Constellation's Spin-Out of the Lumine Group

What you need to know

Summary

Constellation Software announced two weeks ago that it would spin-out Lumine to acquire WideOrbit.

Constellation shareholders will receive 3 shares of Lumine per Constellation share owned sometime next year.

I go over all the details of the spin-out to give you some context.

The premium subscription gives you access to all the content in Best Anchor Stocks, which includes…

All the deep dives

Recurring articles

Access to my real-time portfolio and transactions

Occasional webinars on various topics

A community of like-minded investors

A subscription the Premium + also gets you a quarterly Q&A with me to discuss anything you’d like.

If you want to know the type of content I share at Best Anchor Stocks you can read the Deere deep dive I uploaded a few weeks ago for free…

…or you can also read any of the other many free articles I have shared, just like this one!

You can also read the testimonials that existing subscribers have left. If you are a passionate and curious investor wanting to learn about high-quality companies, don’t hesitate to join Best Anchor Stocks!

Introduction

Constellation Software recently announced that it would spin-out Lumine to be traded as a separate public entity. This might sound familiar because it’s the second time in the past two years that Constellation has spun out one of its subsidiaries, with the first being TSS. Spin-outs are becoming somewhat recurring for the company, bringing quite a good deal of messy accounting but arguably quite a good deal of value creation too.

This is quite a relevant event for Constellation’s shareholders and there’s quite a bit of detail to go through. This article should help you grasp everything you need to know about the transaction to make an informed decision.

If you want to read Lumine’s preliminary prospectus, you can do so here, but I advise you it’s more than 100 pages long.

Without further ado, let's go over the reason for the spin-out.

Why is Constellation spinning out Lumine?

Constellation is spinning out Lumine for several reasons, but I’ll focus on two. The first reason is that Constellation will use a portion of Lumine’s shares to acquire another company (WideOrbit). Lumine could incur significant debt or cash to purchase WideOrbit without needing to issue shares, but the acquisition’s size is significant to justify a spin-out. Constellation typically makes acquisitions with cash on hand, but it sometimes makes sense to use shares or debt as a payment.

This is what Mark Miller said during the last Annual General Meeting:

Usually, it's (a spin out) an opportunity to buy a very significant company, one that we couldn't justify if we were buying it for cash. And so what we're doing is we're putting in some cash and we're using the shares of the spin-off as partial payment.

The second reason is focus and scale. Constellation believes that Lumine can operate better independently as it will be a focused company with no restraints to continue scaling:

Ultimately, CSI believes that the Company will grow faster, and perform better, as an independent public company than it would within the CSI group of companies.

Source: Lumine Preliminary Prospectus

Being owned by Constellation is great due to its decentralized culture, reputation and management quality, so it’s important to note that Lumine will benefit from all these things even as a standalone business. Lumine was born within Constellation, so it’s fair to say that the culture and reputation are embedded in the group. Regarding management quality, we’ll see later on how there’s continuity there too.

Lumine will also continue to benefit from Constellation’s scale regarding M&A. For example, if Constellation comes against a potential target that fits Lumine’s portfolio, it’ll make sure to “direct” this acquisition to the new independent company. This allows Lumine to have an M&A reach that it wouldn’t have without Constellation’s help and definitely something that its competitors are unlikely to enjoy.

In a recent interview, Jamal Baksh (Constellation’s CFO) described a theoretical example of a spin-out which is precisely what we see here at play. The only thing you need to do is to change the word “transit” for “communications and media”:

But how we had talked about it was more about spinning off a vertical and doing it in conjunction with an acquisition.

This is a theoretical example. But let's just say transit, which is one of our largest verticals, had one of their largest competitors become available for sale. We could combine the 2 together, spin it off and have a transit-focused software company.

With the spin-out, Constellation has acquired a significant company in an adjacent vertical using Lumine’s shares as partial payment, creating a communications and media VMS company. Word by word what Jamal describes above.

I also believe that an underrated reason for the spin-out is that it will allow Lumine to compensate and align its employees with shareholders much better. Lumine executives previously had to invest their bonuses in Constellation’s stock. This created alignment with Constellation’s shareholders, but it wasn’t the best for Lumine’s executives, as they were ultimately not responsible for the performance of other operating groups that also weighed significantly in Constellation’s performance.

For example, if Constellation had a bad year, but Lumine had a great year, Lumine’s executives would be negatively impacted due to lousy stock performance without being entirely responsible for Constellation’s results.

Now that Lumine will trade independently, employee shareholders should directly benefit or suffer from their performance, not the performance of other operating groups at Constellation.

The main difference between the TSS and Lumine spin-outs

The first thing many investors did after reading the news of the new spin-out was to compare it with the TSS spin-out. While I understand why this was the case, they differ materially. In fact, if one wants to have a reliable benchmark of future spin-outs, one should look at Lumine and not TSS.

The most obvious difference is that when TSS was spun out, it was one of Constellation’s operating groups and catered to many verticals. Just for context, TSS caters to as many verticals as companies owned by Lumine, 23:

Source: TSS

Simply put, the TSS spin-out would’ve been much more comparable to a Volaris spin-out, not a Lumine spin-out.

