Books of 2024

2024 was a productive year from a reading standpoint. I read 18 books last year, less than I would’ve liked (as always) but probably more than I expected to. I never start a year with a specific goal in mind in terms of reading, but I do go into the year with the goal of reading more than the year before, and I definitely met this goal in 2024.

Below you can find a list of all the books I’ve read this year. I decided to add a grade next to each together with a short commentary. Hope this list helps you expand your library and feel free to leave your best read in 2024 (or any year) in the comments section so I can expand mine.

I am also working on a ‘Resources Library’ with the most useful articles I’ve read over the past few years. I estimate this will be a +1,000 page library of high quality content. If you don’t want to miss it when it drops, feel free to subscribe:

Without further ado, let’s jump in. Books are in chronological order, by the way.

1. Devil Take The Hindmost by Edward Chancellor (7/10)

A bit dense for my liking, but learning about financial history is a requirement for any investor. The main lesson one can draw from this book is that it’s rarely “different this time” as the behaviour of market participants tends to rhyme regardless of the context.

In my view the book also portrays why it’s unlikely that AI will make markets more efficient; investing relies to a great extent on human emotions and avoiding herd behaviour, something that AI is unlikely to change as it’s trained on past human behaviour (this is obviously still TBD!).

2. The Little Book That Builds Wealth by Pat Dorsey (6/10)

Short book that is tailored to my investment strategy (it’s probably the other way around). I don’t think it will add much value if you are well versed on the topic of moats (reason why I didn’t give it a higher grade).

This week, I published the following on X regarding a list of “Wide moat” companies according to Morgan Stanley. It was interesting to see that the main takeaway from the replies was that moats can be highly subjective.

3. The John Deere Way by David Magee (8/10)

The grade here is probably biased as this was the first step in my Deere research, company that made it to my portfolio.

The book is pretty outdated (only covers until 2005) but should serve as a good primer on Deere’s culture. I would caution, though, that a fair bit has changed since and this is probably one of the bear cases today. Some things like the compensation structure that was established to take Deere from a good company to a great one remain true today.

My Deere deep dive is free to read and should serve as a good indicator of the depth of the rest of the deep dives shared behind the paywall:

4. You Can Be a Stock Market Genius by Joel Greenblatt (7/10)

A classic that I had not read until this year. It doesn’t fit my investment strategy well, but it’s a good book about special situations investing. There’s a lot to learn from Joel Greenblatt (there will be a great resource in the Resources Library).

5. What I Learned About Investing from Darwin by Pulak Prasad (9.5/10)

This was my favorite read of the year. Pulak Prasad founded Nalanda Capital and has achieved extraordinary returns over a very long period by focusing exclusively on Indian equities. I was lucky enough to be able to discuss the book with Pulak in a call, and it’s fair to say Nalanda Capital’s investment strategy fits me well. I thought it fit me so well that I wrote an article discussing some learning from the book and how they apply to my portfolio: ‘4 Topics That Define My Investment Philosophy’.

6. The Business Reinvention of Japan by Ulrike Schaede (8/10)

Very good book if you want to dig deeper into the changes and shifts that are going on the Japanese business landscape. These changes are, to a great extent, the thesis that supports recent interest in Japan (together with extremely low valuations in some cases).

7. Capitalism Without Capital by Jonathan Haskel and Stian Westlake (7.5/10)

Much of the developed world has shifted from the tangible to the intangibles economy, and this book aims to explain what this change entails.

There’s no reason to believe that valuation doesn’t matter in the intangibles economy (it does), but there are also reasonable concerns about how historical accounting and valuation practices have adapted to these types of companies.

8. Accounting For Growth by Terry Smith (8/10)

Another classic that is not easy to get your hands on. This book discusses the ways that companies can mislead investors through their financial statements. Accounting standards might have changed since this book was released, but the main lesson stands: don’t blindly trust what you read in financial statements (no, it doesn’t matter if they are audited).

9. Paths to Wealth Through Common Stocks by Phil Fisher (7/10)

Not the most well-known Phil Fisher book (that would be Common Stocks and Uncommon Profits) but definitely an interesting and refreshing read. Phil Fisher “pioneered” the concept of scuttlebut and I came across this books when François Rochon recommended it to me in the conversation we had for the podcast.

10. The Warren Buffett Way by Robert Hagstrom (8/10)

This book goes over (as the title suggests) Buffett’s way of investing. This is a well documented topic but I was actually positively surprised by it and would highly recommend reading it.

11. Automate This by Christopher Steiner (9/10)

If you’ve been following my work you’ll know that I usually cite a book called ‘Flash Crash’ as a great source to understand what moves stock prices over the short term (spoiler: it’s not fundamentals).

While this is something that’s well documented, I believe both that book and this book by Christopher Steiner should help one understand what moves markets over shorter time frames. It also shares the pretty interesting story of Thomas Peterffy, Interactive Brokers’ founder.

