What is Best Anchor Stocks?

Hello reader,

Welcome to the new “Best Anchor Stocks” blog!

We decided it was best to kick off the blog by explaining what Best Anchor Stocks is, where it comes from and what you can expect from this blog in the future. If you like what you see after reading this article, please consider subscribing to receive updates from time to time in your inbox.

Without further ado, let’s start with what Best Anchor Stocks is.

What is Best Anchor Stocks?

Best Anchor Stocks is an investment research service on Seeking Alpha, where Leandro (@invesquotes) is the main contributor, and Kris (@FromValue) provides oversight.

The service aims to provide subscribers with deep research and continuous monitoring of high-quality and resilient businesses. We believe conviction can’t be built with one article but rather with constant company monitoring over time.

We look for companies with the potential to enjoy market-beating returns while experiencing lower-than-average volatility. Is this even possible? It is, and some companies have proven it over the last decade.

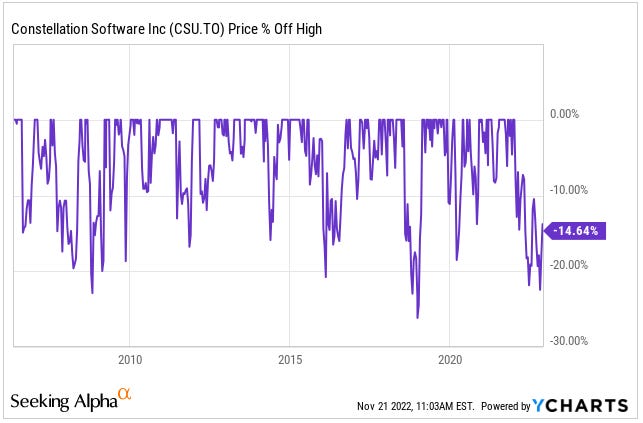

Constellation Software is one such company. It was able to compound capital at high rates (almost 2000% total return) without suffering one single 30% drop ever, not even during the Great Recession of 2008-2009 of the Covid crash in 2020:

We aim to find such companies with relatively lower volatility and higher upside.

Every investor (individual and institutional) looks for market-beating returns (or else they would be better off holding index funds). However, it’s unusual to see investors aim for lower-than-average volatility in combination with growth. So, why do we focus on it?

We are firm believers that the search for worthwhile returns has two legs:

Finding high-quality companies at attractive prices

Holding them for long periods

While some investors manage to achieve #1, they struggle with #2 due to increased volatility. Volatility should not be considered a risk, but it is a catalyst for one of the most significant risks for any investor: acting too much. Stock prices should not guide decisions; unfortunately, they do in many cases. As Warren Buffett once said:

The stock market is there to serve you, not to instruct you.

To get better results, learning to cope with volatility is probably one of the best things you can do. There are methods to avoid volatility taking over the control of your investment decisions. One of these is the coffee can approach, which states that once you are happy with your portfolio, you should avoid looking at it for years. This method addresses the risk of acting too much but has some drawbacks.

The main drawback of the coffee can approach is that it assumes that your portfolio is static. In an ideal scenario, you have built a high-quality portfolio and already made all the required contributions. From this point, you should let it ride for an extended period. As lovely as it sounds, a static portfolio is rare.

For most people, a portfolio is dynamic because of continuous contributions. Most investors (myself included) allocate funds monthly due to their income timing, making it impossible to fully ignore.

We believe the solution must come from a portfolio management perspective.

The first step in any investment journey should be to get to know yourself. Knowing yourself is not only a theoretical exercise; it also requires practice and experience. Many investors believe they can cope with volatility until they are confronted by it.

Once you understand how much volatility you can cope with, you should start building a portfolio based on what you learned about yourself.

Best Anchor Stocks aims to help investors with this task. By allocating to lower-volatility, high-quality growth companies, investors should be able to balance their portfolio to their personality. The key word here is “balance.” There’s no one-size-fits-all allocation.

For example, if you are not much affected by volatility, then you should probably not allocate a high portion of your portfolio to Best Anchor Stocks. On the other hand, if you are more conservative and believe in slowly compounding capital while protecting the downside, you can put more weight on Best Anchor Stocks. The goal is to find your preferred spot along this line, considering that Best Anchor Stocks have the potential to beat the market:

It’s also crucial to understand that Best Anchor Stocks is not a stock-picking service; it’s a research service. We facilitate all the necessary research and help subscribers monitor these companies, but conviction is something one can’t buy and must come from within. We have skin in the game and provide complete transparency regarding our portfolio management, but we don’t encourage copying our portfolio. Why? Because our portfolio is tailored to who we are, not to who you are.

The current state of Best Anchor Stocks (updated: 03/17/2024)

The Best Anchor Stock portfolio is currently made up of 15 companies, all of which we believe are high quality.

We started the service in January 2022, and even though the holding period is still not relevant enough to draw meaningful conclusions, we are off to a good start. This is the performance of the portfolio since inception (01/14/2022):

If Best Anchor Stocks sounds like your kind of thing, there’s a two-week free trial during which you’ll have access to all the companies and the research we have uploaded up to now.

What can you expect from this blog?

We have three types of publications in mind:

Articles on general investment topics

Podcast transcripts from our public podcast episodes

Company-specific articles from time to time

We will not adhere to a recurrent publishing scheme because we don’t want to overwhelm you with emails. We want every publication to be of the highest quality, even if that means waiting a bit more to upload it.

We hope you find value in all that we share in this blog and hope you give it a chance!