Hermes: 186 Years of History Guide The Financial Decisions

The premium subscription gives you access to all the content in Best Anchor Stocks, which includes…

All the deep dives

Recurring articles

Access to my real-time portfolio and transactions

Occasional webinars on various topics

A community of like-minded investors

A subscription the Premium + also gets you a quarterly Q&A with me to discuss anything you’d like.

If you want to know the type of content I share at Best Anchor Stocks you can read the Deere deep dive I uploaded a few weeks ago for free…

…or you can also read any of the other many free articles I have shared, just like this one!

You can also read the testimonials that existing subscribers have left. If you are a passionate and curious investor wanting to learn about high-quality companies, don’t hesitate to join Best Anchor Stocks!

Hi there!

At Best Anchor Stocks, it often happens that we study companies thoroughly but end up not picking them. The reasons always fall into one of two buckets: company quality or valuation.

If company quality is the issue, we stop following the company thoroughly and allocate our time to other tasks. If, on the contrary, we decide not to pick the stock due to valuation concerns, we continue to follow it closely while we wait for a better entry point. Hermes is an example of the latter.

When we started researching Hermes, in June last year, its stock was performing poorly, dropping almost 40% from its peak. Such drawdowns are not only extremely rare for businesses in the luxury industry, but they also tend to be short-lived:

Back then, we decided to pass because we had not finished our research. That means we didn't know if the drop was an opportunity or not. While we were consistent in our investment process by not buying companies that we don't understand thoroughly, we missed a 100% run from the lows. Hermes' stock set all-time highs last week after reporting excellent Q1 earnings:

Insiders, of course, know the company very well and saw the opportunity. They were aggressively buying the stock after the 40% drop:

Between June 21st and June 24th of 2022, several insiders bought €80 million (almost $90 million) worth of stock on aggregate.

We would always caution against focusing too much on insider buys because insiders can also purchase stock to send a positive signal to the market, only to sell shortly after. However, luxury is a different horse because the management teams of luxury companies tend to have significant control as to how much the company will grow in the short to medium term. This means they tend to buy when they feel the market is out of sync with the company's fundamentals. In hindsight, this was the case for Hermes.

We have learned two lessons. First: doing the homework in advance can be of utmost importance. Second: high-quality companies will almost always appear expensive, even if they drop.

In this article, we'll focus on one of the main controversies around Hermes, which is its capital allocation practices. Many people label the company's capital allocation as poor, but we think the criticism the company gets completely misses the point. There's not one capital-allocation-fits-all strategy, and context is needed here to understand why Hermes allocates capital as it does. Before jumping directly into this, let's briefly introduce Hermes.

Hermes - The best luxury company in the world

Hermes is in our opinion the best luxury brand in the world. We consider only Ferrari N.V. at the same level. Louis Vuitton is also a great luxury company, but when we think of luxury, we think of exclusivity and that's the feeling we get with both Ferrari and Hermes. We see LVMH products almost daily, but we only occasionally see Hermes' products and Ferrari's. As with most things in life, this is a matter of perception, of course.

Hermes was founded in 1837 in France and is currently led by Axel Dumas, a member of the sixth generation of the Hermes family. The company sells luxury products across its 16 metiers (equivalent to "product segments"), which range from leather goods (a classic across luxury fashion houses) to jewelry and homeware:

The most important metier is leather goods and saddlery, which made 43% of the company's total sales in 2022:

The company sells its products worldwide, but manufactures a significant portion (80%) of them in its home country France.

Some of these products are 100% handmade by artisans who typically spend long hours in the process and are educated to live up to the company's quality standards. The most important geography for the company's sales is Asia, followed by the Americas and Europe:

The struggle between growth and exclusivity

In every luxury company, there's a tension between growth and exclusivity. Low volume ensures exclusivity but puts a ceiling on growth, while high volume ensures growth but damages the exclusivity of the products. Luxury companies have several ways to solve this struggle.