The fact that Constellation is now spinning out verticals rather than horizontals (operating groups) is something we could’ve expected based on Jamal Baksh’s (Constellation’s CFO) comments in a recent interview:

I don't foresee us spinning off operating groups. I do, however, think that we could spin off verticals in the future, again, in conjunction with an acquisition.

This has several implications, the main one being that from now on, we can expect to see spin-outs of portfolio companies that have become large in any given vertical and have an opportunity to make a significant acquisition.

Catering to one vertical has some advantages but also some disadvantages. On the downside, the TAM is more constrained. On the upside, the company is more focused and can offer customers a comprehensive solution to meet their needs. I think it’s fair to say that, owning 23 companies, TAM will not be a problem for Lumine to scale in the coming years. This means that the benefit of being focused outweighs the TAM disadvantage. The communications and media industry is also growing significantly, so there will be opportunities to grow organically. This said, we must be aware that fast growth is coming thanks to technological developments such as 5G, so it’s also a higher-risk vertical, even for VMS.

What is Lumine

Lumine is one of Volaris Group’s vertical divisions, and Volaris is one of Constellation’s Operating Groups, so Lumine is a sub-operating group of Constellation Software:

Source: Made by Leandro

Contrary to Volaris, which does not specialize in any given vertical, Lumine historically catered to the communications vertical, where the company follows a mix of organic and inorganic initiatives to continue expanding its reach.

Lumine currently has more than 1,500 employees, operating in more than 30 countries and across thousands of customers:

Source: Lumine

The division was formally “born” in 2020 when Volaris decided to rebrand its portfolio of communications and media assets to continue applying its formula in a more decentralized and focused way. However, despite the rebranding coming in 2020, Lumine’s story started in 2014, when David Nyland (Lumine’s current CEO) joined Volaris to build a communications vertical. Volaris already had some communications and media assets back then, but they were scattered and there was no common strategy to compete favorably in the industry.