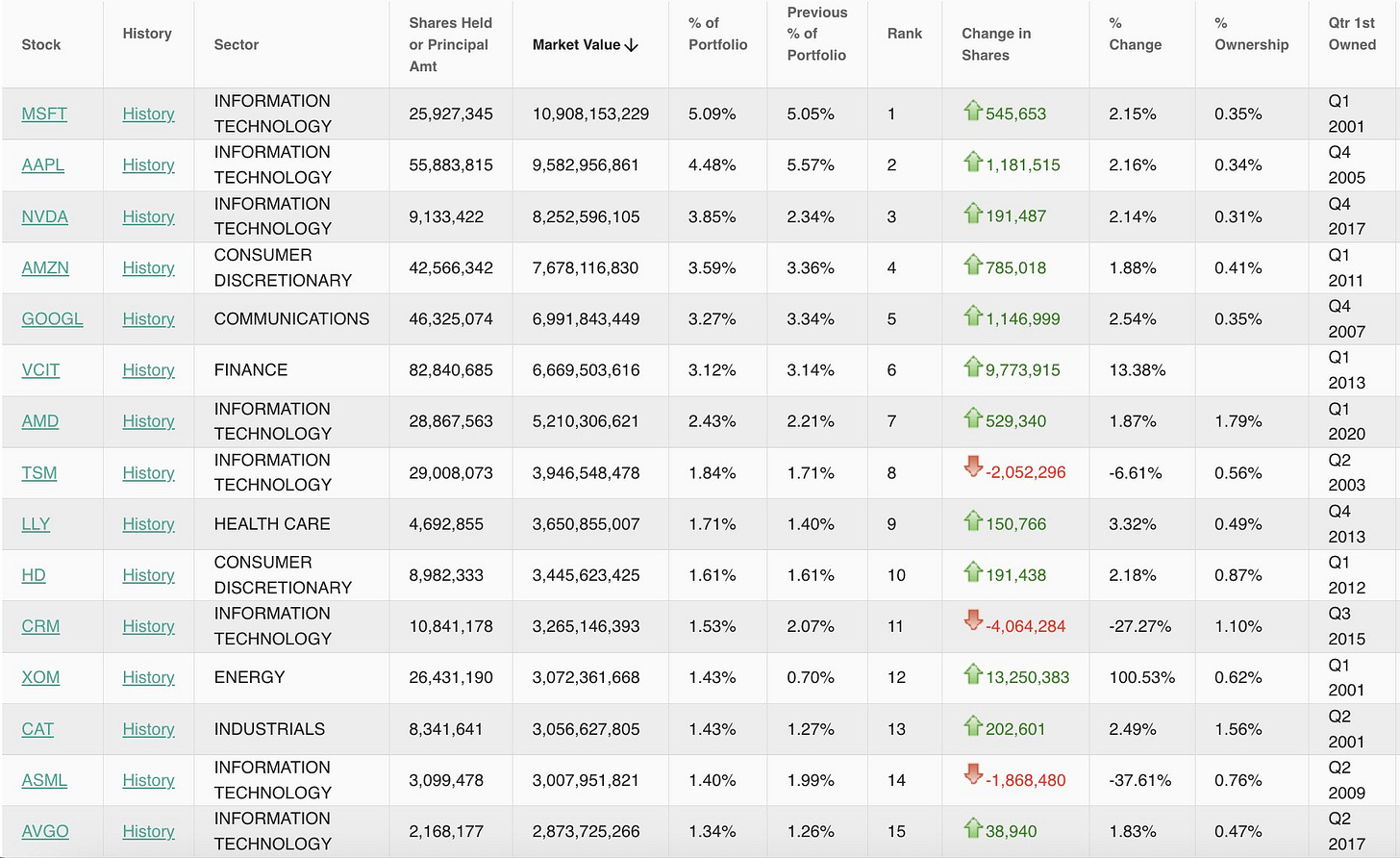

12. The Only Three Questions That Count by Ken Fisher (5/10)

Written by Phil Fisher’s son, Ken Fisher, this book was a disappointment. More so after seeing that Ken Fisher has been a pretty long-term holder of high-quality companies:

Maybe my disappointment comes from high expectations, although there are definitely some interesting ideas shared in the book.

13. Think and Grow Rich by Napoleon Hill (9/10)

A subscriber (that I now call a friend) recommended this book to me this year and I couldn’t be happier he did. It’s not exactly related to investing, but it’ll teach you the timeless principles to become successful.

14. Santa Monica Partners Letters to Partners by Lawrence Goldstein (9/10)

Collection of 40 years of letters written by Lawrence Goldstein to partners of his fund (Santa Monica Partners). Mr. Goldstein has proven to be a magnificent investor over a long period of time, and interestingly enough, he has managed to build his track record by investing predominantly in the Pink Sheets. Not something you would expect from a long-time successful investor.

15. Big Mistakes by Michael Batnick (8/10)

Social media and our own biases tend to magnify success and hide failures, but this book is all about the latter. As investors, the most difficult thing will always be to look ourselves in the mirror and admit we’ve made mistakes. It’s interesting because out of the companies included in any given portfolio, there’s a significant probability that there will be several mistakes (the difficult thing is that we don’t know which!)

The book goes over the mistakes of well-known investors.

16. Contrarian Investment Strategies by David Dreman (7/10)

Good book that discusses a contrarian investment strategy to generate good returns. The only “but” I believe there is with the book is that it focuses on contrarianism through the POV of low multiples, but you can pretty much be contrarian at many valuation levels. Any good investment must be to an extent a contrarian investment.

17. No Bull by Michael Steinhardt (7/10)

Autobiography from stock market legend Michael Steinhardt. Thought it was a good book but not definitely how I view investing or how I would like to live an investing life. This said, you have to give credit where credit is due: Michael Steinhardt has delivered outstanding returns for its investors over many years.

18. Interviews with World’s Best Company Operators by InPractise (9.5/10)

I love learning about new companies and industries and I believe this was an outstanding recollection of in-depth interviews by InPractise. I would highly recommend it if you want to learn about high-quality industries and gain insights that you would not learn elsewhere.

Hope you got a couple of ideas out of this list!

Have a great day,

Leandro

I am reading the Prasad book now; it's well written and thought provoking (though admittedly some of the evolutionary biology material is pretty dense).

I was disappointed with the InPractise book; maybe I had overly high expectations, but it seems like a lot of recycled content, much of which I had already read elsewhere.

Great list especially Think and Grow Rich , classic