One of such ways is to expand the product breadth. For example, Ferrari has "capped" each model's production but has launched more models. This way, a customer who buys a Ferrari Purosangue retains the feeling of exclusivity while Ferrari can grow the number of cars it sells. Hermes has "solved" this struggle through two methods. First, the company has expanded the number of metiers over the past years, thereby expanding its product breadth and its revenue.

Secondly, the company has retained exclusivity in one of its key products while selling more volume of other products. This key product is the Birkin, which typically retails between €10,000 to €40,000 a piece:

Despite already high retail prices, the Birkin typically goes for a much higher price in the secondary market. For example, in 2017 a Birkin was sold for a whopping €380,000 at auction! These characteristics make the Birkin not only a luxury product but also an investment item.

Hermes reserves access to the Birkin to its best and most loyal customers. Birkins are not exposed in Hermes' shops, and customers typically have to spend 2 or 3 times what the Birkin is worth in other Hermes products before even being offered the opportunity to buy one. With this strategy, Hermes grows revenue in other metiers while retaining the image of exclusivity through the Birkin.

Management claims that the supply of the Birkin is not capped on purpose to retain exclusivity:

We're not trying to limit production. We're not artificially creating selectivity. We're trying to produce as many as we can.

Source: Axel Dumas, Hermes' CEO, during the 2022 earnings call.

Even if not done on purpose, Birkins are heavily undersupplied. One explanation might be that, as Birkins are hand-made by artisans who require a lot of training, there's only so much the company can do to expand supply. Management claims to be able to train around 260 to 300 artisans a year, so supply grows slowly.

The desire to own exclusive products is growing faster than the supply growth. When demand grows faster than supply, exclusivity is not only retained, but it's boosted. The amount of Birkins in the market does not really matter; what matters is the gap between the Birkins that are supplied and those that are demanded. There are reasons to believe this gap is getting wider.

