A special offer and the Best Anchor Stocks' 2022 Annual Recap

The premium subscription gives you access to all the content in Best Anchor Stocks, which includes…

All the deep dives

Recurring articles

Access to my real-time portfolio and transactions

Occasional webinars on various topics

A community of like-minded investors

A subscription the Premium + also gets you a quarterly Q&A with me to discuss anything you’d like.

If you want to know the type of content I share at Best Anchor Stocks you can read the Deere deep dive I uploaded a few weeks ago for free…

…or you can also read any of the other many free articles I have shared, just like this one!

You can also read the testimonials that existing subscribers have left. If you are a passionate and curious investor wanting to learn about high-quality companies, don’t hesitate to join Best Anchor Stocks!

Introduction

The first article of Best Anchor Stocks was released almost exactly one year ago on January 13th, 2022. Since then, quite a bit has happened in the service. We’ve released 9 additional picks from several industries and made the service even better with additional features.

During this period, I have only written two recaps. Back in the summer, I wrote a semi-annual recap for subscribers, which I summarized and made public via the following Twitter thread:

This article is the second recap. I know many investors closely follow how their portfolio is doing every quarter or even every month, but I think reviewing so often misses the point of long-term investing. One recap every 6-months seems more than enough to me, and I might even reduce this to once a year in the future.

I hope this article helps you understand better how we think at Best Anchor Stocks. Of course, we also show how the portfolio has performed this year. Looking ahead is key in investing, but so is looking back and reflecting on our past performance to find areas of improvement.

Performance, composition, and volatility

We ended the year with 10 Best Anchor Stocks in the portfolio.

Source: Best Anchor Stocks

As you can see, 40% is in software right now and I want to reduce that weight this year. Best Anchor Stocks aims to find durable companies and in software, the competitive landscape can change faster than in other industries. Constellation Software accounts for 50% of the software allocation. It is arguably more durable due to its VMS orientation and acquisitive strategy. The other two enjoy competitive advantages that are not entirely reliant on the quality of their software (which is obviously high). So, it’s not that I’m not happy with what I have, it’s just that I want to reduce the allocation a bit by not adding to these holdings.

In terms of performance, I am happy with how the portfolio has performed this year, considering the circumstances. The portfolio was down 4.8% in 2022 (the inception was on January 14th), beating both the S&P 500 (SPY) and the Nasdaq (QQQ) by a substantial margin:

Source: Best Anchor Stocks

(The updated performance of the portfolio as of the 11th of January is +1.41%)

The strategy of scaling slowly into high-quality businesses is off to a good start. One year is not enough to judge the portfolio’s performance, of course, but up to now, it seems to work.

From the 10 companies in the portfolio, 6 showed positive performance from my cost basis in 2022. Divergences were significant, with the top performer gaining more than 25% (from cost basis) and the worse performer losing a bit less than 15% of its value.

Currency didn’t have an important role in the portfolio’s performance even though my home currency is the euro, which depreciated significantly against the dollar. A substantial portion of the portfolio was deployed in Canadian dollars at the beginning of the year and that currency was basically flat with the euro in 2022. There were also substantial contributions to US companies during the year’s second half, a period when the dollar was mostly flat compared to the euro.

This said, I don’t hedge my currency exposure as I believe it will not be a significant contributor or detractor of returns over the long term. This, of course, might not be the case for any given year.

If we look at the table that portrays the price performance of the Best Anchor Stocks since we initiated our coverage, the image is also acceptable, especially compared to the indexes. Out of the 10 Best Anchor Stocks, 6 showed positive performance since releasing the first article:

Source: Best Anchor Stocks

However, as I didn’t lump sum into my positions and built them slowly, I improved their performance by buying more aggressively when they were substantially down. The result is that the same number of companies were in positive territory but with larger gains and the losers were down by less:

Source: Best Anchor Stocks (this table shows the performance of the stocks from my cost basis)

The honorable mention here should be Five Below ($FIVE). From the date I initiated my position, the stock was barely 1.80% up through December 2022, but through a series of buys when the stock price was beaten down, the stock was up almost 26% in my portfolio. I believed the company was very cheap around the $120 to $130 range. Recession fears played an important part there but the company might even benefit from a recession. Fortunately, the market disagreed with this last point for a while and focused on short-term results to send the stock down. I don’t believe the “cheap” condition is met at current prices for Five Below, but the market gave enough time to build the position at attractive prices.

