A Smashing Debut

Nintendo's Q1 2026

Nintendo reported great Q1 earnings last Friday, where we finally got to see some official numbers around the debut of the Switch 2. Everything called for record numbers, but the truth is that it was better than most (myself included) expected. Before going into the details, let’s take a look at the headline numbers.

Nintendo’s sales rose a whopping 132% year over year, somewhat expected considering the SW2-related sales (absent in the comparable quarter). Note that the SW2 launched on June 5th, and Q1 goes from April to June, meaning that there’s less than one month of SW2 sales included in these numbers:

Something that might stand out from these results is the margin contraction. Management pointed out that the gross margin of the SW2 is lower than the margin on the SW1 (somewhat putting to rest the false claims that the higher price means that Nintendo is price gouging). Then we have the proportion of hardware/software sales. It’s normal to see a significantly higher proportion of hardware sales during the early months/years of the SW2 lifecycle. The reason is that the hardware base (which ultimately sells the software) takes some time to build up. This ultimately translates into lower profitability during the early innings of the lifecycle, but margins should expand considerably once software sales take the lead in the future (recall that software is where most of the money is made). The proportion of hardware sales in Q1 2026 was almost double the number in Q1 2025:

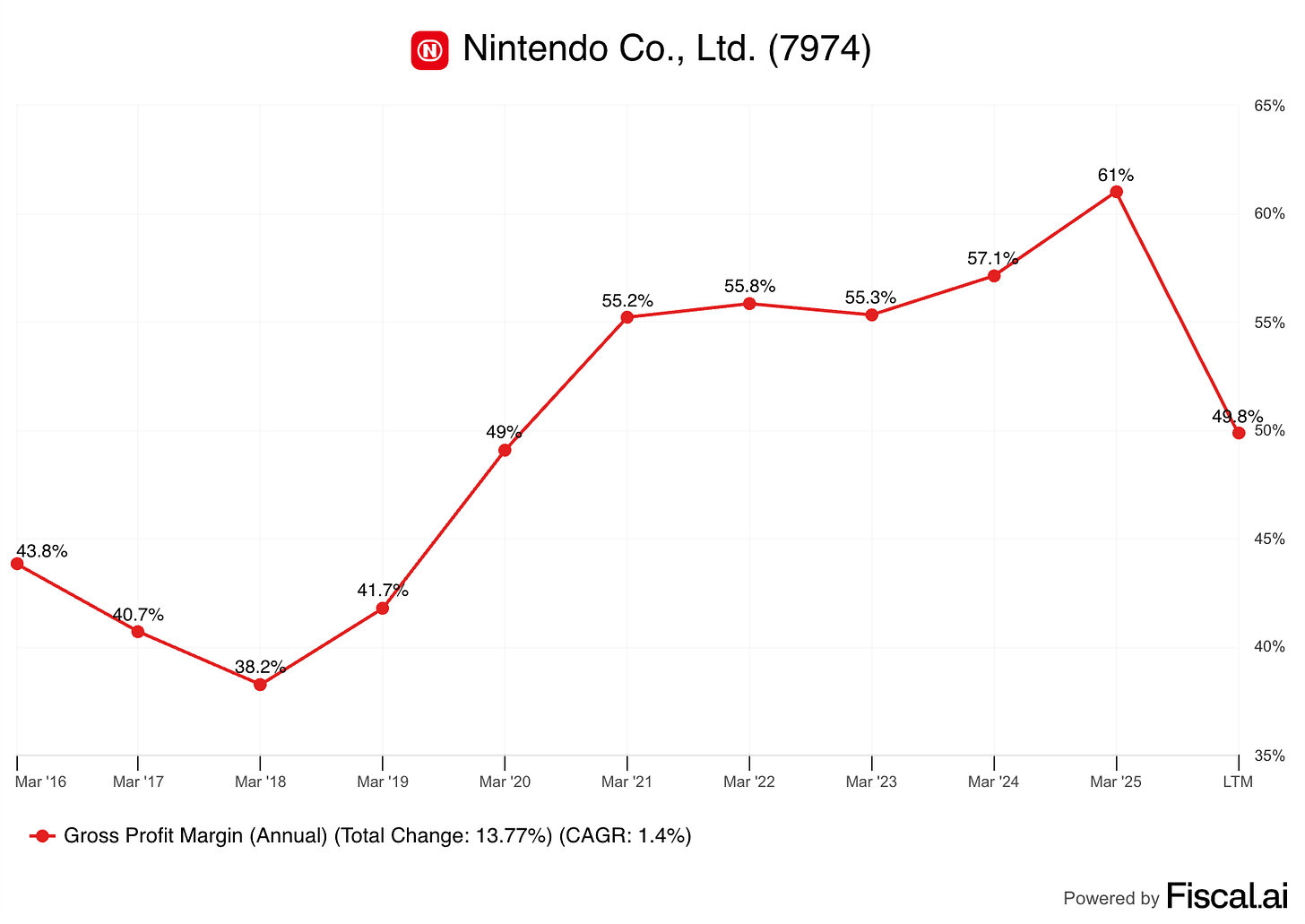

We could see these dynamics at play during the early stages of the SW1 cycle. The SW1 was launched in March 2017. Nintendo’s gross margin initially dipped materially, only to later rise to new highs as software sales started to make a larger portion of the pie. Towards the later stages of the SW1 cycle, hardware sales were dropping considerably faster than software sales, which is why Nintendo’s gross margin reached an all-time high:

We should expect these margin dynamics to be more pronounced this time around for two reasons. First, the gross margin is starting at a higher base due to the success of the SW1 (unlike when the SW1 was launched due to the failure of the Wii U). Secondly, because the SW2 carries a lower gross margin than the SW1 and a good portion of the initial software sales have been sold in the bundle (i.e., at a lower margin). Over the long term, however, I would expect Nintendo to make a lot of money through software sales because it’s likely that the SW2 will receive much more third-party support than the SW1 (supporting AAA games helps).

Note that even though margins are expected to contract as the hardware base builds, Q1 2026 was probably an extreme due to the launch date falling within the quarter. What we should see throughout the year is that sales growth moderates somewhat, and operating profit grows more slowly but at a faster rate than we saw in Q1. This is, by the way, consistent with management’s outlook: 13% operating profit growth for the full year compared to 63% sales growth.