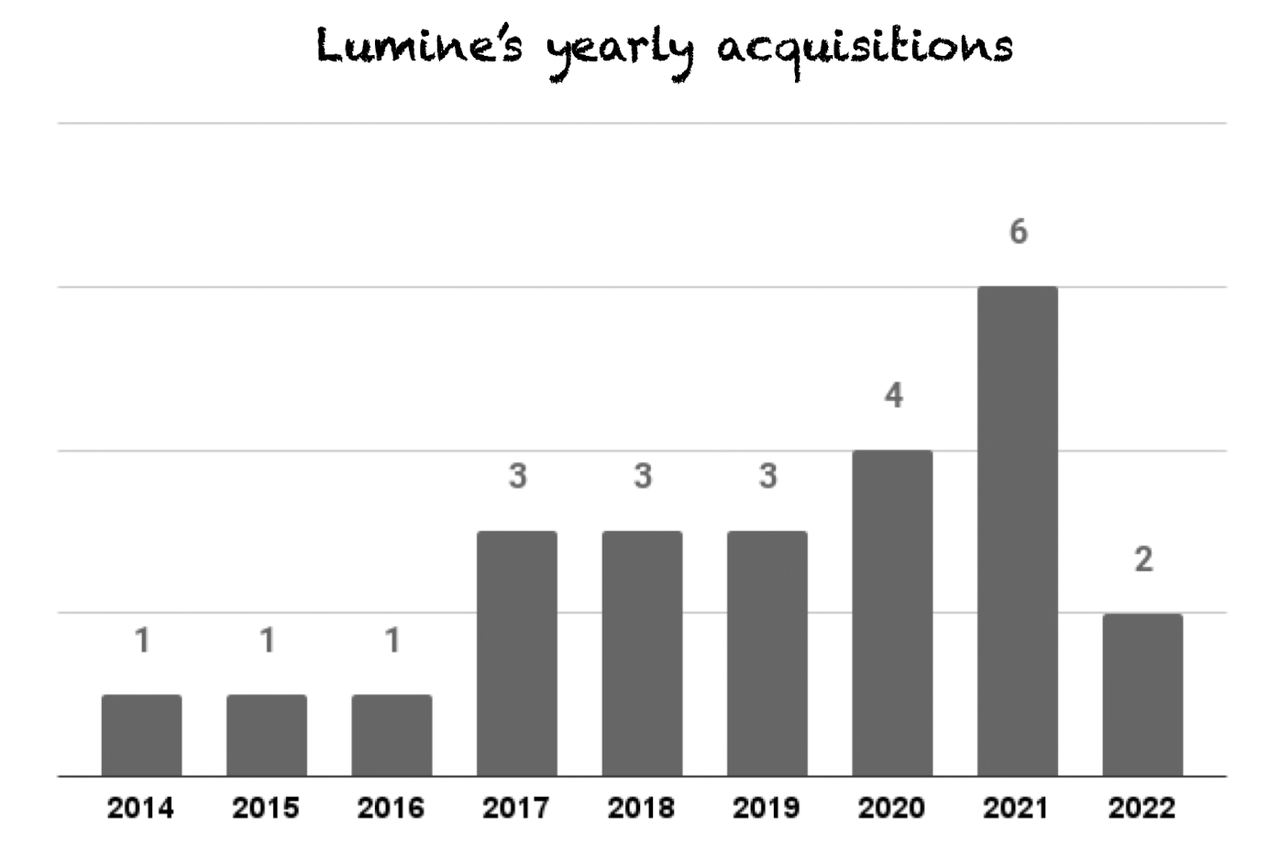

Lumine is not a small company. Since 2014, the company has built a portfolio of 23 companies, averaging 2 to 3 acquisitions per year. It has been able to scale the number of acquisitions successfully, albeit at a much smaller scale than Constellation.

Back in 2014, Lumine was making one acquisition per year, with 2021 being a record number on this front with 6 acquisitions:

Source: Made by Leandro

2022 has been a somewhat particular year as the number of acquisitions has scaled down significantly. However, it’s probably fair to say that the recent spin-out and large acquisition made as a result has most likely played an important role in the reduced M&A activity.

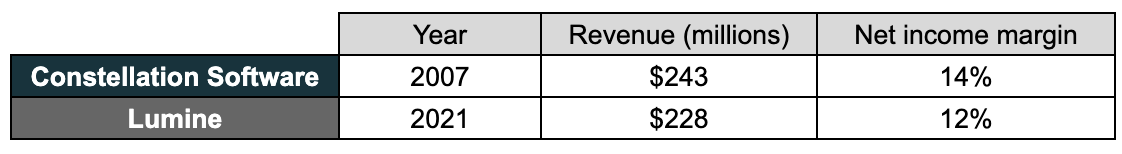

Lumine makes larger but fewer acquisitions than Constellation has historically made. For example, back in 2007, Constellation Software made 15 acquisitions while being approximately the same size revenue-wise as Lumine is today:

Source: Made by Leandro

Furthermore, between 2005 and 2006, Constellation Software acquired 22 companies, almost the same amount as the total number of companies Lumine owns today after 8 years of acquiring companies. Judging by similar organic growth rates, the answer to this divergence lies in acquisition size. Lumine typically acquires companies that are 3x larger than Constellation used to acquire back in 2007:

Source: Made by Leandro

Regarding the income statement, Lumine generated around $228 million in revenue in 2021, growing 37% year-over-year and showing decent profitability with a 17% operating margin and a 12% net income margin:

Source: Lumine Preliminary Prospectus

The P&L is as close as it can get to a company born from Constellation. The two most relevant expenses are amortization and staff (primarily from acquisitions), and revenue growth is mostly achieved through acquisitions.

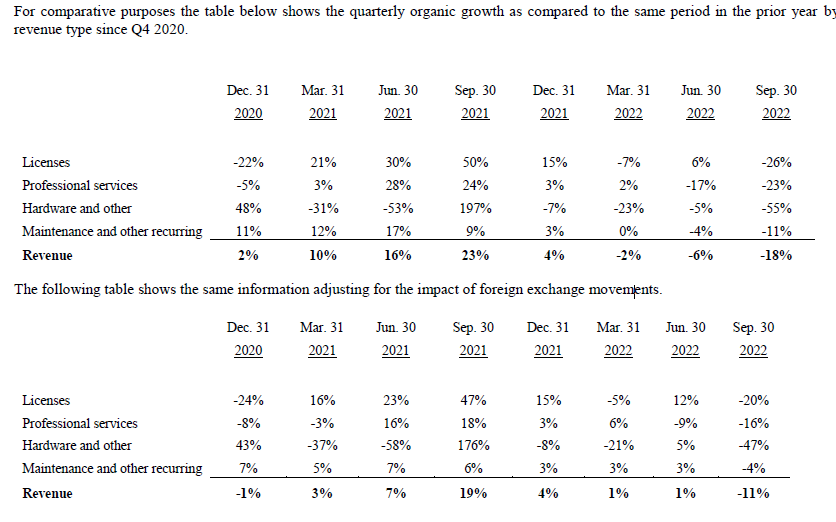

Lumine’s organic growth was pretty strong in 2021 but is finding some roadblocks in 2022 due to what appears to be a one-time contract termination in Q3 2021, which brought tough comps:

The negative organic growth is primarily a result of high organic growth for the 2021 comparison periods, in particular in Q3 2021 due to a settlement from a customer related to termination of future services.

Source: Lumine Preliminary Prospectus

We can infer several things from the tables above. First, Lumine Group is also focused on the growth of maintenance and recurring revenue, just like Constellation and Topicus. Organic growth across all other revenue items seems volatile, but the company is managing to reduce that volatility in maintenance and recurring revenue, which is also logical due to the nature of the revenue stream. In 2021, maintenance and recurring made up 58% of revenue, up from 57% in 2020.

The other thing we can see is that Lumine boasts a global portfolio because foreign exchange rates benefited the company after a surge in the dollar in 2022. In fact, if we go over its portfolio, we can see that out of the 23 portfolio companies, “only” 6 are headquartered in North America, with the remaining distributed across Europe (8 companies), the UK (5 companies), and Asia Pacific (4 companies). Unlike Topicus, Lumine doesn’t seem constrained by borders.

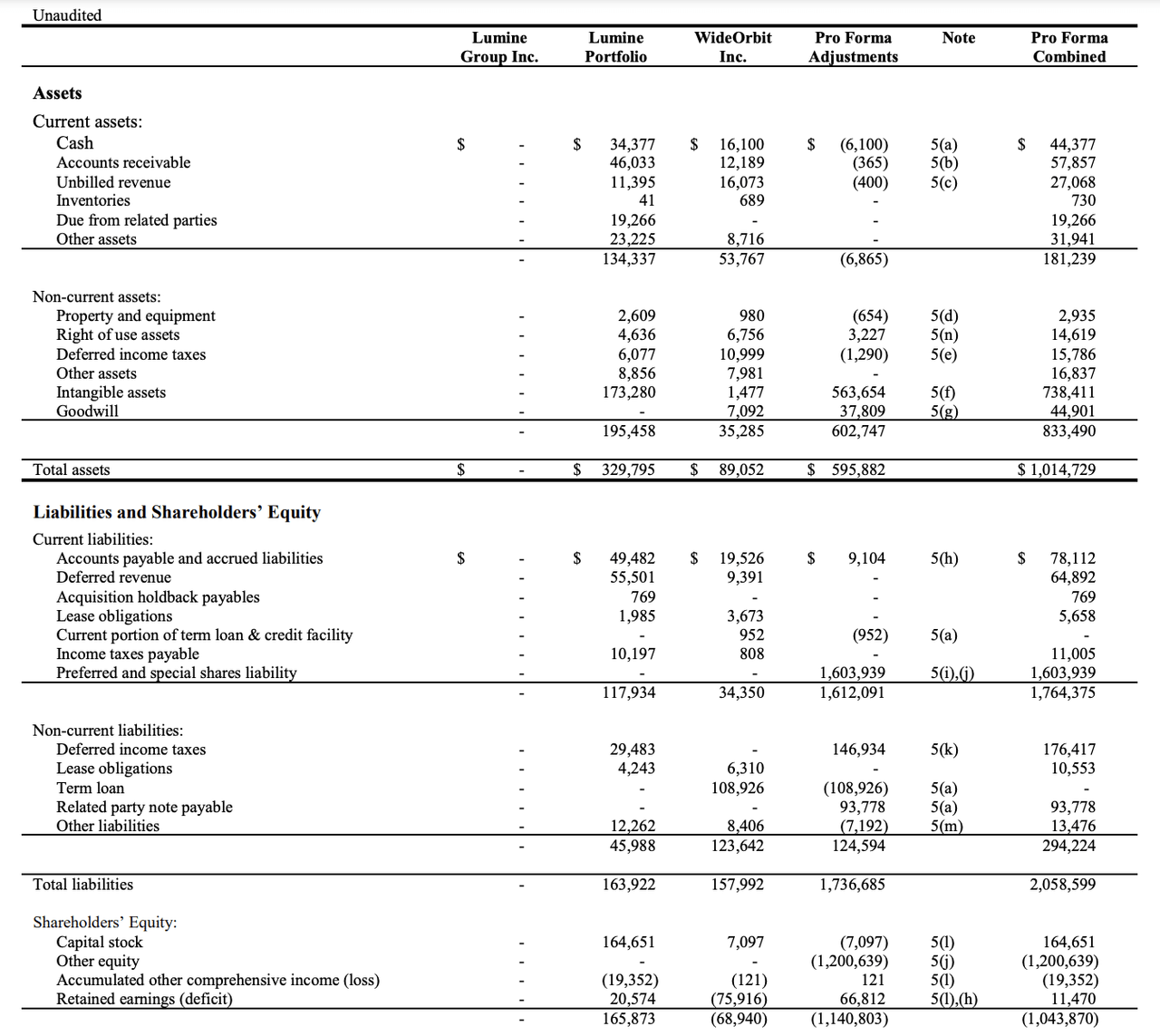

Regarding the balance sheet, the company is also a true reflection of what Constellation has historically predicated with. Lumine boasts a significant cash position and no debt outstanding as of September 2022. The acquisition of WideOrbit (which we’ll discuss later) will bring some debt to the combined company (primarily through a new obligation with Constellation), but it’s safe to say that overleveraging is unlikely to be a risk in the Constellation universe:

Source: Lumine Preliminary Prospectus

Based on the above information, it feels like Lumine follows Constellation’s playbook pretty closely: growing mainly through acquisitions, with organic growth focusing primarily on maintenance and recurring revenue, supported by a solid balance sheet.

Directly comparing any company to Constellation will always be controversial, as it’s unlikely that even those from within will be able to achieve its success. However, if you want to draw a comparison, Lumine looks pretty similar to Constellation back in 2007 regarding company size and margins:

Source: Made by Leandro

It’s also worth noting that Constellation has never been “vertical” constrained, whereas Lumine’s target market is undoubtedly smaller.

If you are enjoying this article don’t hesitate to subscribe to the Best Anchor Stocks blog!

What is WideOrbit

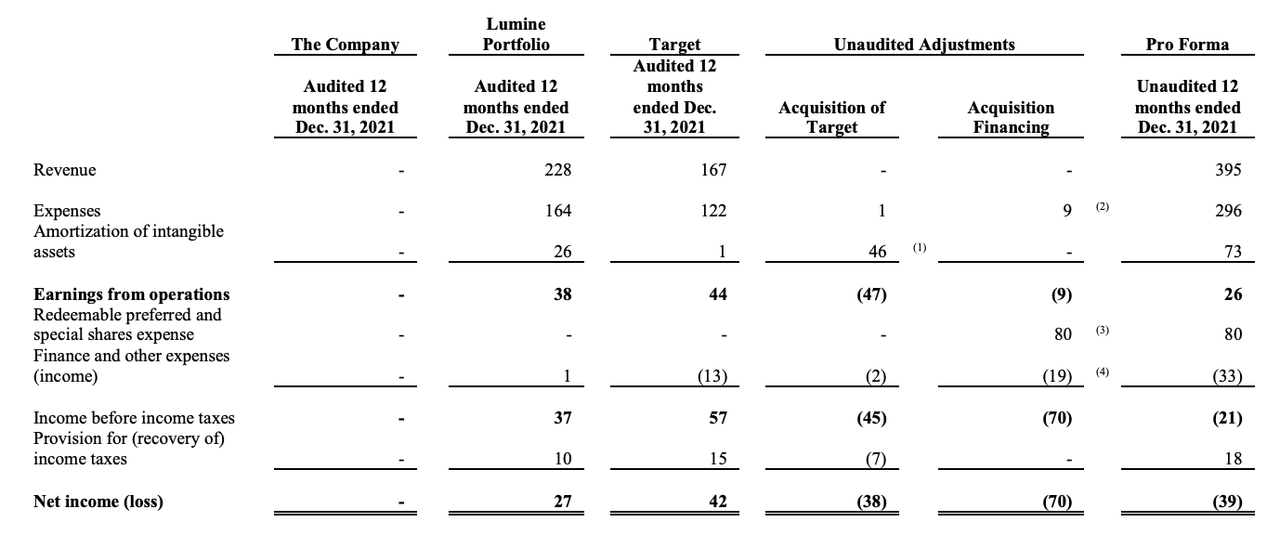

As discussed before, one of the reasons for the spin-out is the acquisition of another company of significant size. This company is WideOrbit, which generated revenue of $167 million in 2021 with an impressive 26% operating margin:

Source: Lumine Preliminary Prospectus

WideOrbit is a US-based media company founded in 1999 by Eric Mathewson with the vision of simplifying the process of buying and selling ads:

We help our clients do more business by eliminating the ubiquitous paper-chasing, chair-swiveling, and data re-re-entry of traditional workflows. And it’s those clients who have made us the leader in premium broadcast technology and the largest sell-side processor of premium advertising, both digital and linear.

Source: WideOrbit

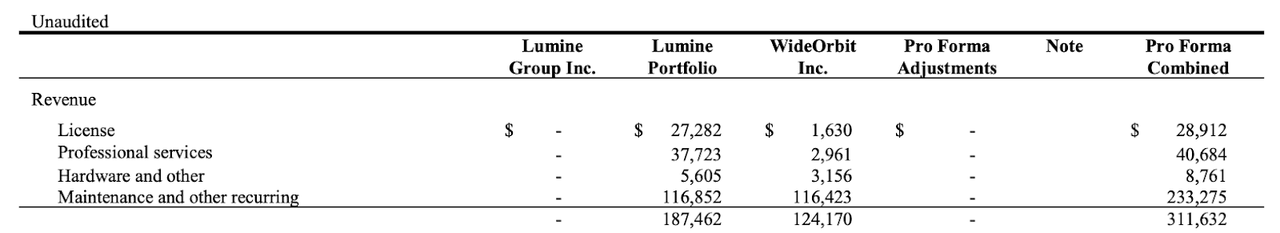

The company boasts of having a 99.9% renewal rate, and if we dig a bit deeper into the revenue sources, we can also see that it has highly recurring revenue with 94% in maintenance and recurring:

Source: Lumine Preliminary Prospectus

After the merger, the new combined company is expected to have maintenance and other recurring revenue of around 75%. This stable and predictable income stream is crucial to continue scaling through acquisitions.

How they grow is also something that sets the two companies apart. Judging by the low level of goodwill in WideOrbit’s balance sheet, we could infer the company grows organically more than inorganically. This would also explain the higher margins (organic growth allows to achieve operating leverage) and the optimized revenue streams toward recurring sources.

Note that acquisitive companies such as Constellation are never optimized for margins or maintenance and recurring revenue because they are constantly acquiring companies that are rarely optimized for these metrics.