I don’t want to talk too much about the portfolio’s performance because what really matters is the long term, and this stands true when the portfolio has a good year as well as when it has a terrible one. An investor’s investment horizon should not depend on performance, even though it does for many investors.

Volatility is another essential aspect of Best Anchor Stocks because we strive to find companies that can compound while experiencing lower volatility than stocks of similar growth potential. The objective is to build a portfolio that is “easy” to hold. It’s also worth noting that we will never be in control of the market’s gyrations, so the best we can do is to strive to find companies with consistent fundamentals. Note that I don’t believe volatility to be a risk, but it can lead many people to act too early, which is indeed a risk that can harm returns.

So, how did the portfolio fair in this regard? Well, 2022 was definitely a volatile year, but the portfolio remained much less volatile from peak to through than the Nasdaq and only slightly more volatile than the S&P 500:

Source: Best Anchor Stocks

Constellation Software (a well-known Best Anchor Stock pick) was an important element in the relatively lower volatility. The Canadian company again did not see much volatility during the year, and it made up a substantial portion of the portfolio:

As a sidenote, Constellation Software has never dropped 30% since its IPO in May of 2006. So, that even includes the Big Recession of 2008-2009. And the COVID crash. In general, lower valuations in the market (both public and private, but especially the latter) should benefit its acquisitive strategy, so that might be part of the reason for its resilience.

If someone had told me at the beginning of the year that we would beat the market with lower or similar volatility, I would’ve definitely signed immediately. However, I should not remain complacent because the stock market can humble everyone, even the greatest investors of all time (a group I don’t consider myself to be in, of course).

Portfolio quality

One of the things I like the most about Terry Smith’s annual letters is how he discloses the quality metrics of Fundsmith’s portfolio. So I have decided to take a similar approach at Best Anchor Stocks not only for transparency but also to help me remain disciplined with the companies making it into my portfolio.

All these metrics are backward-looking and what really matters in investing is the future. There are also limitations on what these metrics portray as important qualitative characteristics are not taken into account.

This said, there’s a higher probability of seeing a high-quality business remain high quality than a low-quality business suddenly turns around. As Warren Buffett famously said:

Turnarounds seldom turn.

I acknowledge that the future is the most important thing in investing, but that doesn’t mean that the past is not also of great importance when assessing a business.

The first thing we can look at is growth and profitability. I like to look at these two concepts together to understand if the companies in the portfolio are growing at all costs or if they are doing so profitably.

The companies in the portfolio have shown solid growth over the past 5 years. However, some of them benefited from the pandemic period and we could see growth go down in the coming years due to tough comps and a softer economy:

Source: Best Anchor Stocks

The above numbers also show that the businesses in the portfolio are highly profitable and excel at converting their accounting profits into cash profits. I would, however, take the cash conversion number with a grain of salt as it includes several outliers.

The next thing I look at is capital allocation, which will be a key driver of shareholder returns over the long term. Here I try to keep it simple and look at Return on Invested Capital (‘ROIC’), Capex as a percentage of revenue, and the dividend yield:

Source: Best Anchor Stocks

We can say that the companies in the portfolio are comfortably creating shareholder value, showing a high ROIC which stands high above their cost of capital. We can also see that most of these are capital-light businesses that should have substantial capital left over after the necessary investments.