Then, besides the gross margin impact, one also has to factor in the significant increase in advertising that Nintendo experienced due to promotion activity around the SW2 launch. Advertising expenses grew 115% year over year:

So, what’s the takeaway from the headline numbers? The SW2 seems to be doing great and profitability should improve materially throughout the year and throughout the lifecycle of the SW2.

Now, let’s take a look at what matters most: the SW2.

The SW2

We need to unpack the SW2 sales numbers to understand what’s going on “under the hood.” Let’s start with some data. Nintendo claimed to have sold…

3.5 million SW2 units over the four days following the June 5th launch

5.82 million units in Q1 (April - June), so basically 5.82 million SW2 in 25 days in June

6 million units in the 7 weeks after launch

If we crunch some numbers, we can estimate the run rate of SW2 sales post-launch. So, assuming Nintendo sold 3.5 million SW2 during the first week and that we can consider this “launch week,” we can subtract this number from the 6 million units the company sold over the first 7 weeks to estimate a normalized sales/week run rate. This results in 2.5 million SW2 sold over 6 weeks. Divide the units by the weeks, and we get 410,000 SW2 units sold per week (ignoring the launch week).

I will overlook the seasonality that Christmas brings and assume this will be the sales per week run rate that Nintendo will achieve until the end of its fiscal year. If sales continue at this pace, Nintendo is on track to sell around 21 million SW2 units in its first year (3.5 million over the first week + 410k*42 remaining weeks in the FY, ignoring the launch week). For context, management’s current estimate is 15 million units (of which they’ve already achieved 40% in seven weeks, and there’s still Christmas to go). The sell side is under 20 million (on average for the year), citing supply constraints.

So, what are some reasons to remain optimistic that Nintendo can achieve said 21 million unit sales (or maybe higher)? A couple. First, management mentioned again that in many geographies, they were unable to keep up with demand. This means that the 6 million sales figure should have been higher if Nintendo had managed to keep up with demand. Note that management mentioned in the last earnings call that the forecast was not set according to supply capacity, meaning that there’s an opportunity to go over 15 million units if there’s demand for it. Where’s the supply limit? I don’t know, but I’d say SW2 sales are likely to be significantly higher than the 15 million forecasted by management.

Another thing we should take into account is that the current software lineup of the SW2 is still nowhere to be seen, and it’s the software that sells the hardware in this business. This means that there might be people holding off from buying a SW2 until the software library is more extensive, which should come naturally over time.