The transaction details

At first, I was pretty worried about the transaction details because the TSS spinout was definitely a headache regarding accounting and comparables. It seems that the structure of the new spinout will be no different, and we will have to “bypass” messy accounting and mute all the noise of the financial statements. The good news is that we already have practice from Topicus, so following the company should be easier this time.

The structure of the newly formed company

I want to discuss the new company's structure from two angles: operational and shareholder base.

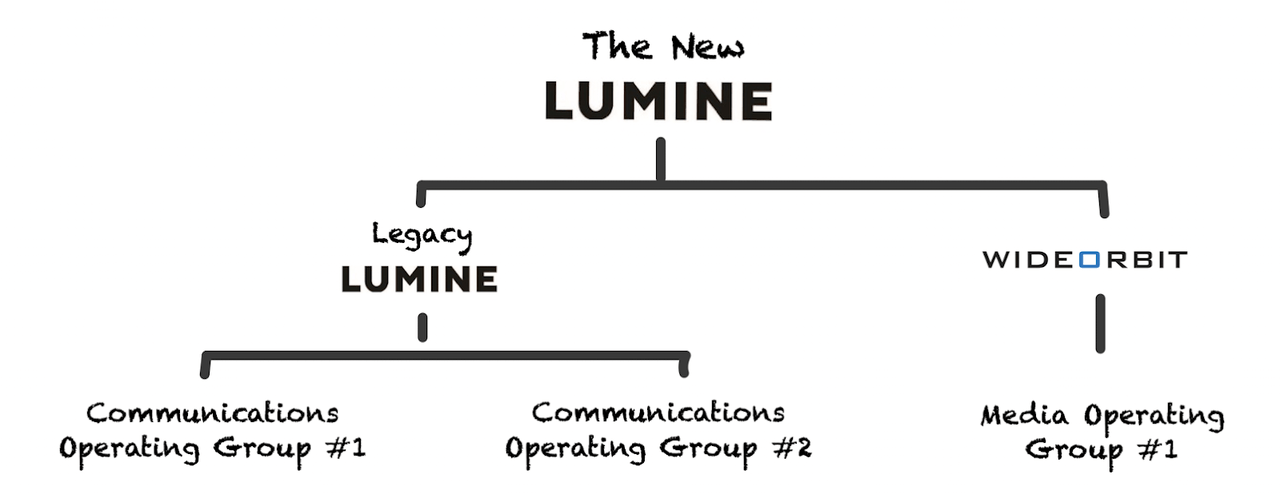

From an operational standpoint, the company will be divided into three operating groups, two geared toward the communications vertical and one toward the media vertical. The Media Operating Group is new and constituted only of WideOrbit, while the other two groups will be the home of the remaining 22 companies:

Source: Made by Leandro

As mentioned before, Lumine has grown primarily through acquisitions, whereas WideOrbit seems to have grown organically. This sets a similar stage to the TSS spin-out, where Constellation tried to achieve a mix between inorganic (TSS) and organic (Topicus) expertise.

From a share structure perspective, things start to get a bit complex and messy. Similarly to Topicus, the spin-out will bring preferred and special shares, which will enjoy a 5% preferred dividend. One year after Lumine’s shares start trading, preferred and special shareholders will face the choice of conversion, although they can choose to convert their shares anytime before this date.

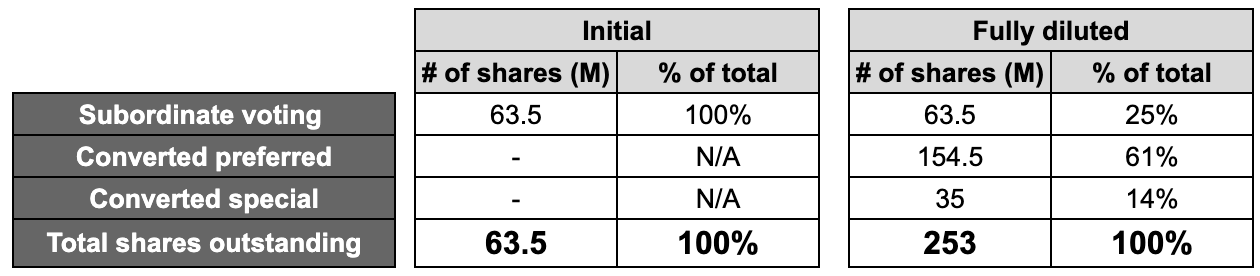

Each preferred share will be able to be converted for 2.43 voting shares, and each special share will be able to be converted for 3.43 voting shares. This conversion event makes the share structure dynamic. Below you can see how it’s expected to shift pre and post conversion:

Source: Made by Leandro

Initially, the preferred dividend should negatively impact cash flows available to deploy into acquisitions or organic initiatives. However, one year later, if preferred and special shareholders choose to convert their shares to subordinate voting shares, we should see absolute cash flow and the number of outstanding shares go up. This is precisely what happened with Topicus. Shareholders were diluted upon conversion, but Topicus had an additional €60 million to deploy.

The question is: who owns these shares? Constellation owns 100% of the super voting shares, 100% of the preferred shares, and a small number of subordinate voting shares. These subordinate shares result from Constellation not distributing fractional shares to its shareholders.

Public shareholders (ie., Constellation’s current shareholders) will own all outstanding subordinate voting shares except those owned by Constellation, as previously discussed. Lastly, the special shares belong to the rollover shareholder group (i.e., previous WideOrbit employees):

Source: Lumine Preliminary Prospectus

The result is that, on a fully diluted basis, Constellation will own 61% of the subordinate voting shares, public shareholders 25.12%, and the rollover group 13.82%. So it looks like the public float will not be large this time either and Constellation will retain control of the company.

The above shareholder structure has several implications. First, Constellation shareholders will indirectly own 60% of Lumine on a diluted basis even if they choose to sell their shares. Secondly, if you hold both Lumine and Constellation, a good portion of the preferred dividend will accrue to you either way. The only thing that will change is if that cash is available to you via Lumine or Constellation, considering the tax implications that it has when accrued through Constellation, of course.

If you are a Constellation shareholder, you are entitled to approximately 3 Lumine shares per Constellation share owned. These will be distributed once the spin-out closes sometime maybe in Q1 2023.

The purchase price

Lumine will pay $490 million as total consideration for WideOrbit, with the new company having a combined value of $1.6 billion. The company will pay this amount through a combination of debt, cash, and stock:

Source: Made by Leandro

With the new debt incurred, Lumine plans to pay off WideOrbit’s existing debt. Seeing the hefty purchase price, we can start to understand why the spin-out happened: $222 million will be paid with stock, $180 million in cash and the remaining $87 million will go to the debt repayment. This is an amount that Lumine would’ve not been able to pay without incurring significant debt.

The new management team and the compensation structure

As expected, the newly formed company will “carry over” certain key Constellation managers as directors. This is a result of Constellation choosing 6 out of the 7 existing directors, which will allow the company to play a crucial role in important decisions, such as the following:

Acquisitions of more than $20 million have to be voted unanimously by the board of directors of the newly formed company. Note that $20 million is not that significant for a company that tends to make acquisitions with an average size of $11 million

Acquisitions of more than $100 million have to be voted by Constellation’s board

The above basically means that if Lumine wants to make a significant acquisition, Constellation has to approve it. If you have trust issues regarding management or capital allocation in the new company, knowing that Constellation has your back might be reassuring.

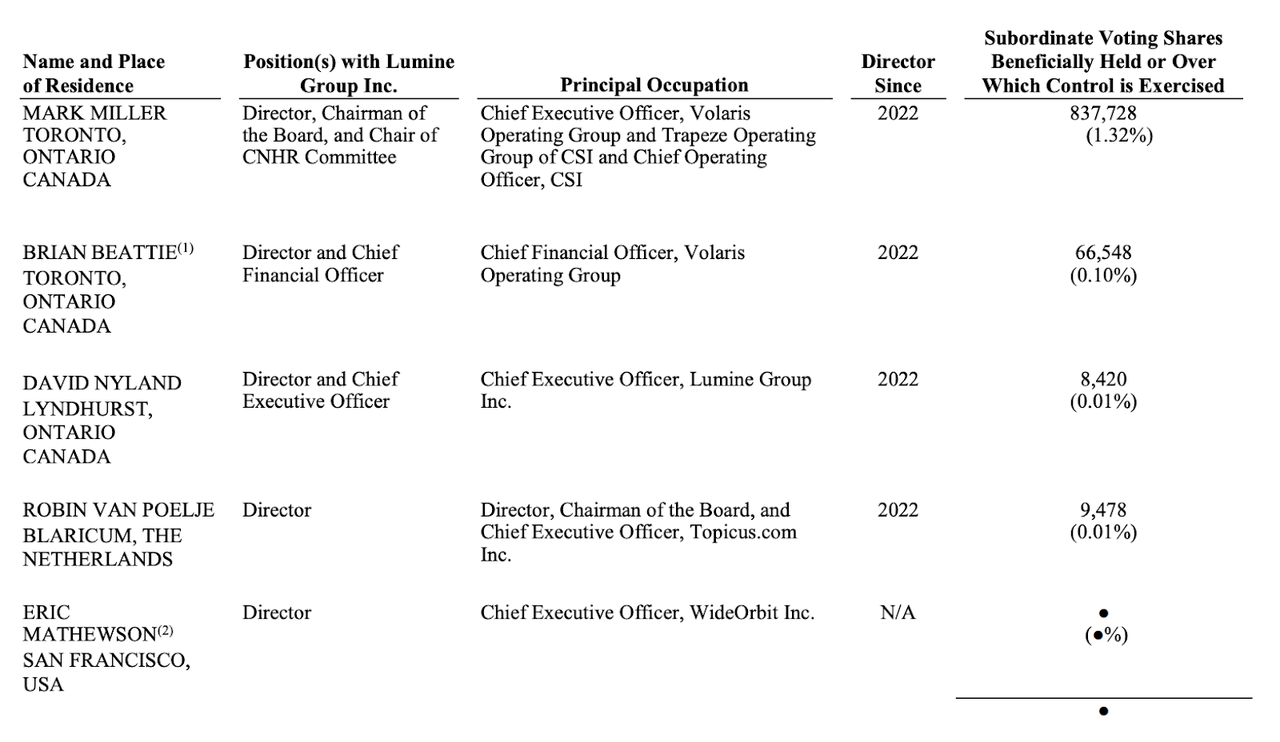

The executive board will be constituted by the following people:

Source: Lumine Preliminary Prospectus

It’s also worth noting that the newly formed company will have a very similar compensation structure to that of Constellation, where executives invest a portion of their bonus into the company’s shares in the open market with a consequent lock-up period:

Managers and employees will be encouraged to invest a significant portion of their after-tax bonus in Subordinate Voting Shares. All Subordinate Voting Shares under this program will be locked-up for a three to five-year period, after which the employees will be free to either hold them or sell them.

Note how the word used here is “encouraged.” This is the exact wording used in Topicus’ prospectus, but Topicus’ management claimed during the 2021 AGM that the bonus was being invested in Topicus’ shares, so we can argue the same will happen in Lumine. Board members must also invest 50% of their bonuses in Lumine shares.

The bonus will be paid according to the difference between the Return on Invested Capital and the cost of capital. So if the ROIC is lower than the cost of capital (i.e., no shareholder value creation), then there’s no bonus. Talk about an aligned compensation structure!

What to do with the shares

As discussed above, Constellation shareholders will be entitled to 3 shares of Lumine per share of Constellation owned. Once issued, you must choose between holding or selling the Lumine shares. I will personally keep them, but you should do what feels right for you.

You should also consider that Constellation will have an ownership stake in Lumine (just as with Topicus), so you’ll have an “indirect” ownership of Lumine even if you decide to sell the spin-out shares.

It’s also worth noting that Mark Leonard has not hidden his excitement for the new company. Of course, you should not copy any investment, even if it comes from one of the best capital allocators of all time, but it’s always a positive:

I look forward to working with Eric. He and his team have built an extraordinary business over the last 23 years. I hope their knowledge will benefit all of Constellation’s operating groups. WideOrbit will continue to operate as an autonomous company within Lumine Group, building on their history as a market leader and partner to leading broadcast and media companies. I look forward to having CSI's long-term shareholders become long-term shareholders of Lumine Group. I hope my grandkids are still holding Lumine shares fifty years from now.

What the spinout means for the future of Constellation’s shareholders

It seems obvious that Constellation’s shareholders might end up with a large portfolio of the company’s spin-outs. Constellation has historically been a collection of private VMS companies, but it seems the transition to being an owner of publicly traded VMS companies is already underway. In fact, Jamal Baksh claimed that this has always been Mark Leonard’s vision:

Mark had mentioned at an AGM that he saw the future of Constellation as being many of these spinouts.

Spin-outs have several advantages, from which I would highlight the following:

Allows Constellation to buy large companies using stock as payment

Better align the interests of employee shareholders with company performance

Allows Constellation to keep scaling without incurring too much complexity

Unlocks shareholder value as the different companies are expected to trade at a premium when compared to what they are valued at under Constellation’s umbrella

This last point makes no “theoretical” sense, but it’s typically how it works. Take the example of Topicus, which is now trading at a significant premium compared to Constellation. The most logical explanation is that investors expect smaller companies to outperform as they are “free” from the law of large numbers (i.e., it’s easier to imagine Topicus multiplying its market cap by 5 than Constellation’s).

Either way, after seeing two spinouts in the past two years, we should expect more in the future. This in turn means that if we are willing to hold onto the spin-out shares we will end up with almost an entire portfolio of independent VMS serial acquirers. Good news is we’ll have the choice to decide which we want or don’t want to hold.

If you want to guess the next spin-out, Caleb Oppel, a good friend of mine, listed some months ago the internal groups at Constellation that have the potential to be spun out. Call it luck or call it skill, Lumine was the first on the list back in November:

Conclusion

I hope this article helped you understand all there is to Constellation’s Lumine spin-out. The decision of holding or selling the spin-out shares is one that you must make, but making decisions with the necessary context is always easier. It’s pretty obvious that grasping Constellation Software’s shareholder value creation just by looking at the stock’s total return will become increasingly challenging with future spin-outs.

In the meantime, keep growing!

Disclosure: This is not investment advice and I am long Constellation Software ($CSU:CA)

It's interesting that once you go through the full list of CSU business units and their sectors, you realize that Lumine is actually quite specific, in that, that no other OG or sub-OG have invested in communication and media VMSs. Big question is how much of the legendary 40.000 companies defining CSU's total addressable market, falls into description of communication and media. My assumption is that they do not have so many small targets ahead of them, but that this is a convenient way to acquire a larger target from time to time (merger instead of full acquisition).

I am updating my database with sector information for the whole CSU. We will know soon :)

https://nicoper.substack.com/p/6-the-whole-constellation

great overview Leandro, thank you!