Deere: Still cheap after the run?

Q1 2025 Earnings Digest

Deere reported Q1 earnings last week and, with no intention of spoiling this article, I must say that not much has changed. If anything, the thesis is playing out as expected, and the environment is improving (so more positives than negatives).

After listening to the call I saw that Deere’s stock was dropping around 8% before market open, which made no sense as I believed Deere should’ve been up and not down on these earnings! This is the reason why I said in the chat (reserved for paid subs) that if Deere were to be trading 8% down after those earnings, I would most likely be a buyer:

If Deere were to be 8% down as it was pre-market, I would've considered adding too.

The market eventually caught up to the qualitatives and the numbers and the company’s stock recovered during the day and on Friday. It remains close to all-time highs:

Management referred to Q1 2025 as a “quiet quarter,” an assessment that I believe was spot on. From the POV of a long-term investor, Q1 2025 simply reaffirmed the thesis and guidance (and was impacted by several non-operational items).

Despite this quarter being a “non-event”, there were several interesting highlights I want to go over. I will also discuss the valuation now that the stock is significantly higher than when I first added it to my portfolio less than a year ago (it’s up 33% without considering dividends). I still believe the company is pretty cheap.

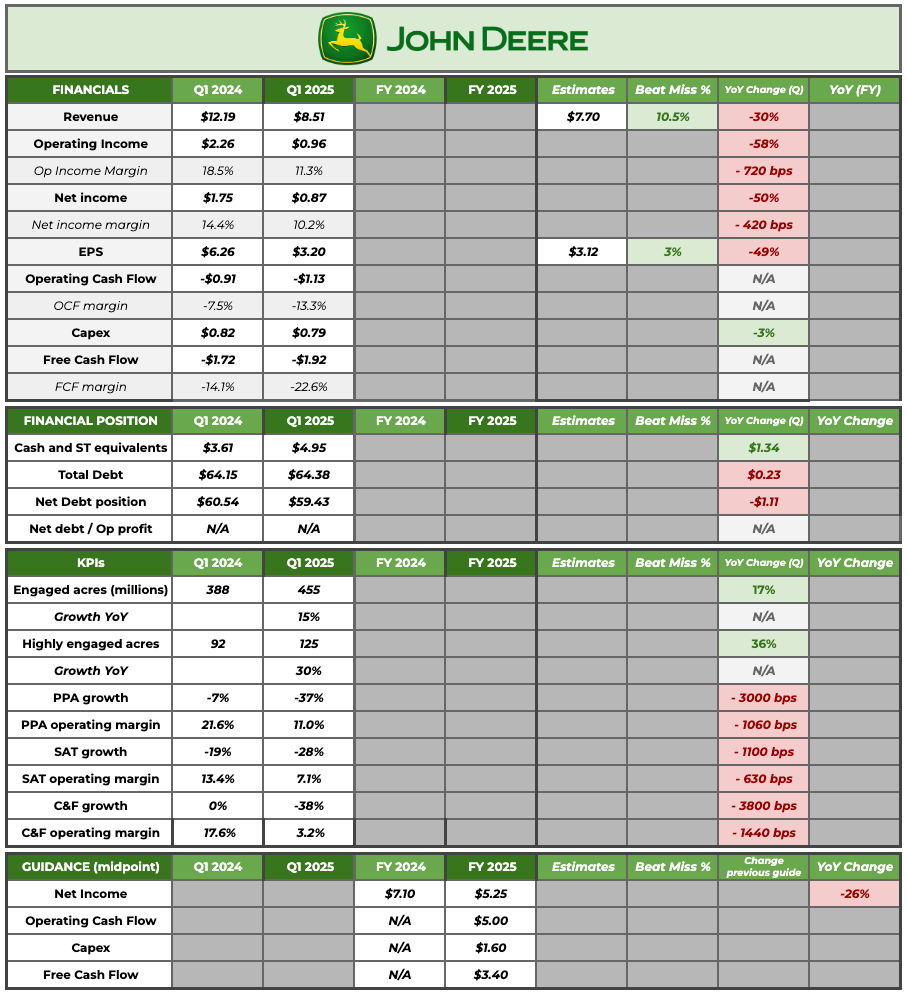

Here is Deere’s summary table:

Deere is a cyclical but secular company, so the quarterly numbers can be pretty misleading when thinking about the long term. The company’s industry is currently going through a downcycle, and Q1 was an unusually soft quarter for several reasons. The first of these was foreign exchange. The dollar has appreciated meaningfully against other currencies, negatively impacting revenue (Deere is a global company that reports in dollars). Not all is bad news for Deere regarding foreign exchange, though. The company hedges its currency exposure, so the impact on operating profits is not expected to be that significant.

There’s yet another benefit from a strong dollar (albeit indirect) for Deere: commodities are typically sold in dollars in global markets. This means that a strong dollar is good news for Deere’s customers in countries like Argentina or Brazil as customers in these geographies face costs in local currencies but sell in dollars. This means that, when the dollar appreciates, their profitability improves. These dynamics show themselves in the updated guide: Deere lowered its sales forecast due to FX but maintained its net income guidance.

The second reason for the unusually soft Q1 was timing. Management expects to recover this performance in Q2 and Q3 due to a return to normal seasonality and end the year where they initially expected. This soft performance made margins come significantly lower (7.7%) than where management expects they will end the year at (around 14%-15%), something that also makes sense considering the fixed-cost nature of the business.

Management is significantly reducing its inventory to streamline the business through the downturn, so it’s normal to see significant drops in the top and bottom lines while this happens. These numbers, however, are not really relevant when thinking long-term (they make up for a good headline and surely make recency bias kick in, though).

Despite being immersed in the downturn, there was certain good news that should help investors see the light at the end of the tunnel. Here’s a non-exhaustive list…

US net cash farm income forecasted to be up 22% YoY in 2025

Commodity prices on the rise (improves farmer profitability)

$10 billion in additional support for farmers in the US

Third consecutive year of decline in input costs for farmers

Management believes these will not translate into order velocity in 2025 but will help farmers stabilize their fundamentals to support a healthy upturn. Another thing worth noting is that fundamentals differ across geographies: Brazil and Europe seem ahead of North America in terms of stability, and this year’s weakness is mainly attributable to the latter. What seems clear is that if 2025 is not the trough of the cycle, it’s getting pretty close!

Two things might make the upcycle quite violent (in a good way). The first one is Deere’s inventory position. Management has worked through its inventory during this downcycle and is already producing at the level of demand:

On the new inventory side, we ended the calendar year with large ag field inventory down 25% year over year and roughly 15% below pre-2020 averages.

This potentially means that Deere will benefit from end demand and stocking once the cycle turns. The second thing is that there’s a significant replacement opportunity despite what many people think. Many believe Deere’s fundamental growth during the pandemic came from a replacement cycle, but the reality is that much of it came from price (which Deere is not giving back). This means that the fleet is still quite old, and a replacement cycle will eventually take place (something I discussed in my deep dive):

We’re still aging out. We put much less equipment into the market when things were on the way up in 2021, 2022, and 2023.

The increasing technological penetration makes this replacement cycle more likely. The reason is that farmers are price takers (they sell commodities), so the cost part of the equation is critical. Farmers employing technology are experiencing an improved cost structure and profitability, meaning that farmers who do not employ the same technology will see their profitability eroded eventually if they don’t do something:

We recently published our business impact report, and in that report, we did an update on the value that employing all Deere available solutions to a typical corn and soy operation in the midwest would bring. And it was just under fifty cents a bushel of improved profitability by fully employing the Deere production or the solution set.

A bushel of corn is sold for $5 today, so a 50-cent cost improvement is quite significant. Truth is, though, that farmers can currently deploy technology without needing to upgrade their equipment; the average age of the equipment where technology is being implemented is 12 years (in North America). This is “bad” because it defers the replacement cycle, but it’s good because it allows Deere to make technology prevalent without requiring a replacement cycle.

There were other relevant highlights related to technology. The first one is that JD Link (the company’s partnership with Starlink to bring connectivity to remote areas) will be a big deal for farmers in places like Brazil…

70% of ag land in Brazil doesn’t have, you know, sufficient cell coverage.

Tech penetration in Brazil is growing quite fast (above the company average), and the recent introduction of JD Link Boost has grown the “technology” TAM in the country.

Management also shared several interesting data points. Engaged acres grew 15% year over year to 455 million. These have grown at a 13% CAGR, and a 10% growth in 2025 is all the company needs to meet its objective of 500 million engaged acres one year ahead of schedule. Highly engaged acres are growing even faster: they made up 30% of engaged acres and have grown at a 24% CAGR over the last 3 years:

This data shows that the thesis is playing out: farmers are increasingly embracing technology, which, as discussed in the deep dive, has important implications for Deere’s business (more recurring revenue, higher margins, better cash conversion…)

Another highlight came from the repair side. Technology allows Deere to make remote repairs, which insulates the company (to an extent) from the right to repair complaints and improves customer satisfaction. Remote repairs have grown pretty fast over the last two years…

In 2024, we had 2.5 million remote display sessions through the John Deere Operations Center. That was an 85% increase from two years prior.

Yet another reason for farmers to embrace technology and connectivity.

Tariffs: not so bad as many people fear

Deere has been in the spotlight regarding tariffs since Trump said (before being elected President) that he would put a 100% tariff on Deere’s products manufactured in Mexico. It turns out, though, that the impact is not as severe as people feared.

Most of Deere’s products sold in the US are assembled in the US, and component sourcing is not as exposed to Mexico (10% of total component imports), China (2%), and Canada (1%) as many people feared. Management also mentioned (as I shared in a recent NOTW) that China’s retaliatory tariffs are expected to have an “immaterial impact” on the business.

I hadn’t considered that the pandemic had prepared Deere (and many other companies) for a trade war (albeit by coincidence). During the pandemic’s supply crunch, many companies reduced their exposure to China and started double-sourcing, which is expected to be useful during a potential trade war.

Taking a look at the valuation

Deere has come a long way since I added it to my portfolio less than a year ago. The stock is up more than 30% since then, which begs the question of whether it’s an attractive buy today.