Stocks to anyone you think might enjoy it (it’s a new feature on Substack that will be available until January 1st).

Articles of the week

I didn’t publish any articles this week as I am working on a deep dive which I expect to publish before year end. The deep dive will bring all the relevant information about a very interesting company that’s not widely discussed:

History and what the company does

Financials and growth drivers

Competition, moat, and risks

Management and incentives, capital allocation, and valuation

The reason I have decided to publish the research of this company in one go rather than the usual 3 or 5-part article series is that I was unclear if I wanted to make it a position in my portfolio and thought it would be a good idea to write everything down as I made up my mind.

Market Overview

If you’ve been looking at the market daily this week, you probably think: “What a week! Things are rough.” That said, the beauty of financial markets is that if you hadn’t looked at financial markets for the past month, you’d say: “Nothing much has happened.” The long-term is definitely made up of a series of short-terms, but boy, is it easier to make our way through when we put things in perspective.

Both indices were down around 2% this week after a “terrible” Wednesday, but if we barely zoom out one month (not asking for more), we can see that the Nasdaq is still up 3% and the S&P 500 is flat:

So, what happened on Wednesday? The Fed lowered interest rates again but signaled that the pace of decreases might moderate in 2025, something that the market did not like one bit. The S&P 500 was down more than 3% on Wednesday, a rare occurrence. Just for context, this was the most significant one-day drop in the S&P 500 over the last year and the second-worst over the last 3 years. To be honest, considering the amount of algorithmic trading and leverage in the system, I don’t think violent moves should be all that surprising. The market is currently swamped with momentum traders, so when things go bad, these momentum traders make sure that they go even worse. Then, you have all the leverage that forces people to sell in the worst possible time.

I am not giving an opinion on whether the drop was justified or not. I acknowledge that interest rates “are like gravity to asset prices.” It all has to do with opportunity cost and discount rates, both of which are related. When there are higher interest rates across the system, stocks have to theoretically justify a higher return going forward to compensate for the risk. The market adjusts for this return by lowering the prices of the assets and, therefore, increasing the expected IRR.

What seems pretty evident is that the market has turned into a “violent” system (over the short term, that is) because it seems to currently be filled with:

Momentum traders

People with no conviction (some people like to call these “paper hands”)

It barely takes one negative day nowadays to know who was swimming naked. So long as one has used a conservative discount rate, I don’t think they should worry much about whether the Fed will drop interest rates next year. If anything, a slower pace of decreases should signal that the economy is stronger than expected, and a strong economy is likely to be better news for stocks than marginally lower interest rates.

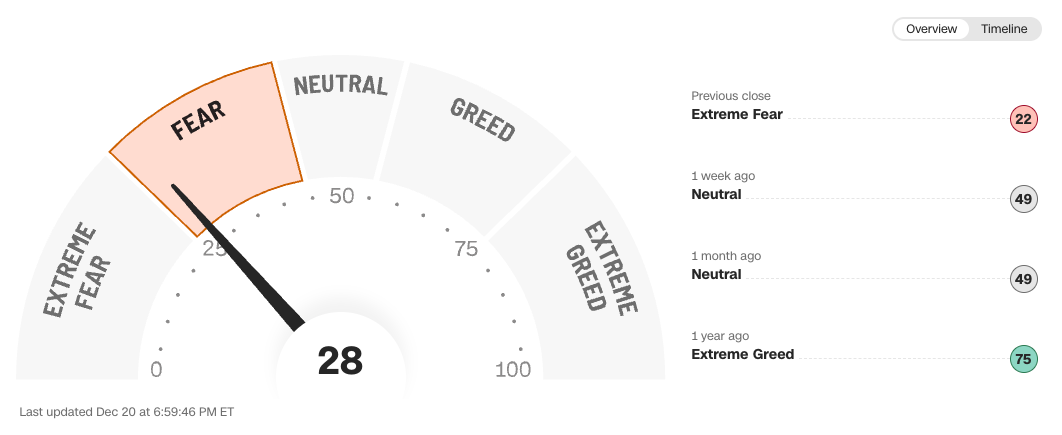

The market recovered shortly after (still soon to tell, but this is what we can see today), enjoying a strong day on Friday. This also has lessons for investors. This is something I learned from Ken Fisher’s book “The Only Three Questions That Still Count” (which honestly surprised me negatively, but one can always learn something from any book): humans are unlikely to remain at emotional extremes for long. Extremes happen in the market, and they seem to happen faster every day, but it’s tough for people to remain at an emotional extreme for very long. This is probably why the market tends to overshoot with such ferocity. This is also why I always claim that the fear and greed index is only useful when it’s at extremes, not when it’s treading water in the middle.

Another topic I’d like to discuss (completely different from macro and the Fed) is that of royalty companies. I’ve been analyzing some royalty businesses and currently own one. I’ve found that they always seem to be wonderful businesses but tend to face a similar roadblock: growth (the absence of). Growth is what sets most of these businesses apart from software businesses because, for the rest, they tend to share several commonalities:

Very high incremental margins

Capital light

50%+ FCF margins

It’s in that #1 when there are “problems” for many royalty businesses, as you can’t enjoy incremental margins if you don’t grow. For this reason, many tend to become dividend payers with a finite life (once their resources are depleted). I’d even say they enjoy several advantages compared to software businesses:

They tend to have lower SBC (don’t need a genius running the business)

They tend to have a lower risk of disruption due to not being directly exposed to technology

On the flip side, I must say there’s a disadvantage: most royalty businesses are exposed to commodity cycles. The good news is that they tend to survive every cycle due to their capital-light nature and high margins. The “holy grail” of a royalty investment would be finding one that can grow because then you basically get a software business with a low risk of disruption that’s not constantly in the spotlight (who writes about royalties?). I must say that these are tough to find at reasonable prices, although I still have some more searching to do.

I own a business in which one of its segments is a royalty. That segment enjoys excellent margins (EBITDA margins above 80%) but is not a fast grower (surprise). The good news is that the company has another segment where it can deploy these royalty streams to generate good returns and growth. I’ve written a deep dive in three parts about this company for paid subscribers; you can read the first part below:

Few places to hide in the market this week as most of it was red:

As discussed earlier, sentiment shifted quite fast this week after the drop on Wednesday. The fear and greed index went from neutral to extreme fear in barely a couple of days, although it recovered slightly and it’s now in fear territory: