Bluff, Break, or Burn: Trump’s Market Gamble (NOTW#38)

Best Anchor Stocks has a partnership with Finchat (the research platform I personally use), through which you can enjoy a 15% discount on any plan. Use this link to claim yours! You’ll find KPIs, Copilot (a ChatGPT focused on finance) and the best UX:

The market suffered a historic week, experiencing two consecutive >4% drops caused by uncertainty in the global trade landscape. I discuss this and give my opinion in the market overview (yes, I talk about macro).

Articles of the week

I published two articles this week. The first was my latest podcast, where I discuss the life sciences industry with my good friend Jon (aka Borlaug). I recommend not only listening to the episode but also reading the transcript if you want to understand the industry. You can listen to the episode on Spotify, Apple Podcasts, or YouTube.

Vials, Tubes, & Billion-Dollar Niches w/ Jon aka. Borlaug

Welcome to another episode of the Best Anchor Stocks podcast. This time I was lucky enough to be joined by Jon (author of The Borlaug Report) and we decided to focus on the profitable niches one can find in the lifesciences industry and what makes them great. We discussed...

The week's second article was a summary of Nintendo’s most important direct to date: the Switch 2 direct. I review the highlights from the direct and what it might mean for Nintendo going forward. I am also working on an article about the valuation and will record a podcast episode with Ryan O’Connor next week (also about Nintendo).

A New Nintendo Era Begins

Nintendo hosted its most awaited Direct of (at least) the last 8 years: the Nintendo Switch 2 Direct. The company shared many highlights, some of which were relatively well-known due to leaks/rumours…

Without further ado, let’s see what the markets did this week.

Market Overview

So…the market had a rough week (put mildly). The S&P 500 and the Nasdaq were down considerably this week; it all started on Thursday:

For context, the Nasdaq was “close” to activating the circuit breakers both on Thursday and Friday and suffered it’s two worst one-day drops since 2020 and it did so consecutively. A Circuit Breaker is simply a trading halt that "stops the bleeding” that can come with automated trading and kicks in when the S&P 500 is down more than 7% in a day. The Circuit Breaker was implemented in 1988 as a response to Black Monday (1987). The DJIA (Dow Jones Industrial Average) dropped 22% (yes, you read that right) in a single day due to what was coined portfolio insurance.

The 80s were a period in which many people were selling index futures to hedge their portfolios (this is where the name portfolio insurance comes from). This strategy worked well to protect downside so long as losses were not severe, but it came with a flaw: it could potentially send indices into a downward spiral when things got rough because selling would be automated. As losses mounted, portfolio insurance kicked in and selling continued to levels not thought possible. There was nothing to stop this automated selling back then, which is precisely why circuit breakers were implemented.

The key question we should try to answer is why the indices were down so much in such a short period. Many of you might know that I do not attempt to forecast macro and don’t enjoy talking about macro, but this doesn’t mean that I don’t believe macro is relevant for the stock market (it definitely is).

So, Trump presented a now-famous chart on Wednesday evening with the reciprocal tariffs that would be implemented to pretty much every country with which the US has a trade relationship. These spooked the market because they were far higher than anyone expected. Here’s just one of the tables for reference:

As you can see, the reciprocal tariffs are at nosebleed levels, even though Trump claimed that the US is “being fair” because it’s only implementing half the tariff that the other country is implementing on US goods. The real problem lies in how the administration arrived at these numbers. While Trump spoke about tariffs, the method to calculate reciprocal tariffs was not based on tariffs but something that has little to do with them: the trade surplus/deficit of the US with that country. An X user realized that “trade barriers” had been calculated by dividing that country's trade deficit by the imports of the US from that country. For example, China has a trade deficit of $279 billion with the US, and the US imports $427 billion from China. Divide one by the other, and you get to the 67% figure quoted above.

This calculation method has many implications. First, it shows that Trump’s administration believes that running a trade surplus with the US is a sign of “unfair trade,” which is a heck of a statement. For example, it’s pretty obvious why Vietnam has a trade surplus with the US: the country is a low-cost manufacturing hub, and it doesn’t buy high-end goods from the US for obvious reasons: due to its size and relative poverty. Note that many US “exports” are intangibles/services, products that the Vietnamese economy doesn’t need much of. Does this mean that Vietnam deserves a 46% tariff? I’ll leave that up to you.

The fact that clothing is made in Vietnam (and other related countries) means that US consumers can get it significantly cheaper than if it were manufactured in-house. The US has probably the most expensive labor force in the world, so the thought that these need to be manufactured in-house makes little sense because costs would be substantially higher (and there will probably be nobody willing to do it). Vietnam exports labor because it has a comparative advantage over the US in labor. In plain English: Vietnam is better off exporting labor, and the US is better off “importing it” from Vietnam. This doesn’t mean that the US can’t do it in-house but that the optimal economic decision is to outsource it (I recommend reading David Ricardo’s work for more on this topic of comparative advantage).

Probably the most important implication of this calculation method is that it leaves little room for negotiation. The reason is that there’s little other countries can do to “fix it.” For example, even if Vietnam reduces all US import tariffs to 0%, there’s a high likelihood that it will come out as a serious trade “offender” in the chart above. So, with what Trump did on Wednesday, he basically set global trade on fire while (apparently) leaving little room for negotiation (this is not a political opinion by the way, it is what it is…)

To add insult to injury, note that one of Trump’s tables included a 10% tariff on the Heard and McDonald's Islands, which is exclusively inhabited by penguins! All of this is a pretty serious topic, but there’s always time for a good meme:

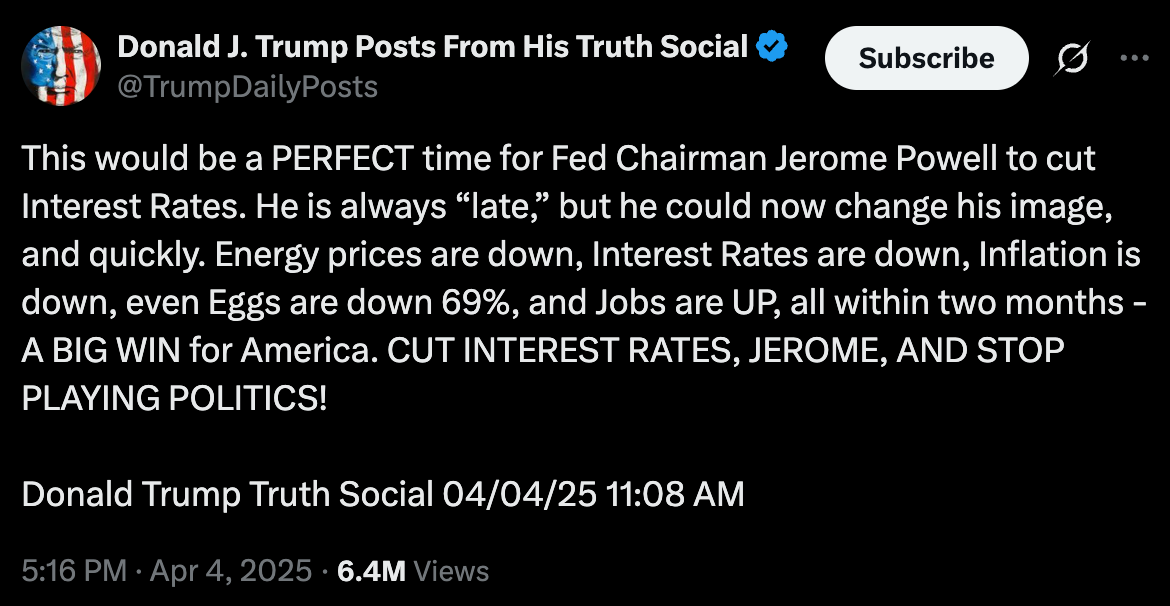

Another thing worth trying to answer is: What is Trump’s objective with this strategy? While I would like to say that I know how to forecast Trump, it has become evident that this is pretty much impossible. Based on the market’s reaction on Thursday, I’d say that the consensus is that Trump is unpredictable but that this tariff talk might still be just one move of a broader strategy (or else the market would’ve dropped significantly more). The strategy here seems to be to sound credible in wanting to light the world on fire so that interest rates go down, and therefore, the Fed has an excuse to lower rates (something similar happened during Trump’s first term, by the way, and markets did not love it). Trump even went as far a to publicly tell Jerome Powell to lower rates on Friday:

The administration might want lower rates because $9 trillion worth of US debt is coming up for refinancing this year. Refinancing this debt at lower interest rates will help the US government save billions in interest payments. Some also believe these savings will be passed on to businesses and consumers eventually through tax cuts. I must say that seeing no business or multi billionaire in the US speaking against what Trump is doing and even many publicly defending the strategy is kind of puzzling (and maybe consistent with this being a part of a broader strategy, who knows).

While this strategy is more credible than the US administration willing to set Global Trade on fire, Thursday and Friday suggest that nobody knows what will happen next. What does seem evident is that, if the market believed these tariffs would be implemented for the long term, the drop would’ve been much more violent (albeit we still have to wait and see what happens here over the next few weeks). It also seems clear that there’s a broader strategy to all this, as Trump still believes that the “US stock market is going to BOOM.” I don’t want to believe he thinks this will be the case with these measures in place. What seems evident is that if the market takes this as a bluff, then the strategy will not work. This means that Trump needs to sound believable and keep his foot on the pedal.

The only problem is that the administration is walking on a very thin line here. First, recessions are typically self-reinforcing because if consumers/businesses think a recession is coming, they might pull back spending, creating a recession even if one was not about to occur. This means (assuming the strategy above is correct) that the administration might unwillingly pull the US into a recession just due to a pure loss of confidence. Or in other words…the cure might be worse than the disease itself.

Secondly, I do think this strategy can turn out to be harmful to the US’ dominance in the long term. The reason is that, even if it’s a bluff, trading partners and allies now know they must try to rely less on the US because things like these can happen. The only problem that allies will face while trying to “diversify” away from the US is that the US consumer is by far the wealthiest consumer in the world, giving the US quite a bit of leverage in the negotiation table. That said, it has incentivized trading partners to unite “against” the US, so we’ll see how it plays out long term.

This has some similarities to China being blocked out of leading-edge semiconductors. China is still miles away from self-sufficiency regarding leading-edge semis, but it now has an incentive to pursue this self-sufficiency. If I had to guess, China would be further away from self-sufficiency had the US not blocked their access to EUV (ASML’s most advanced system), but we’ll never know. By the way, I am not claiming this was the wrong strategy, just that incentives rule the world and the US might have given what historically were trading “enemies” like the EU and China the incentive to talk to each other.

All this macro talk to tell you that I have no clue what will happen next. I lean on the side of this being part of a broader strategy to lower interest rates (I believe Trump does care about the stock market just due to his ego), but if Trump really wants to sound believable, then he will probably need to keep his foot on the pedal, and that is no bueno for markets. Will we be able to buy assets cheaper in the coming weeks? Possibly, I don’t know. I also think it makes little sense to rush things much, and it will probably pay off to stick to one’s strategy. There’s one thing that tends to work well over the long term: buying undervalued, resilient businesses regardless of the environment.

A few weeks ago, I released a two-part series discussing how my portfolio would fare in a recession and tariff-driven world. I believe it’s a good time to read that, even though it did not contemplate tariffs to the extent we saw them this week:

The second derivative here is retaliation by other countries to these measures. China was the first to retaliate, setting 34% import tariffs to US goods. The only “good” news is that these will go live on April 10th, compared to the US’ April 9th deadline. These dates would suggest to me that a negotiation is possible, but there’s no incentive for Trump to take the foot of the pedal as of today and therefore it would not be rare to see markets remain in risk-off mode until that happens.

The EU will probably follow next week with retaliatory tariffs and there are rumours that it might try to target the US’ big tech companies. We’ll see what happens but it does seem that a retaliation is likely the outcome.

This week’s industry map is one for the history books:

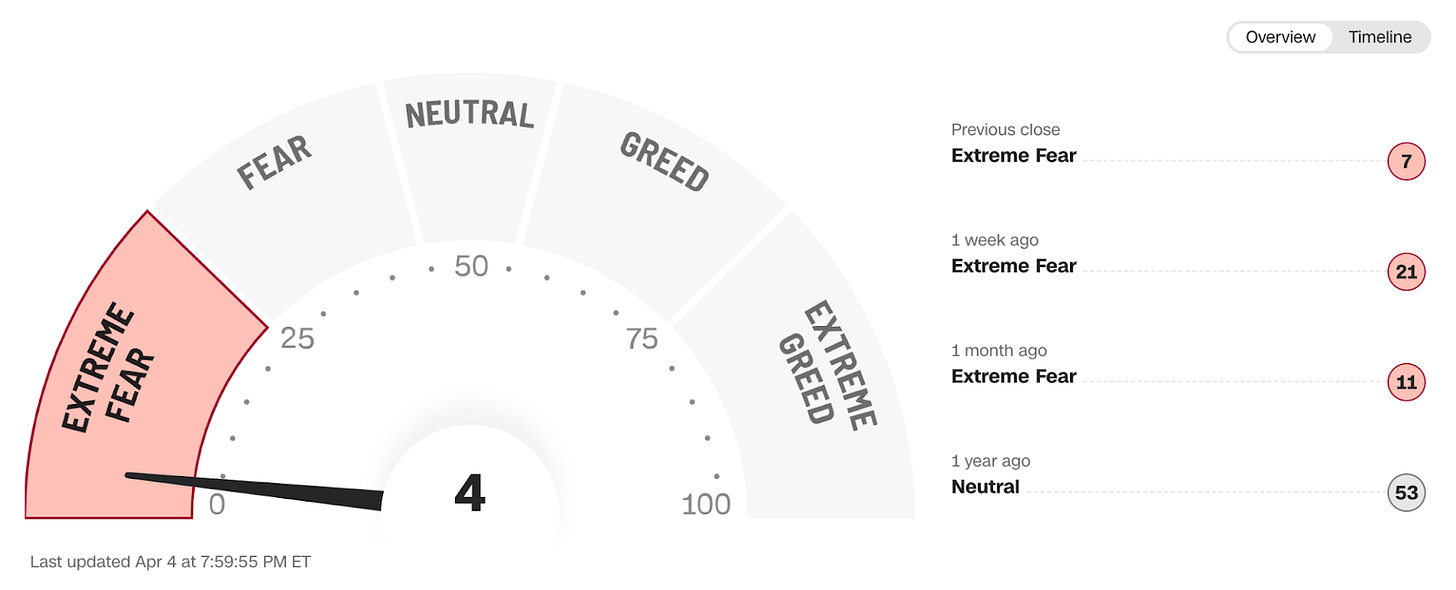

As you might have correctly imagined, the fear and greed index dropped considerably this week and it’s at four. Two times when it has been this low: 2008 and 2020.

I will be deploying significant amounts of cash over the coming weeks, but there’s no need to rush by any means as the environment is not the best and we are “flying blind” here. Literally this can be undone with a public communication from Trump, or it can go even worse for the exact same reason.

It’s worth remembering that when the market is going to start reversing, they’ll probably be few people telling you that this is going to be the case. Never forget that markets climb a wall of worry and that they are filled with recency bias.

The rest of the content where I share my transactions, watchlist changes, and news of the week is reserved for paid subscribers.