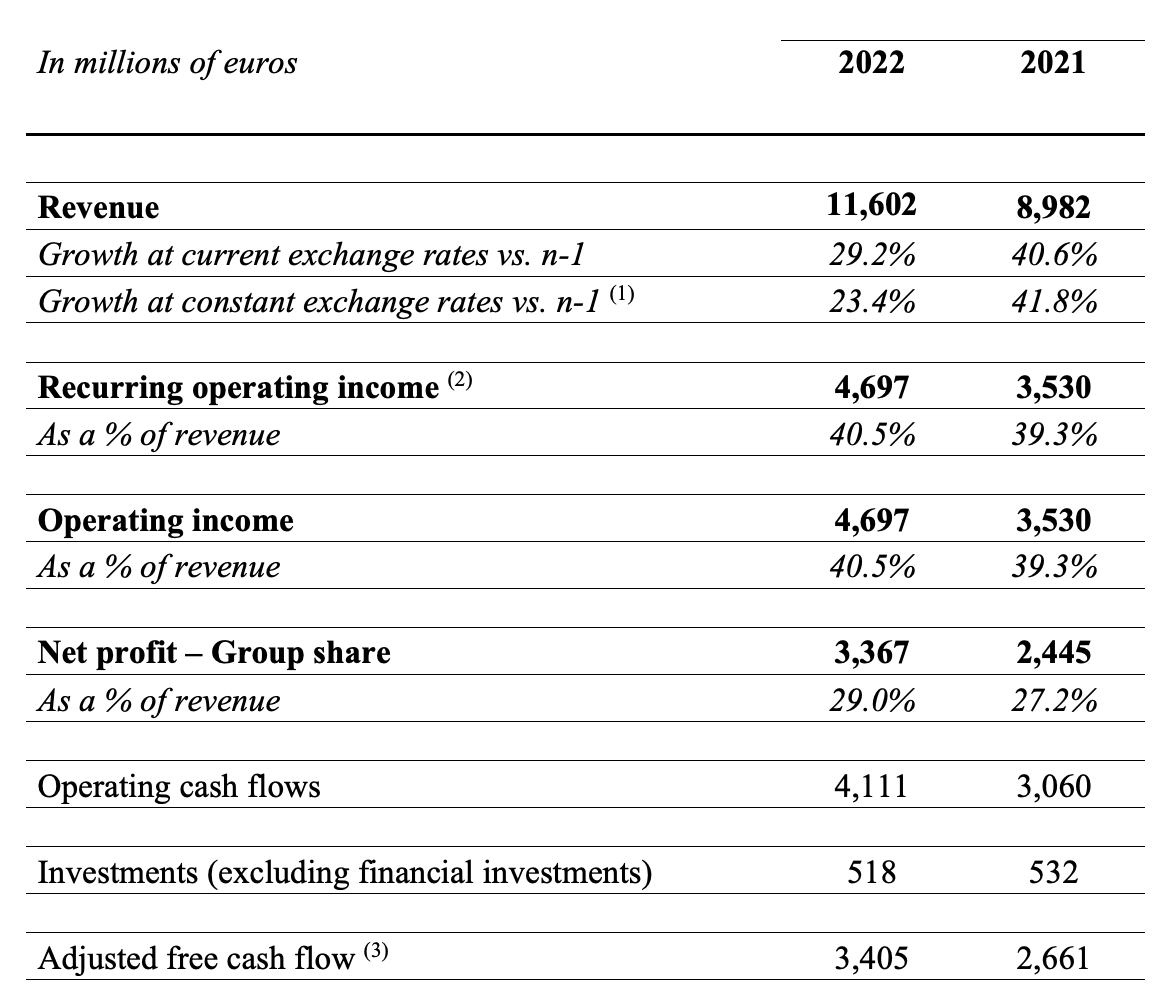

Quality translated to the financials

The great quality of Hermes is also evident in its financials. The company has grown rapidly over the past years and exhibits software-like margins. The company grew its revenue by 23% in 2022, posting an outstanding 40.5% operating margin and 29% net income margin.

The best thing about these software-like margins is not just the margins but the fact that they are protected from technological disruption. Luxury is built on trust, and trust can only be built with time. Hermes is almost 200 years old and has the know-how of artisans to maintain the quality of the products its customers seek. These customers know that every time they buy a Hermes product, they are going to buy the highest quality. They know this because it has been this way for decades, and this trust can't be disrupted with money.

How many companies have software-like margins and are heavily protected from technological disruption and competitors? I'd say very few. Hermes is one of such companies.

Hermes' quality is common knowledge, and thus it typically trades at a significant premium to the market. The company currently trades at 60 times earnings and, for a good part of the last decade, has never been below 30 times earnings:

This high valuation doesn't mean the company is immune to investor criticism, though. Many argue that management should significantly improve the capital allocation, but we disagree. In our opinion, the capital allocation is excellent, and management is focusing on what really matters.

Hermes' capital allocation

We believe Hermes' capital allocation gets plenty of criticism because investors tend to view Hermes through the same lens they view other companies. This, in our opinion, is a mistake. Investors criticize Hermes because it doesn't adhere to the "efficient capital structure" theory.

This theory states that there's an optimal capital structure (how the company is financed between debt and equity) for every company. Companies with a more recurring model should be able to withstand more debt on the balance sheet, thereby boosting returns for equity investors. On the contrary, highly cyclical companies should shy away from leverage to avoid getting in trouble during downturns.

Hermes belongs to the first group. The company has pretty reliable profits, with net income barely budging during the Global Financial Crisis:

According to the "efficient capital structure" theory, Hermes should carry some debt to boost shareholder returns. Well, it turns out this is not the case. Hermes has no debt on the balance sheet and plenty of cash, resulting in a €9.7 billion net cash position. That's about $10.7 billion. With a rather predictable and safe business, wouldn't it make sense for management to run the company with a more aggressive capital structure? It would, but Hermes is not run for capital efficiency; it's run for survival under all circumstances.