We must be careful with the interpretation of the capex, though, as it doesn’t really portray the investments these companies make to grow. For example, the number above ignores that one of the companies spends a substantial amount of its capital on leases and that others spend significant sums in sales and marketing to generate top-line growth. R&D is also a significant source of investment for other companies in the portfolio. It’s difficult to portray such “exceptions” in a summary table, but they are worth taking into account.

As for the dividend yield, it’s low but dividend investing is not a focus of Best Anchor Stocks. For dividend-oriented investors, we believe that the cash generation capacity will allow the companies to grow their dividends consistently over time if they choose to return the cash to shareholders in this manner.

Capital allocation quality goes beyond such metrics, but in some cases, it’s difficult to portray it just with numbers. Buybacks and M&A are also important capital allocation decisions, but there’s plenty of qualitative assessment involved.

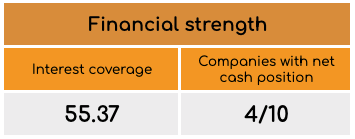

Lastly, I also look at the financial strength of the companies included in the portfolio. If we aim to own these businesses over the long term and enjoy the fruits of capital compounding, they must have solid financial positions. That enables them to be safe from external economic shocks. The portfolio enjoys a strong financial position, which looks as follows:

Source: Best Anchor Stocks

There are also aspects of the financial strength, like the durability and resiliency of cash flows, that I can not accurately portray with numbers. The interest coverage ratio is high, but what matters is its resilience. I believe Best Anchor Stocks enjoy resilient cash flows that will allow them to meet their debt obligations, if they have them, even during a very challenging period.

Note that all the above numbers are an equally-weighted average of the metrics of each Best Anchor Stock and not the weight they have in my personal portfolio.

What to expect from Best Anchor Stocks in 2023

We are only a couple of weeks into 2023, but I am already focused on improving the service again throughout the year. For example, I want to build a comprehensive checklist that allows me to screen businesses faster, which will also be at subscribers’ disposal. I would also like to markedly improve the conviction rating table to show what sections of the businesses I like the most and which I don’t like as much. All in all, quite a bit of change that I have lined up.

Regarding the number of Best Anchor Stocks that will be released in 2023, I can’t give an exact number as it depends on research that has yet to be conducted and the prices available in the stock market. What I can tell you is that I expect to end up with around 20 high-quality businesses in the portfolio in the long run, not that the remaining 10 or so will come in 2023.

Several studies suggest that 20 companies already allow us to enjoy 90% of the benefits of diversification, and I believe this is a number of companies that I can keep up with on an ongoing basis. More would probably make it almost impossible to follow to the standard that I have set for myself and it may also dilute the quality of the portfolio.

I often research companies that don’t end up as a pick. This research may be interesting for subscribers, though. For this reason, starting in 2023, I plan to upload some articles on companies I have researched but have not made the cut. In this way, subscribers can learn about new companies and I can make my research process more visible.

I am also planning on slowly updating all the research articles to reflect not only updated numbers but also the new knowledge I have acquired while following these companies for a longer period.

A last intention for 2023 is to have more webinars. Subscribers really appreciate them and I thoroughly enjoy them.

The premium subscription gives you access to all the content in Best Anchor Stocks, which includes…

All the deep dives

Recurring articles

Access to my real-time portfolio and transactions

Occasional webinars on various topics

A community of like-minded investors

A subscription the Premium + also gets you a quarterly Q&A with me to discuss anything you’d like.

If you want to know the type of content I share at Best Anchor Stocks you can read the Deere deep dive I uploaded a few weeks ago for free…

…or you can also read any of the other many free articles I have shared, just like this one!

You can also read the testimonials that existing subscribers have left. If you are a passionate and curious investor wanting to learn about high-quality companies, don’t hesitate to join Best Anchor Stocks!

Conclusion

I hope you enjoyed this annual recap, and it helped you understand several aspects of the Best Anchor Stocks’ portfolio. The portfolio's performance was good this year, considering the circumstances and compared to the indexes, although it’s still early. But up to now, the system seems to work.

In the meantime, keep growing!