A Myriad of Reasons for Conservativeness

Danaher's Q4

Danaher reported Q4 earnings yesterday and the stock dropped almost 5%:

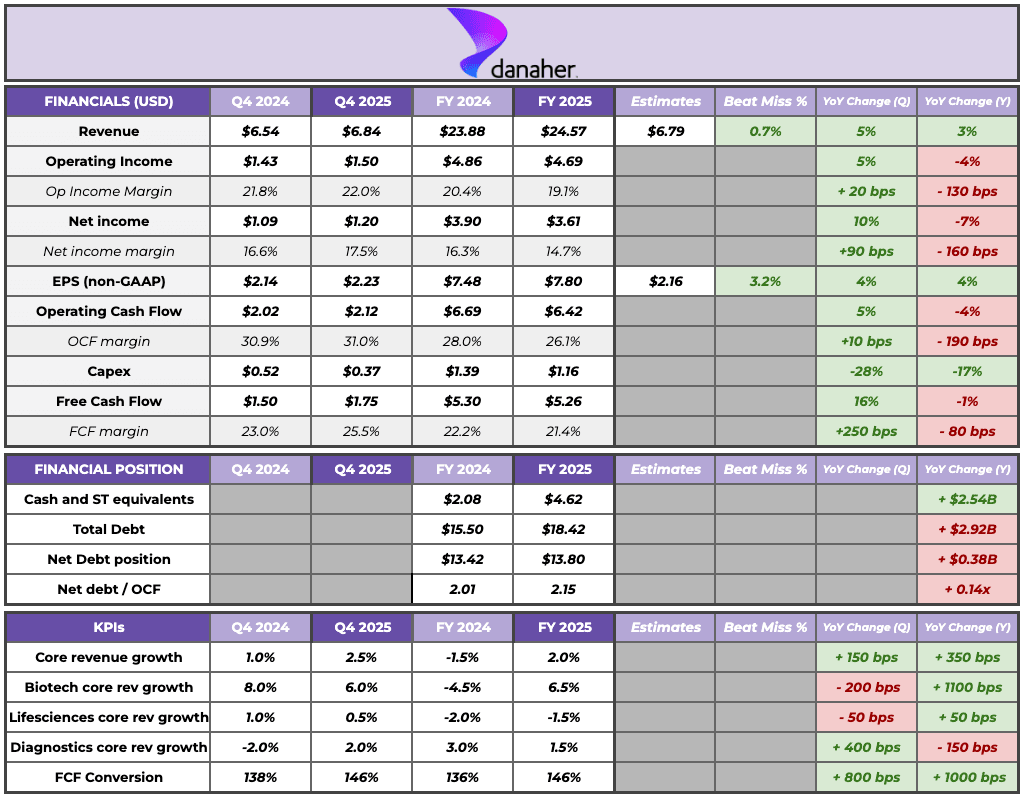

I don’t expect this to be a long earnings digest because I am going to focus almost exclusively on one thing: the 2026 guide and how to contextualize it. 2025 was an acceptable year for Danaher. The company saw a stabilization and gradual improvement across most of its end markets (primarily biotechnology) but it was a pretty tough and volatile environment that led Danaher to miss its yearly guide. Management set a 2025 guide that called for core revenue growth of 3% year over year in Q4 2024, but Danaher ended up achieving only 2% core revenue growth. In all fairness, they faced several significant (and some of them unpredictable) headwinds:

Equipment, due primarily to tariffs and the hesitance these created to invest in Capex. Note that tariffs also brought a long-term potential tailwind to the table: reshoring (more on this later)

VBP (Volume Based Procurement) in China, which pressured equipment in that country (primarily in diagnostics)

A somewhat muted biotech funding environment (which showed green shoots toward year end)

All in all, this is how 2025 played out:

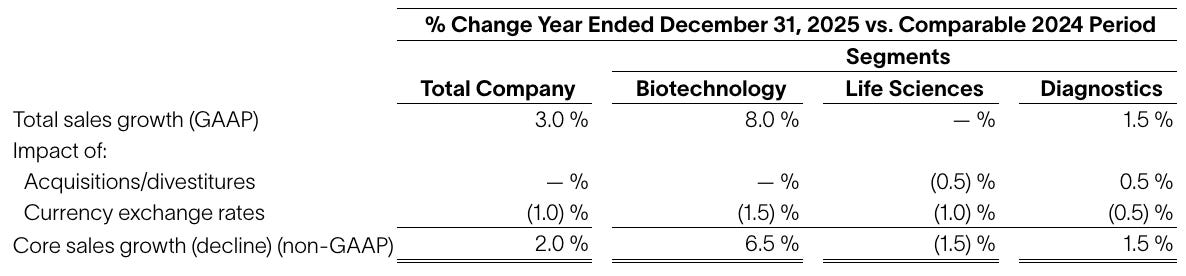

The commentary was similar all throughout the year: “consumables are doing fine and recovering, but equipment is experiencing headwinds.” These dynamics were pretty evident in the performance across segments. Danaher’s biotechnology and Diagnostics segments are much more exposed to consumables than Lifesciences, which is why (uncoincidentally) Lifesciences lagged both (note that Diagnostics grew despite headwinds from China’s VBP):