So, in light of all this, why isn’t management raising its hardware outlook? I obviously don’t know the direct answer. However, Nintendo’s management is known for its conservativeness and we are still in Q1, so I wouldn’t have expected them to raise said guidance even when it seems evident that it might be conservative.

What’s interesting about all of this is that Nintendo continues to sell SW1 despite the launch of the SW2. The company sold almost 1 million SW1 during the quarter, down 53% year over year, but still impressive. This, however, might change going forward. The reason is that management mentioned that they would raise the price of the SW1 and certain accessories in the US (in what seems like a response to tariffs). This means that the price of the SW1 and the SW2 will converge, which may make the SW2 more attractive for lower-income buyers.

Note that Nintendo has decided not to raise the price of the SW2, and it’s the right decision (in my view). Management is well aware that most of the profits are made on the software and that to sell the software, they need a large installed base. The price of the SW2 is already “high”, so raising it further might have dented demand. I imagine that the demand for the SW2 is relatively inelastic, but knowing that profits will be made on the software, I think it makes little sense to test this hypothesis! We should expect the impact of tariffs on long-term profits to be relatively minimal.

Say that Nintendo imports a SW2 system from Vietnam (20% tariff) to the US, and that it sells at a 10% gross margin. This means that the import value of the good is around $410. With tariffs, Nintendo’s cost to bring the unit to the US would be $492, thereby erasing the profit margin and forcing Nintendo to sell said system at a loss in the US. Now…this is not as worrying because every game sold to this installed base comes at 90%+ margins, and these are not subject to tariffs (at least not yet!). So, what’s better, to raise prices 9% to counter the impact of tariffs on hardware that comes with a 10% profit margin, or to stay put and sell as many games as possible that come with a 90%+ margin? I know what I would do!

Let’s talk about software

Nintendo also sold a significant number of games in Q1. The company sold 8.67 million SW2 games in Q1, which results in a tie ratio of 1.5 despite few games being available yet (note that Donkey Kong Bananza was launched in Nintendo’s Q2). Mario Kart sold 5.63 million units in Q1, a lot of which I would imagine were bundled sales.

The software dynamics of the SW1 are interesting because they portray why Nintendo’s business is interesting (and also demonstrate why not raising the price of the SW2 is the right choice). Nintendo sold 24.4 million SW1 games. Software sales “only” decreased 20% year over year despite hardware units sold dropping more than 50%:

This shows the power of the installed base (i.e., distribution). Nintendo still doesn’t have a lot of games to offer to its nascent SW2 installed base, but a large installed base promises to bring a highly profitable and durable business down the line. So, now that we have the whole picture, let’s take a look at how this compares to Nintendo’s forecast. I’ve already discussed that Nintendo is probably being pretty conservative with its SW2 hardware sales estimates. What about software and the SW1? On Software, Nintendo expects 45 million SW2 software units sold for the FY. It has already sold 8.67 million in Q1 despite the software library being very limited. Note that management tends to be much more conservative with software than hardware.

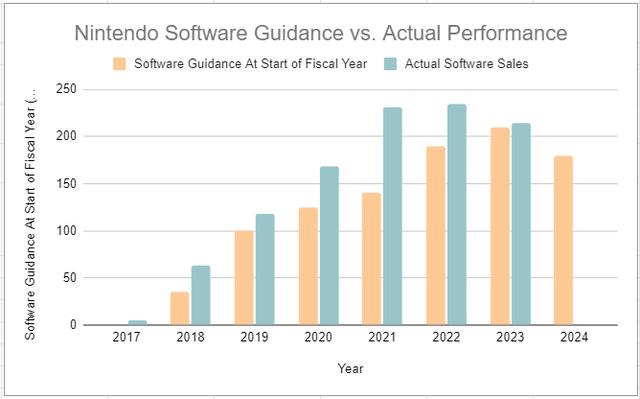

A while ago, my friends at Chit Chat Stocks put this graphically. This is how Nintendo’s hardware sales typically perform against management’s estimates:

And this is how they typically do against software:

There’s a clear trend here: management tends to overestimate hardware sales and underestimate software sales (albeit this time around, I believe hardware sales are sandbagged). This is “good” because software is more profitable, and therefore Nintendo’s management tends to err on the side of caution regarding profits!

Is Nintendo still a buy?

Some months ago, I shared an article titled ‘Why I Am Still Adding to Nintendo’ where I shared my valuation model for Nintendo. Now that we have some fresh data, I thought it would be a good idea to see how my estimates are tracking.