Hi reader…announcement time!

If you have been following the Best Anchor Stocks blog for a while, you’ll know that the content I bring here is just a tiny fraction of what I share behind the paywall on Seeking Alpha. This changes today…because Best Anchor Stocks, the full service, is coming to Substack!

I already explained what Best Anchor Stocks is all about in this article, but I thought it would be a good idea to go over it here as well.

At Best Anchor Stocks, we aim to provide deep research on high quality companies. The goal of this research (and every article) is to be instructive so that you can…

Discover high-quality companies

Read top-notch quality research

Learn how to analyze the best businesses in the world

Have someone do the follow-up of those companies once they are picked (earnings analysis).

See how I build my own portfolio over time.

Ask questions you have about a stock or investing in general

Build a portfolio of great assets to protect and grow your wealth

I will obviously not share the names of the companies in my portfolio here (this information is reserved for paid subscribers), but I will be transparent with its performance and industry composition.

The Best Anchor Stock portfolio (or what’s the same: my personal portfolio) has returned 54.9% since inception (January 14th, 2022), beating the S&P 500’s return of 19.9% and the Nasdaq’s return of 20% over that same period:

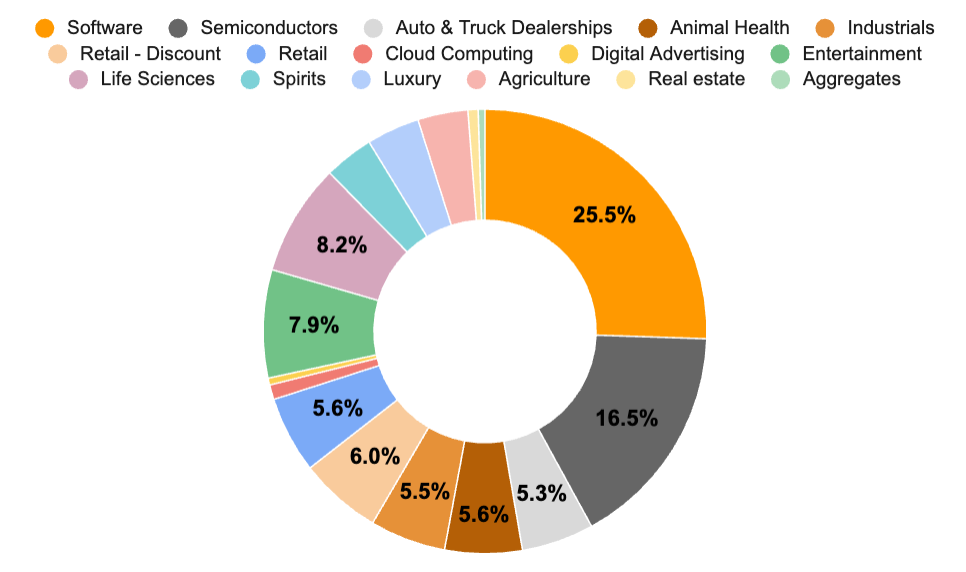

I have built the portfolio over time, but as things stand today it’s weighted as follows across industries…

Testimonials

Up to now it has been an exciting endeavour not only for me but also for subscribers. Current subscribers have given Best Anchor Stocks a grade of 4.9/5 on Seeking Alpha and they have written the following testimonials…

Extremely useful investment research at a reasonable price: I have been a subscriber to Best Anchor Stocks for over six months and have been very impressed. Leandro has chosen and continues to evaluate a number of high quality companies and not only provides a rationale for investing in them but also follows up on their earnings and any other significant news. This is particularly important during the inevitable times that some of the companies display negative performance . Leandro's analysis is focussed on the quality of each company's business and management and has brought to my attention a number of companies I would not otherwise have invested in. His interviews with money managers have also been very useful. I am delighted with this service and I my wish I had come across it earlier.

Great Service / Great Finds / Great Market Perspectives: I became a charter member back at a time when I was looking to diversify my investment holdings. Understanding my investment philosophy as most suited towards 1) growth / disruptors and 2) solid consistent compounders, I chose "Best Anchor Stocks" to help with the 2nd approach. Since making the jump, I have been impressed and pleasantly surprised. I don't need someone to tell me that MSFT, AAPL, GOOG and META might be good core holdings. Instead, through this service, I have found some great companies that I simply wouldn't have found otherwise. While I haven't purchased every company put forth by the service, I have no regrets about the positions that I have entered. Furthermore, even those for which I was skeptical, appear to be bearing fruit. So, if you are tired of the volatility associated with "growth stocks" and want to find solid companies to gradually build up a strong, winning position, then subscribing to this service is a must. Additionally, the author is very responsive and great at answering questions (both specific and general). Looking forward to when they offer a "lifetime subscription" option.

Very good analysis of quality companies for long term investors: I recently came across Leandro's work thanks to an interview he did with the manager of a family office, and I was impressed at his maturity and focus on what is important for a long term investor. I found his work on Atlas Copco very useful in understanding the company and the case for investing in it. After many years on the sell-side, it is very refreshing to find someone working on what is necessary to understand if you want to own good businesses for the long term. Unfortunately, brokers cannot do this (their business model prevents it) and many investors are also have a shorter time frame, and compliance often limits what they can say about their investments. So this kind of service from Leandro is not quite a free lunch, but almost, because the financial industry is not designed to do this.

If you want to see first-hand what these subscribers are talking about don’t worry because you can (and for free). I recently published a 120-page long deep dive on Deere that should help you understand the kind of research I provide at Best Anchor Stocks.

I’m sure you have many questions, so let’s go over these.

Will I no longer get free articles?

You’ll definitely continue getting free articles just as you had over the past months. Of course, free content will be episodic more than recurring, but nothing changes on this front. You will also be able to read the first part of the paid articles.

How will you publish all the existing content from Best Anchor Stocks?

We’ve uploaded content to Best Anchor Stocks for more than 2 years, so there’s obviously a considerable gap between the content there and the content you’ll have access to in Substack. We’ll be closing this gap by uploading a deep dive (just like Deere’s) on every company in my portfolio. You’ll get…

One deep dive a month

+ all the recurring articles on the companies in the portfolio

+ other articles

The end state is that you are going to receive 16 deep dives on high-quality companies… to start with, and this is only to close the gap. There will be many more deep dives along the way and many recurring articles.

There’s also significant skin in the game as I am personally invested in all of these companies.

What about the price?

Based on our experience, we’ve decided to offer two paid tiers: a premium and a premium+ subscription.

The Premium subscription will have a price of $399/year and gets you access to…

All the deep dives

Recurring articles

Access to my real-time portfolio and transactions

Occasional webinars on various topics

A community of like-minded investors

Considering all the content we will upload and the work we’ve put into it, I’d say it’s a fair price.

There’s also another option, though. The Premium+ subscription will have a price of $799/year and gets you access to all the above plus…

A Q&A with me every quarter to discuss anything you like

A special offer and how you can subscribe

But this is not all…today is a special day because Best Anchor Stocks is coming to Substack, so we decided to offer a lifetime 25% discount on all annual plans. This means you’ll be able to get…

The Premium subscription for $299/year

The Premium+ subscription for $599/year

There’s a catch, though. This discount will only apply to the first 25 subscribers of each tier. You can choose the plan that suits you best by clicking below…

Thank you for your time and for reading Best Anchor Stocks!

Have a great day!

Leandro

Congrats on the move! Welcome to living full-time in the neighborhood 💚 🥃

Hi Leandro, do you offer a community chat 💬? Quick earnings summaries ? Updated valuations? If yes, which tier it is ?