The question here is: what expectations has management set for 2026? Management left its preliminary 2026 guide (issued in Q3) unchanged. This means they still expect core revenue growth between 3% and 6%. They also initiated the EPS guide which calls for EPS of $8.425 at the midpoint (+8%). Management later clarified that this EPS guide is set based on 3-4% core revenue growth and that any upside to core growth would be upside to EPS (maybe to a greater extent considering the incrementals that Danaher experiences on its growth). Now, the question here is: what’s the upside to core revenue growth? (assuming there is some)

First things first, I must say I was a bit disappointed seeing that the guide from Q3 was maintained. I was expecting a raise or at least some commentary around the company being able to achieve the higher end rather than the lower end. We didn’t get any of these, but when I read the call and stopped to think about it, I realized that a conservative guide makes sense, for several reasons.

Management shared that the guide was built considering a gradual improvement of the end markets continuing in 2026 and…

High single digit growth in bioprocessing (with equipment flat)

Lifesciences: modest improvement with growth remaining below historical levels

Diagnostics: assuming higher growth due to easier comps from VBP in China

This is somewhat similar to what the company experienced in 2025, which means that management is implying a similar environment in 2026 centered around one primary headwind: equipment. Analysts evidently asked management about the sources of upside because the qualitative commentary doesn’t seem consistent with the guide. Management shared several sources of upside, starting with lifesciences and biotech:

To your point as to the upside levers, there’s probably two larger drivers that are most relevant here. One is to see continued improvement across our life science end markets. We’re seeing some of that. We’d like to see that improved biotech funding environment fall through now to an increasing order book in that particular segment.

Management, however, seems to be saving most of their conservativeness for equipment. Their “excuse” is lack of visibility despite recent quarters being encouraging:

Until we have a bit more, a few more data points to point to on the equipment side, I think it’s, again, kind of demonstrated ability over the past year that we’re just gonna go ahead and guide to flat. I think it’s a good place to start. Let’s see how the year progresses, and we’ll go from there.

Despite recent equipment strength (3 consecutive quarters of sequential equipment order growth), management attributed the lack of visibility to shorter term investment patterns:

Current momentum in our equipment order book and funnels is concentrated around shorter cycle projects, such as line additions and brownfield expansions, with US reshoring-related greenfield investments expected to provide incremental upside over time.

Why all this conservativeness on equipment? I believe it makes sense for several reasons. First, 2025 was a heck of a volatile year on the political front, creating instability that impacted investment patterns. Let’s not forget that the same President is in charge in 2026; who knows what might happen. Secondly, we are talking about Capex here. Consumables are a non-discretionary expense, but Capex can be deferred. Capex can be deferred only so much, though. In fact, Rainer Blair believes that Danaher might enjoy soon a pretty significant investment cycle:

I think the takeaway here is that, one, equipment investment has been muted here for the last couple of years, despite the fact that demand has been fairly strong, as we see in the consumables demand. There’s probably some catch-up required here over time just to meet the existing demand, and then you add on top of that, the reshoring topic, which continues to advance. There’s no question that is going to happen. It’s just a matter now of bringing that timing together, but we really believe we could be in the early innings of a long-term investment cycle.

Management decided to assume that “timing” will not be in 2026. This conservativeness makes even more sense when we consider that Danaher recently appointed a new CFO. It’s highly unlikely that a new CFO would want to set a pretty optimistic guide only to miss it. As I stand here today, I would say that Danaher is more likely than not to end the year above its EPS guide, but we’ll see.

Another potential growth lever for the company is M&A. Management shared that the environment is now more conducive to acquisitions and that they are in a strong position should an opportunity present itself. On the M&A front, they also shared that Abcam now enjoys 500 bps higher operating margins since the acquisition date. It’s in M&A where the DBS (Danaher Business System) shines, so we’ll see if it can be applied again successfully this year.

All in all, not much has changed for Danaher.

Have a great day,

Leandro