Management knows the hefty valuation the stock has historically carried relies primarily on the company's terminal value. In our article "What Makes Quality Undervalued," we used the following chart to show that most of the value of high-quality companies relies on what happens in the distant future, not what happens next year. This occurs due to the effect of compounding:

So, what happens over the next two years is not really critical for long-term investors. What's critical is what happens after year 10, which is why it makes much more sense to focus on competitive advantages and growth runways rather than forecasting macro or the company's financials for the next year. It's this terminal value that Hermes' management is trying to protect at all costs:

We are putting us at a place to have a perpetual growth higher than the model, which has more impact than to know what I'm going to do in 2023 in terms of growth. We have a perpetual growth, which for the moment is quite high. And that is what I try to preserve.

Source: Eric du Halgouet, Hermes' CFO, during the 2022 earnings call, our bold.

This is the first time we have encountered a management team explicitly discussing how they target terminal value. Many managers will spend hours discussing what the company will do next quarter or next year, ignoring the fact that this will not matter much over the long term. It's very refreshing to see a management team focus on what long-term investors focus on, although it's not surprising considering the Hermes family owns more than 60% of the company.

Management knows that to realize this terminal rate, they must be able to go through tough times, which is only assured when one runs the company very conservatively:

Also, traditionally, our payout rate, we increased it to 40%, but it's lower than the average of the CAC 40 corporations. This is in line with my rationale. Part of this goes to dividends, part goes to reinvestments and part of it is held in store on reserve for any possible tough time ahead. This really helped us during COVID.

Source: Axel Dumas, Hermes' CEO, during the 2022 earnings call (emphasis added).

(CAC 40 is the French index, like the Dow Industrial or the S&P 500 in the U.S.)

All statistics and research papers give a very low probability of occurrence to a company lasting 200 years (there are very very few of these). Most companies end up disappearing before even making it to the 50-year mark. The reason for many bankruptcies has been (besides lousy operational performance) not having sufficient financial strength when it was most necessary.

The terminal value of a company that retains and reinvests all of its profits is 0 if it files for Chapter 11 (bankruptcy). As per the book Capital Allocation:

If a firm never pays dividends and then goes bankrupt in 20 years in the future, from a financial theory standpoint the company is worthless today.

Hermes pays dividends today, partly because the family relies on this income, but not enough to justify its current valuation. This means that the market is focusing on the company's terminal value (or future free cash flows).

We know all of this contradicts the "efficient capital structure" theory. Many would argue that Hermes is far away from its "optimal capital structure," and while we can agree if we look at it from a theoretical point of view, what does "optimal" really mean? For us, optimal means having a capital structure that allows the company to be worth more in the future. In Hermes' case, with most of the company's market cap tied to its terminal value, most of the value will be unlocked by surviving for many more decades and realizing this terminal value.

It's also worth noting that capital efficiency sounds great on paper, but it doesn't consider the occurrence of black swan events. What was an optimal capital structure coming into the pandemic? Nobody knew because companies were not financed considering we could suffer a pandemic. Black swans are indeed extremely low-probability events, but it only takes one of them to wipe out a company. Hermes' management doesn't want to be that company. After 186 years of doing business, the company wants to keep doing what it does very well.

Conclusion

As in every investment-related topic, there's no black or white and context is needed. While Hermes' capital allocation strategy might not make sense for companies with a significant portion of their market cap tied to the next 3 to 5 years, it makes a lot of sense for a company with a significant portion of its value tied to its terminal value. One could think this is a matter of perception, but management has openly discussed its focus on terminal value with investors, something one doesn't typically see.

In the meantime, keep growing!

Yes, a doubling of price was missed, but the integrity of your process was maintained. Well done and well written. Thanks!

What a wonderful digest of Hermes! It's definitely going on my research/watch list. I was wondering if you could provide any additional information on the company's management incentive structure, aside from the fact that the majority ownership is held by the Puech family?