Durability, Family Ownership, and a Long Growth Runway (Part 3)

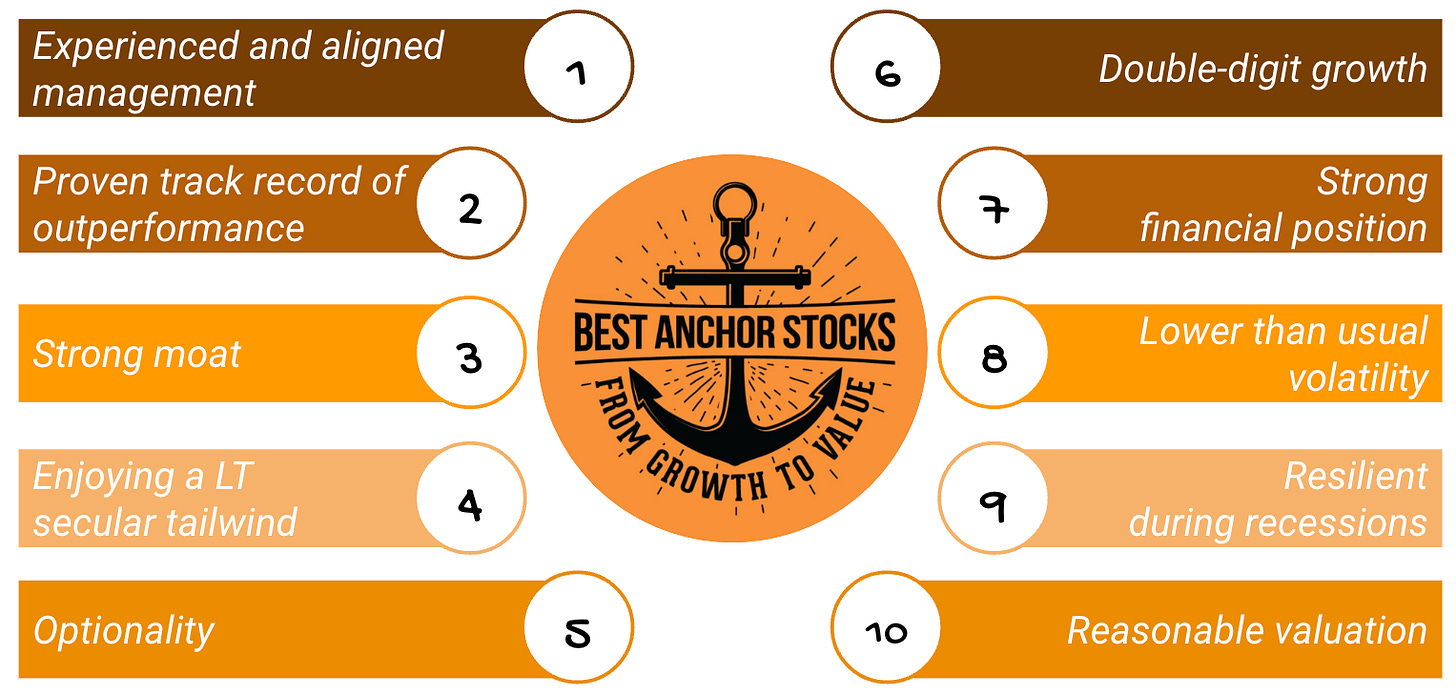

The Best Anchor Stock traits

Hi reader,

Welcome back to another Best Anchor Stocks article. This is the last part of my 3-part deep dive on the most recent addition to my portfolio. In the first article, I outlined a brief investment thesis for this company for free, here it is:

The company owns excellent assets, some of which remain highly undervalued by the market. The nature of these assets (together with how the market values them) provide a more-than-adequate protection against permanent loss of capital (which is what an investor should always try to minimize). They also provide a good source of optionality.

Much of that optionality and some of these assets can be ignored altogether and the path to a decent return is still credible.

The company operates in attractive markets and has a management team with an excellent capital allocation track record. There is plenty of history to study this track record, despite the company pivoting several times over its long history.

The company is still owned and managed by the founding family (they own about 30% of the outstanding shares). Their interests are clearly aligned with those of the shareholders, which is always important, but probably more so given the industries in which they operate.

As a family-owned company with high insider ownership, it is focused on durability, thus further protecting against permanent capital loss.

The company is currently significantly undervalued (in my view), and the management team is focused (among other things) on closing the current valuation gap.

The accounting in no way reflects the real value of the company, something that gives an advantage to those investors willing to “get their hands dirty.” In a few words: the company screens poorly.

Something that is not important (but noteworthy) is that this is a small company (capitalization less than $1 billion) and therefore “out of reach” of many large funds.

In that article I also explained its history, business model, financials, and growth drivers. In the second part, I touched on a wide variety of topics like…

The competition and the moat

The risks

Management & Incentives

Capital Allocation

Valuation

In this last part I will go over how the company complies with the Best Anchor Stock traits. These traits have been carefully thought out and help me adhere to my investing philosophy and remain objective. Here they are…

The rest of the article is published exclusively for paid subscribers. Paid subscribers have already chosen the company for the next deep dive, which operates in the spirits industry. I’ll upload that deep dive around the end of the month. If you want to have access to the entire archive and upcoming deep dives, don’t hesitate to join:

Without further ado, let’s jump right into the traits.